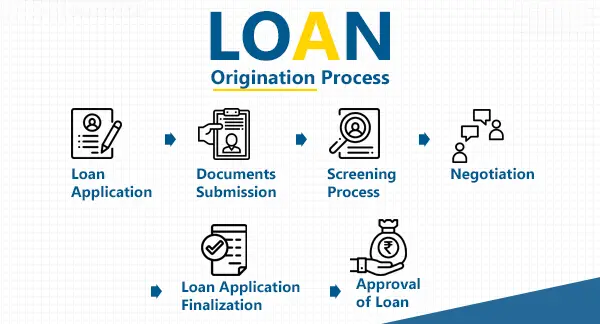

- Loan Application – The homebuyer or the borrower fills out the loan application form.

- Documents Submission – The buyer/the borrower must submit relevant documents either during the initial loan application process or after the pre-approval of the loan. Document verification is done to substantiate income, employment, financial status, and other credentials.

- Screening Process – The lender now screens the buyer’s loan application, verifies the credentials of the buyer, checks their credit score, and determines whether the buyer’s income, as well as the financial status qualify for the loan criteria.

- Negotiation – Based on the financial status of the borrower and the lender’s approach towards a loan, the negotiation could take place depending on favourable loan terms.

- Loan Application Finalization – Once both the borrower and lender agree for the terms and conditions, the lender processes the loan application

- Approval of Loan – After completing the final processing, the lender makes the final call to approve or reject the borrower’s loan application.

You May Also Like: Why Should You Use A Cloud-Based Loan Management Software?

Latest Trends in Loan Origination Process

With the evolution of technology, digital mediums, and cloud computing technology, even the loan origination process has evolved. Now that the loan origination process has been moved from manual operations to cloud-based technology. This digitalization of the loan origination process is commonly referred to as Digitalized Origination.

Digital Origination – Simplified

The Digital Loan Origination process includes all the process that is present in manual loan origination process – namely filling of loan application, collection and validation of supporting data, and other processes. This digital process includes the entire gamut of the loan origination process and keeps the paperwork minimal.

Below are the latest trends in Loan Origination Process:

Paperless Loan Origination – Thanks to the evolution of the Internet and advancements in the latest technologies. Now, several loan originators have started moving towards a paperless loan origination process. This is because traditional loan origination involves a lot of paper-based work and documents handling. The use of SaaS has helped organizations to move towards Paperless Loan Origination Systems.

Managing Documents – The loan origination process involves a lot of document handling. The advent of Cloud-based solutions and several other new technologies have made the document handling process simpler. The borrower’s details and other relevant documents are kept safely and processed in a secure manner. Cloud servers are used to store the KYC details and other relevant documents.

Usage of cloud-based solutions eliminates the need for manual maintenance of documents. Also, the verification process is made simple and done with the help of image processing and machine learning process. You can also authorize the documents digitally by choosing the remote “eSigning” option.

SMS Facility – Another key advantage of using a digital system is that all your KYC accounts are linked to the mobile number. This means you will be receiving all the transaction details, financial updates, career opportunities, and other banking information via SMS.

The lender can check the credit-worthiness of the borrower/customer by analyzing their SMS history.

Social Media Activity – The digital world has transformed the lives of people, and thereby everyone has started using the Internet and smartphones. This is another advantage for the lenders as they can analyze the activities of the borrowers.

People share and update their day-to-day activities on their social media platforms. This helps lenders to analyze the spending patterns of the borrowers/customers.

Psychometric Test – This test is carried out to generate the socio-psychological profile of the customers/borrowers. These psychometric tests help lenders to assess and analyze the borrowers and the risk posed by them (if they can pay back the loan or not).

This test result is coupled along with the CIBIL score of the borrower and is used to assess the risk associated.

Challenges Faced by NBFC and MFI in Loan Origination Process

The domestic NBFC organizations and MFIs that serve customers are facing quite a set of challenges. Addressing these issues in manual loan origination process is quite challenging.

Traditional loan origination process involves a lot of paperwork and involves manual screening process. This process is cumbersome for both the lenders as well as the borrowers. This poses a major challenge in loan origination process making it time consuming.

The manual loan origination process usually takes 35-40 days for the processing (from application filing to sanctioning or rejecting the loan). Also, the credential verification process is quite hectic and takes a long time.

Also, there are chances for fool-proofing and malpractice. It goes unsaid that manual processing is generally prone to errors. Hence arises the need for an alternative method that reduces the errors and time-taken for loan-origination.

Here is a list of problems that are mainly faced by NBFC and MFI in Loan Origination Process:

- Handling various types of loans at times can be a tedious process

- Manual processing of user details and documents can really be a mess

- Streamlining of eKYC details mandates a lot of time, and committing even a small error might result in a major issue

- Collecting credit score details and handling its information can be a lengthy process

How Software Addresses the Challenges in Loan Origination Process

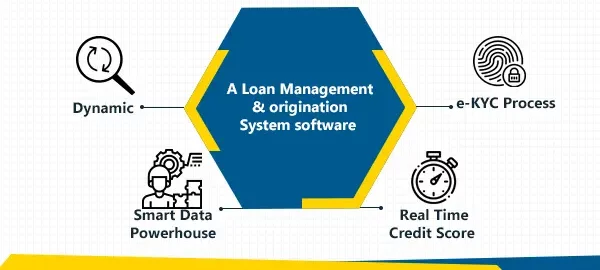

The use of digital technologies and software solutions eliminate the challenges faced in the loan origination process. One such software is CloudBankin – a Loan Management and Origination System Software that makes the process simpler.

The key challenges involved in manual processing, including documents, handling & maintenance, time constraint, and errors can be eliminated with the help of the CloudBankin software.

It is a robust and scalable Loan Management and Origination Software that is designed with an aim to simplify the entire loan origination process. The CloudBankin software features a suite of options that delivers operational efficiencies, eliminates the occurrence of an error, makes reporting and analytics integration process simpler, and much more.

Below are the ways how CloudBankin Software helps organizations in Loan Origination Process: