Loan Management System

Seamlessly integrated, end-to-end solution designed for efficiency and ease.

What our Loan Management System can do?

CloudBankin lets you automate the entire loan lifecycle, steadying your top-line growth while building a solid customer base that will be delighted with your services! New products can be swiftly introduced, and tracking the repayment procedures is made much easier.

In addition, your decision-making becomes seamless and clear with features for generating module-wise reports. You can also adhere to processes and comply with audit requirements easily with a fully digital, cloud-integrated platform.

Easy to Use Dashboard

A single dashboard to manage a large client base gives you a one-stop tool for managing your products and clients.

Flexible Reporting

A host of analytical tools lets you view, export, and download a variety of customizable reports.

User-Friendly Workflows

Seamless, user-friendly workflows help process loan applications faster and more accurately.

Scalability

CloudBankin is designed to deliver exceptional performance and responsiveness to a greater extent, ensuring seamless loan management and enhanced customer satisfaction.

Security

CloudBankin offers peace of mind and security with state-of-the-art encryption features, VAPT testing, and cyber-security!

Reports and Dashboards

Over 50+ options for reporting and exporting data improve your decision-making abilities.

Global Configuration

Comply with global regulatory standards with easily configurable workflows for various markets.

Audit Trail

Track data and transactions easily with cloud integrations, making audits seamless and hassle-free!

Template Creation

Customizable templates allow you to maintain an unmatched standard of service across products and clients.

Alerts and Notifications

Custom alerts help in timely reminders to your clients regarding due dates or important events.

Advance EMI

Provide flexible payment plans and speedy disbursals with seamless integration of advanced EMIs.

Top Up Loans

Remain ahead of your client’s needs with the easy addition of top-up loans to existing payment plans.

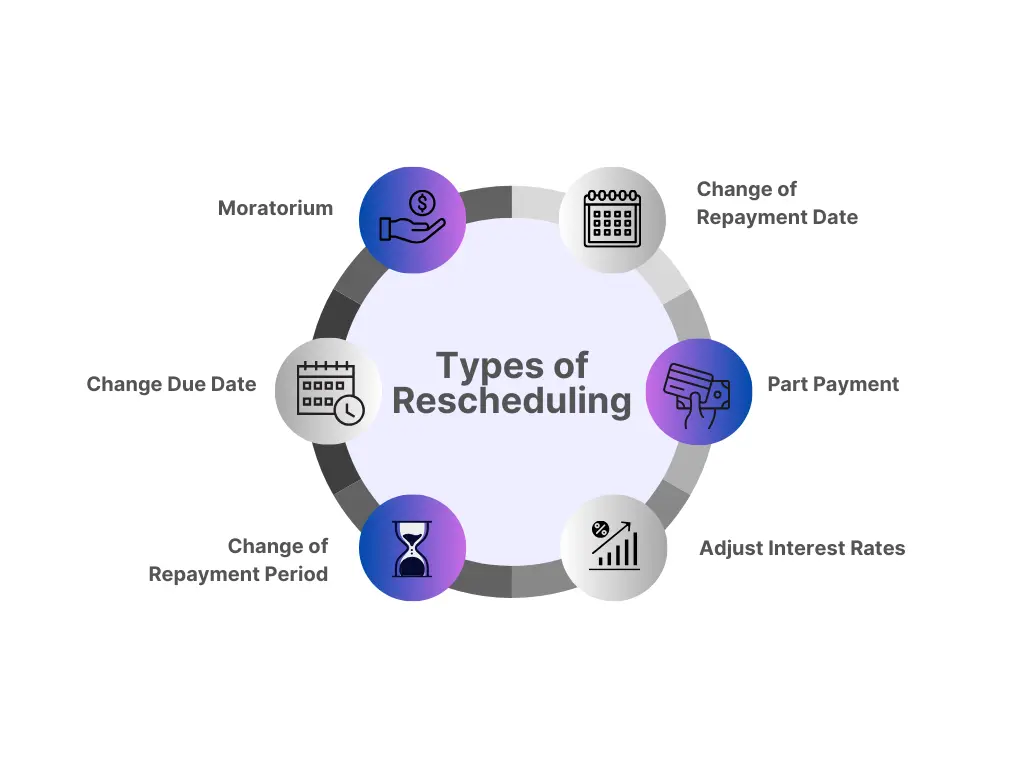

Rescheduling of Loans

Protect against defaults by easily rescheduling existing payment plans and flexible rescheduling options.

NPA Management

Approval and aging-based provisioning with calculations of Days Past Due (DPD) and auto-reversal on regularization.

Co-lending Module

Manage fund allocation, repayment tracking, and facilitate communication among lending partners.

Accounting

Comprehensive financial tracking and reporting. Provides accurate financial insights and compliance with accounting standards.

User Access Restrictions

Control and manage who has access to the system. Ensures data security by limiting access to authorized personnel only.

Auto Write-off

Automate the process of writing off non-recoverable loans. Improve efficiency and accuracy in dealing with bad debts.

Chart of Account

Customizable to adapt to changing financial needs. Offers flexibility in organizing and categorizing financial transactions.

Recovery Repayment

Tools to manage and track repayments from recovered loans. Facilitates the recovery process and ensures timely repayments.

Key Highlights of CloudBankin's LMS

Why Choose The CloudBankin Loan Management Software?

Cost Effective

CloudBankin is an extensive, cost-effective, and fully customizable loan management system that can handle the ever-changing needs of your clients and a dynamically changing market.

Scalable

It suits multiple business lines. It is fully scalable, letting you grow your business with custom workflows and compliance tools for a variety of markets.

Reports

A fully digital, cloud-based platform helps lenders with accurate statements and reports for improved decision-making.

Secured and policy compliance

Auditing, tracking, and adherence to local regulatory standards is a breeze with a platform that is secured and built towards policy compliance for a variety of markets.

Frequently Asked Questions

What is CloudBankin Loan Management System (LMS)?

As the business grows, managing loan transactions efficiently can become a challenge. With CloudBankin loan management system, it will be simple, efficient, and enable quicker decision-making. The system offers easily configurable modules for all types of loans. The client will be able to manage their customers in multiple locations through a single platform. With the help of CloudBankin, lenders can manage their portfolio in a paperless way.

Can I use the Loan Management System to launch multiple loan products?

CloudBankin has the facility to configure different types of loan products with configurable parameters such as minimax of principle interest, different interest methods, days configuration, broken period interest calculation, moratorium, and NPA setup, charge configuration, interest recalculation enable, etc. Currently, our software is capable of handling 12 different types of loan products like Personal loans, Business loans, Vehicle loans, Gold loans, Line of Credit, Payday loans, Microloans, Agriloans, Loan Against Property, Microfinance, Yearly salary loans.

What type of Financial institutions can use Loan Management Software (LMS)?

CloudBankin aims to provide end-to-end lending infrastructure to Non-Banking Financial Companies, Fintech companies, Microfinance Institutions, Co-Operative banks, Credit Unions and Banks.

What is LOS and LMS in banking?

A loan origination system is defined as the platform to manage and automate the lending process of the loan life cycle, including application to loan disbursement. A loan management system, otherwise, is defined as the platform in the loan life cycle where it oversees the lending process after disbursement till closure.

Is accounting included in the LMS?

Yes, accounting is available in our system. All the transactions related to the loans can be managed using our LMS. You can configure the COA, which can be mapped with the individual loan products. Whenever a disbursement is made, a repayment is made, or a fee is collected, the respective journal entries will be created automatically in the system. Apart from that, if you want to create any manual journal entries, you have the option to do it manually. All the transaction information can be exported to other external accounting software like Zoho Books, Tally, etc., via API or bulk upload option.

How is the Collection & Repayments handled in the system?

A lender can easily collect repayments from borrowers via auto-debit or manually. The LMS ensures timely repayment from borrowers, updates loan balance, and amortizes interest and principal components of each repayment. Cloudbankin can also manage part-payment of loans, handle foreclosures of loans, reschedule of loans, waive-off charges & penalties, and write-off loans.

How can a lender handle rescheduling of loans by using CloudBankin’s LMS?

Lenders have the option to do rescheduling or restructuring of loans using our LMS. There are 4 functionalities available for rescheduling. A lender can configure any or a combination of them: 1. Changing the Repayment Date 2. Moratorium 3. Extending the Repayment Period 4. Adjusting the Interest Rate of the Remainder Period of the Loan

Can we configure different charges inside the system?

Yes, we have the facility to configure different types of charges in our LMS with the below configurable parameters: 1. Charge Collection Time - at the time of disbursement, specifying due dates, instalment fees, overdue charges, foreclosure charges, etc. 2. Charge Calculation- flat amount, percentage of loan amount, percentage of interest, percentage of outstanding amount, percentage of principal partly paid, etc.

How is NPA management done in CloudBankin?

If a loan is overdue for certain days (for example, 90 days), as per RBI regulations, the loan will be marked as an NPA. Cloudbankin LMS can track and generate a report of all the NPA cases. If all arrears are cleared, the loan will move out of NPA. We manage NPA in the following ways 1. Identify loans that are at risk of becoming non-performing. 2. Monitor their status regularly. 3. Send out an early warning in case a loan is going to be NPA. 4. Allow lenders to work with borrowers for repayment. 5. In case of a loan is not moved out of NPA, it can be written off or taken any other necessary action accordingly. Our LMS is there to make sure that it mitigates as many losses as possible for the lenders easily.

What's the rule engine?

Our rule engine is the credit decision-making platform that is configured with lenders’ credit rules & policies. It obtains data from various sources like PAN, Aadhar, Credit Bureaus, Bank Statements, SMS transactions, etc. It configures up to 2000 data points and can also integrate more based on lenders’ requirements. A lender gets the credit assessment memo as the output for their borrower’s eligibility.

Can I send emails via the system?

Yes, you can send emails via our system. This can be on the following ways: a) Event-based - You can send emails on events such as login, signup, non-repayment of borrowers, etc. b) Schedule-based - You can schedule to send emails with available email template formats on a daily, weekly or monthly basis. For reports, you must separately schedule to send emails to the given email IDs. Our system easily allows you to customize the templates used for sending emails. Email IDs and reports are configured in our database without any hassle.

Is template customisation possible in the LMS?

Yes, template customisation is possible in our LMS, which is useful for Sending personalised alerts & notifications for SMS and emails according to the availability of the variables. Generating loan agreements, loan closure letters, etc., as per the loan applications. This can be downloaded in PDF format under the respective loans.

Is reporting available in this system?

Yes, reporting is available in our LMS. There are 50+ reports, such as active loans, balance sheets, trial balances, general ledger reports, loan payments due, ageing detail, etc. By seeing the reports, lenders can get current snapshots of their businesses. The reports can be exported as CSV and can also be customized according to your requirements.

What are the Benefits of Having a Loan Management System (LMS)?

A Loan Management System (LMS) offers several benefits, including increased efficiency, enhanced accuracy, improved customer service, cost reduction, better regulatory compliance, enhanced risk management, and scalability. Transitioning to a paperless, agentless, contactless, and branchless model further simplifies processes and modernizes operations for financial institutions.

How to select a Loan Management System (LMS)?

Exploring these factors will guide you in making a well-informed choice when selecting a loan management system. Broader Coverage of Loan Types, User-Friendly Interface, Centralized Solution, Speed & Agility, Authenticated Access, Technology and Customer Service Support, Cloud Based or On-Premises Deployment, Better Third-Party Integration, Flexibility, Web And Mobile Compatibility, Data Security & Compliance, Scalability Cost.

What are the essential modules in the loan management system(LMS)?

The essential modules in the Loan Management System (LMS) are Reports & Dashboards, Audit Trail, Template Creation, Alerts & Notifications, Advance EMI, Top Up Loans, Rescheduling of Loans, NPA Management, Co-lending Module, Accounting, User Access Restrictions, Auto Write-off, Chart of Account, Recovery Repayment, etc.,

How long does it take to implement a loan management system?

The implementation of a loan management system typically takes about 2 weeks from onboarding, subject to various factors such as Data Migration, LMS setup, Third-party configurations, Accounting Configuration, and testing & matching repayment schedule.

How do I set up a loan management system(LMS)?

To set up a Loan Management System (LMS), begin with 1) Setting up your organizational structure. 2) Add Chart of Accounts. 3) Loan Product and Charge Setup. 4) Migrate data from the existing system. Then proceed with onboarding your customers and the loan servicing process.

How to Migrate From a Old System to a New Loan Management System?

The process of migrating from an existing system to a new loan management system involves any one of the methods below:1) Database - ETL (Extract, Transform, Load) 2) Through API 3) Bulk Import. And the process includes: 1) Understand the Database Schema of the Source System. 2) Identify the Modules Required for Migration. For example, Office, Clients, Loans, etc. 3) Decide the Migration Strategy, deciding whether to start from historical data or focus on data as of a specific date. 4) Write SQL queries tailored to extract relevant data from the source system efficiently. 5) Run Validations to ensure the output of SQL queries accuracy and adherence to predefined criteria, mitigating risks of data discrepancies during migration. 6) Create new loan products within the new Loan management system, configuring settings and parameters to align with organizational objectives and regulatory standards.

Can I generate collection reports for a specific period?

Yes, we can generate collection reports for a specific period. Our system offers over 50+ customizable reports, allowing you to generate reports tailored to your requirements.

Is API documentation available for LOS and LMS?

Yes, we provide comprehensive API documentation for both the Loan Origination System (LOS) and the Loan Management System (LMS) to facilitate integration with your existing systems.

Related Articles

- Email: [email protected]

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576

Quick Links

Resources

© 2024 LightFi India Private Limited. All rights reserved.

(Formerly known as Habile Technologies)

After smartphone penetration, people are not watching their SMS at all. They use SMS only for OTP related transactions. That’s it.

But What can a Lender see in your SMS after you consent to them?

Lender can see income, expenses, and any other Fixed Obligation like (EMIs/Credit Card).

1) Income – Parameters like Average Salary Credited, Stable Monthly inflows like Rent

2) Expenses – Average monthly debit card transactions, UPI Transactions, Monthly ATM Withdrawal Amount etc

3) Fixed Obligations – Loan payments have been made for the past few months, Credit card transactions.

It also tells the Lender the adverse incidents like

1) Missed Loan payments

2) Cheque bounces

3) Missed Bill Payments like EB, LPG gas bills.

4) POS transaction declines due to insufficient funds.

A massive chunk of data is available in our SMS (more than 700 data points), which helps Lender to make a credit decision.

#lendtech #fintech #manispeaksmoney