What Is Bank Statement Analysis in LOS: Why Is It Important?

India’s digital lending has witnessed a staggering growth of 12 times from financial years 2017 to 2020. The total lending disbursement was INR 21.6 lakh crore in 2022 and it is expected to reach a remarkable INR 47.4 lakh crore in the next couple of years.

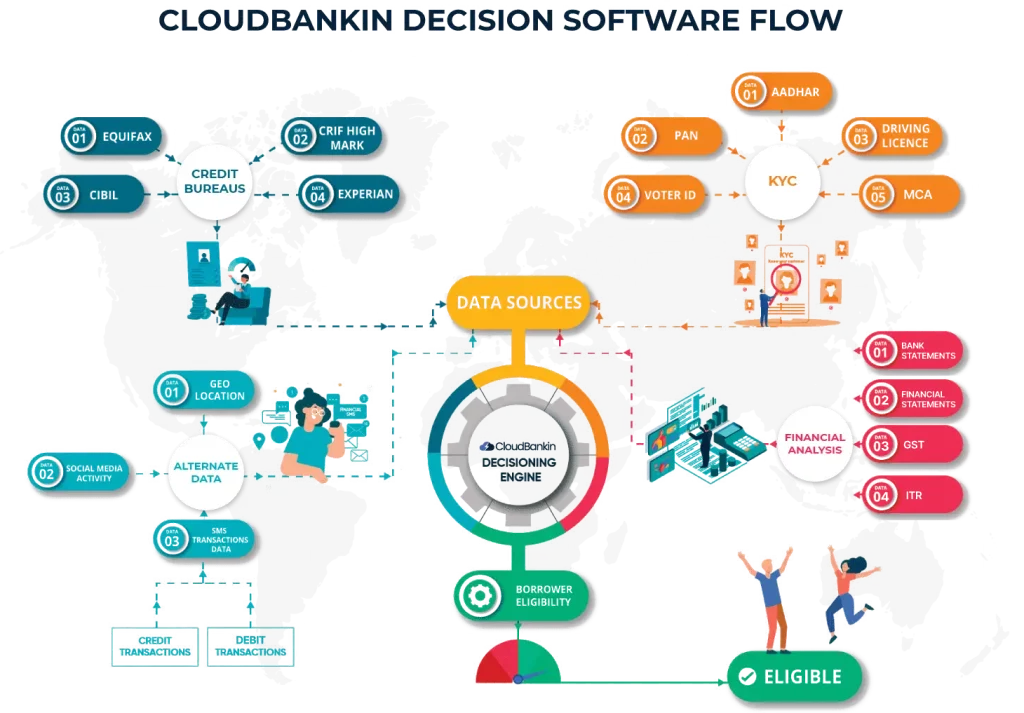

For Financial Institutions (Banks, NBFCs, Fintech, etc.), embracing Loan Origination Systems (LOS) in this booming environment is of utmost importance. The most crucial role within a LOS is played by the Bank Statement Analysis. Primarily it helps gauge the borrower’s ability to repay loans in its analysis, which is the most important to check before lending to any business or individual.

A borrower evaluation is typically needed to be carried out by lenders before loan approval and disbursement to gauge their creditworthiness and financial well-being. Bank Statement Analyzers do a pretty good job in offering insights into their cash flow, spending and saving patterns and their overall financial position from bank statements, which give reliable evidence of a borrower’s sources of income and expenditures and also their withdrawals, credit repayments, and all sorts of financial transactions over a period of time.

What else can bank statement analysis help lenders with? It assists in fraud prevention and money laundering patterns in line with the AML-CFT guidelines, decreasing drop-offs and default rates, and increasing how many loan approvals can be given with the use of automation.

Why is all this necessary? To assess the borrower’s financial standing and their creditworthiness. And for achieving a higher credit underwriting accuracy, giving you confidence in the lending process.

And for achieving a higher credit underwriting accuracy, giving you confidence in the lending process.

What Is Bank Statement Analysis and What Is Its Significance When Processing Loans?

To review, break down and examine the bank statements of a borrower, bank statement analysis is an incredible tool within a loan origination system. While it was performed manually all these years, the digitalization of analysing the borrower’s financial standing has transformed the processes within NBFCs, Banks, and other financial institutions worldwide.

The following key factors explain the significance of bank statement analysis in the lending process:

Evaluating creditworthiness

To measure a borrower’s creditworthiness is the primary objective of a bank statement analysis. Lenders can determine their ability for loan repayment using this metric and it serves as a critical role in underwriting. It analyses their cash flow, spending and saving patterns to make informed decisions and reduce the risk of default.

Fraud detection

By scrutinising transactions, bank statement analysis can accurately detect fraudulent activities. For example, if the borrower makes huge transactions continuously from abroad or local ATMs, these are considered potential indications of fraud and money laundering as recommended by AML-CFT and are highlighted by the analyzer. This can help lenders reduce risks and prevent huge losses well beforehand.

Maximising loan approvals and lowering default rates

Bank Statement Analysis conducts a comprehensive Individual Credit Evaluation helping lenders achieve a higher accuracy in credit underwriting. This evaluation gives clarity on an individual borrower’s various incomes, consistency in their inflow and outflow of cash, financial commitments, etc. Further, it offers real-time analysis that streamlines the loan process. With accurate information regarding these parameters, lenders will be able to optimise loan approvals by reducing turnaround times, and improving customer satisfaction whilst avoiding potential defaults from the borrower’s side.

Offers customizable data categorization

Lenders often find the need to tailor their analysis to specific requirements. Bank Statement Analysis in an LOS facilitates this by offering customizable data configuration that categorises several parameters from expenses to credit limits and all other relevant financial insights. This ultimately helps lenders understand the borrower’s financial situation more quickly and thoroughly.

Provides additional insights

With the Banking and Financial sector’s focus is majorly on KYC (Know your Customer) a bank statement analyzer can also provide valuable supplementary information, helping the lenders to get to know their customers much better.This could be their place of residence, what assets do they possess, their credit limits, and different categories of expenses. It gives a comprehensive view of the borrower’s financial situation and helps with the decision-making process

Helps with income tax evaluation

Whether individuals or businesses, financial institutions can also verify the different sources of a borrower’s income against their tax returns, gather evidence of their compliance with tax regulations and assist in identifying business-related costs, charitable contributions, etc. with the help of a bank statement analysis.

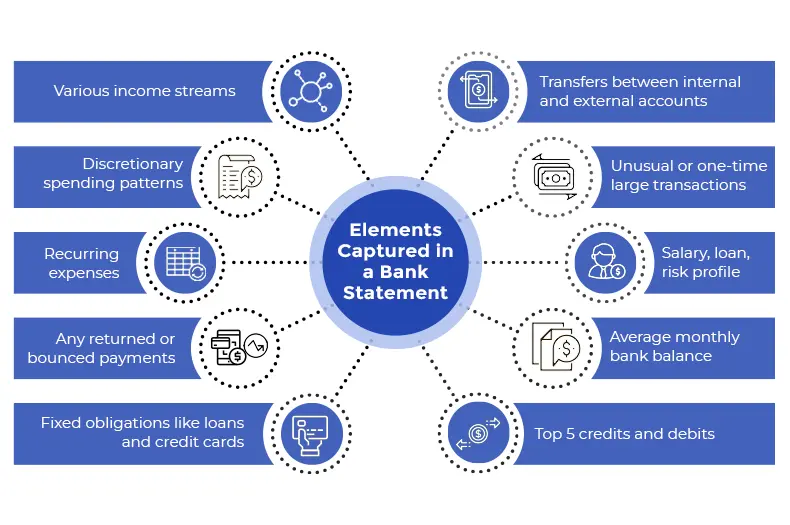

What Is Captured in a Bank Statement Analysis by an LOS?

Given a set time period, an individual’s or business’s record of transactions is what constitutes a bank statement. What does it capture? A wide array of the borrower’s financial data points to provide a holistic view of their accounts. Here are some key elements that it highlights:

1) Various income streams – Eg: salaries, dividends, rental incomes, business revenues, and other incomes. Also bonuses, commissions, earnings on a freelance basis, investment returns.

2) Recurring expenses – utilities, rent, loan repayments, insurance premiums, and other fixed costs.

3) Spending patterns – dining out, travel, entertainment, other non-essential expenses etc.

4) Pre-existing loans or credit card balances – their overall debt burden and credit utilisation as on date.

5) All transfers between different accounts, either within their home bank or to other financial institutions.

6) Any fee or penalty levied by banks due to an overdraft or account mismanagement.

7) Payments that were returned or bounced indicate financial stress or cash flow concerns.

8) Unusual, one-time large transactions – withdrawals or deposits that require further investigation.

Mainly, a bank statement analysis report contains details about the borrower’s transactions, everyday EOD balances, top 5 credits and debits, returned or bounced payments, their salary, loan, credit and debit profile and finally predictors of frauds and fraudulent transactions.

How Does Bank Statement Analysis Work in LOS? 7 Steps

How Does an LOS Analyze Borrowers’ Bank Statements? Key Factors

A Loan Origination Software, in essence, through its bank statement analysis, gauges the borrower’s creditworthiness, financial standing, and their ability & intent to repay the loan. The key variables, based on which it performs this analysis depend on whether the borrower owns a business or is an individual. However the overarching goal is to give lenders a complete report of their financial profile and help reduce potential risks in granting them the loan amount.

Parameter | Why it is considered |

| Cash Balance | If the business’s cash balance has been positive over the past several months, it shows the borrower’s ability for effective financial management, thereby highlighting their credibility. A negative cash balance highlights potential business mismanagement, in turn showcasing their inability to repay any debt. |

| Receivable Financing | Borrowers can use outstanding invoices and any receivable payments as collateral for their loan application. Transactions accounted for the outstanding invoices in their books of accounts with their debtors are checked so lenders can verify their eligibility for the loan. |

| Payable Financing | Also called as vendor finance, this is typically used by borrowers to obtain credit from other vendors when they make purchases of products or services. A good trade credit shows the borrower’s creditworthiness for payable financing but it could also be an indication of their financial obligations and continuous debt cycles, leading the borrower to a debt-trap. |

| Deposits | Timely and consistently recurring deposits from the borrower’s business on commercial transactions mean that they have continuous profitable operations and proper revenue streams. This can mean a higher likelihood of them repaying the loan. |

| Withdrawals & liabilities | Some of the red flags identified when considering this parameter are: Large/ frequent withdrawals, hires, leasing, other loans, etc. that are recurring liabilities. |

| Cash Overdraft | The borrower should not have repeated cash overdrafts which are essentially additional funds than the borrower’s profile holds. Excessive overdraft usually suggests the borrower’s trouble managing his finances and repaying the loan. |

| Bounced Penal Transactions | A cheque bounce often referred to as a rubber cheque, can be a red flag as primarily it indicates lack of funds in the borrower’s account. No check bounces possibly indicate a healthy financial aspect of a firm. |

| Fraud Control Unit (FCU) Indicators | The FCU indicators give a heads-up on the possible suspicious transactions and relevant frauds that have taken place in the financial management of a firm. These indicators help to cross-check the borrower’s transactions, identify fraudulent activity and count for the number of triggers. |

| Seasonal fluctuations | Bank Statement Analysis also considers seasonal variations of a particular business and adjusts the parameters accordingly. |

| Investment activities | The borrower’s investments can play a critical role in their financial stability. So this parameter is also analysed by the system. |

Individuals

While the financial standing of a business is identified by the above parameters, the following factors are what indicate good financial performance for an individual.

Income Stability: Salaries, Dividends, Rental Income, Other Earnings, etc.

Withdrawals: Essential spending, discretionary spending, other daily expenditures, etc.

What else is checked by the LOS for individuals?

Opt for CloudBankin’s LOS for Robust Bank Statement Analysis

Related Post

How To Choose A Successful Loan Origination System–Top Factors To Keep In Mind

Without a doubt, there has been a paradigm shift in

Navigating the Regulatory Landscape: A Dive into Understanding NBFC Compliances

Overview Delve into the realm of financial compliance for Non-Banking

A Complete Guide to Loan Origination System

A robust Loan Origination System (LOS) that can establish strong

- Email: [email protected]

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576

Quick Links

Resources

© 2024 LightFi India Private Limited. All rights reserved.

(Formerly known as Habile Technologies)

After smartphone penetration, people are not watching their SMS at all. They use SMS only for OTP related transactions. That’s it.

But What can a Lender see in your SMS after you consent to them?

Lender can see income, expenses, and any other Fixed Obligation like (EMIs/Credit Card).

1) Income – Parameters like Average Salary Credited, Stable Monthly inflows like Rent

2) Expenses – Average monthly debit card transactions, UPI Transactions, Monthly ATM Withdrawal Amount etc

3) Fixed Obligations – Loan payments have been made for the past few months, Credit card transactions.

It also tells the Lender the adverse incidents like

1) Missed Loan payments

2) Cheque bounces

3) Missed Bill Payments like EB, LPG gas bills.

4) POS transaction declines due to insufficient funds.

A massive chunk of data is available in our SMS (more than 700 data points), which helps Lender to make a credit decision.

#lendtech #fintech #manispeaksmoney