How GSTN on Account Aggregators are Making Business Lending Smarter and Faster?

A world where getting a business loan is as easy as ordering a pizza online?!

Too good to be true?

We live in the 21st century where everything working around us is digital. The internet is helping us rapidly reach places where even the roads don’t go. No doubt it has made our lives a little easier than it has ever been before, but this is also a critical moment in our country’s journey to financial inclusion with digitization. But as Uncle Ben said in Spiderman “With great power comes great responsibility!”

Imagine this scenario: You’re sitting in a shop, laptop open, trying to apply for a business loan. Emails, printouts, and endless paperwork can make even the most motivated entrepreneur lose their steam.

Well, the integration of the Goods and Services Tax Network (GSTN) with the Account Aggregator (AA) framework, promises to transform how we handle financial data, making the process more efficient, secure, and user-friendly. But what makes this system truly stand out? In this blog, we’ll dive into the essential role of GSTN within the AA framework, how it’s reshaping business lending and the incredible benefits it’s bringing to both lenders and businesses.

Challenges in Business Lending for Lenders and Borrowers

Before we dive in, let’s understand why business lending feels like pulling teeth. Both lenders and businesses face quite a few hurdles along the way. Firstly, before a lender can even think about handing out a loan, they first need to dive through a swamp of paperwork and manual verifications. Endless back-and-forth with businesses to gather financial documents – that’s a maze of inefficiency! They need to sift through multiple sources to validate a business’s financial health.

In this maze, the risk of encountering fraudulent applications is a constant concern for lenders. Businesses might intentionally present inflated numbers or hide liabilities to secure loans they would otherwise not qualify for. This increases the risk of lending to untrustworthy applicants.

On the other side, businesses have their own set of hurdles. They are supposed to provide documents manually, which not only consumes time but potentially causes delays in loan approvals. For MSMEs who contribute more than 30% to India’s GDP, 45% to its manufacturing output, and 48% to exports, the situation is even worse! Despite their immense importance, MSMEs in India have been grappling with a significant credit shortfall of Rs.33 trillion! These enterprises often operate with limited resources and low investment profiles. With limited access to comprehensive financial data, lenders struggle to accurately assess the creditworthiness of these small businesses, making it difficult to predict repayment capabilities and potential risks. This restricts their growth, resulting in low business closures and working capital.

Understanding GSTN and Account Aggregators

GSTN

The Goods and Services Tax Network (GSTN) is a computerized online system that oversees India’s GST portal. It’s the central nervous system that keeps the entire GST ecosystem functioning smoothly!

The unified digital platform maintains a repository of all GST-related information for taxpayers across the country. This includes registration, details, returns, and payment status. The system handles billions of invoices every month, facilitates seamless tax compliance, and ensures efficient administration across businesses.

With more than 13.8 million users registered on the network, GSTN provides a clear view of a business’s financial health by showcasing its revenue, tax compliance, and payment histories. This data is invaluable for lenders, who can use it to evaluate the creditworthiness and stability of potential borrowers accurately.

What is the Account Aggregation (AA) Framework?

The process of compiling financial data from various sources in a single location is called Account Aggregation. To make financial data freely accessible through data intermediaries, RBI launched the Account Aggregator (AA) Framework in India in 2021. It allows financial data to be shared securely and seamlessly across financial institutions, all with the user’s consent. A detailed picture of a consumer’s needs, income, savings, and financial behavior can be consolidated and analyzed from multiple financial sources. This holistic view empowers consumers and provides financial institutions with more accurate information. Isn’t it a win-win for both?!

How is GSTN included under Account Aggregators Facilitate Business Expansion?

With over 50 million MSMEs in India, only 16% of MSMEs receive adequate funding and support from banks, as most find it tedious to access credits from banks. As a result, loan applicants have no choice but to approach informal channels for credit due to the absence of proper financial documentation records and, therefore, pay high interest rates.

The Account Aggregator (with an NBFC-AA license) architecture seeks to salvage MSMEs from the shortage of credit. By streamlining the flow of financial information, it empowers small businesses to secure loans more efficiently.

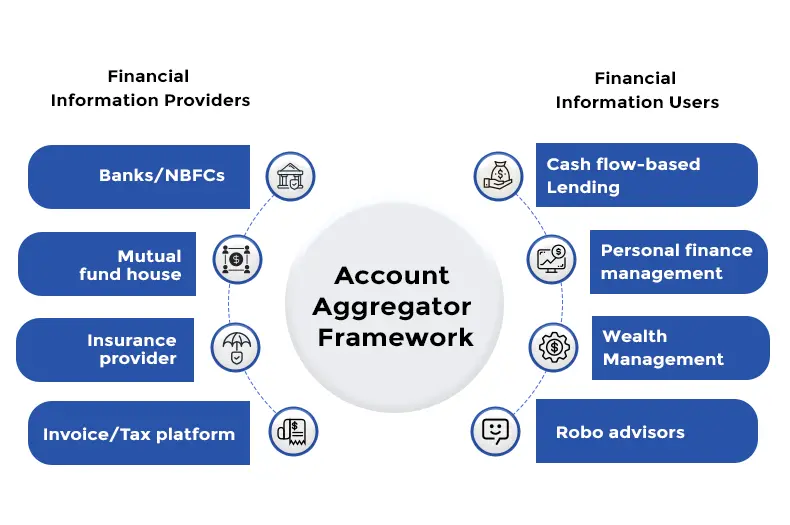

Financial Information Providers (FIPs) are institutions such as banks, insurance companies, and mutual funds that hold and manage financial data. FIPs provide the essential data that is required for financial assessments, loans, and investment decisions. Financial Information Users (FIUs) are entities, such as lenders, investors, or other financial institutions, that utilize the financial data provided by FIPs. FIUs analyze this data to make informed decisions regarding credit, investments, and other financial services.

Who is the middleman who could transport all the data from one end and deliver it to the other, all within a finger snap? Account Aggregators! It collects, consolidates, and securely transmits financial information from FIPs to FIUs. This streamlined approach facilitates better access to financial services and supports more informed financial decisions.

How Does the Account Aggregator Network Function?

The AA framework facilitates quick credit access for MSMEs through secure and consent-driven data sharing between financial institutions and businesses. The AA model works in the following way:

Step 1: Account Set-up

When the business is in the quest for a loan, to facilitate the process, the business must set up an account with an AA. The business must keep a record of their financial data by linking this account with their bank accounts, insurance policies, investments, etc.

Step 2: The Green Light

The business then has to provide consent for the AA to access and share its financial information. This consent is crucial for the AA to access the GST and financial data.

Step 3: Gathering the Info

Once the consent is given the green light, the account aggregator fetches the data from various financial information providers (FIPs). These FIPs could be banks, insurance companies, or any place where his/her financial details are kept. The AA aggregates and consolidates the collected data into a single, organized format, making it easy to review and share.

Step 4: The Grand Delivery

The data is transferred from FIPs to the AA in a top-secret encrypted format. With the data safely packed, the AA delivers it to Financial Information Users (FIUs). They are the ones who need these data to evaluate the customer’s financial background and analyze the credit profile of the borrowers to determine their creditworthiness.

Step 5: The Moment

The FIUs use your freshly delivered data to evaluate the credibility of your business. The lender then disburses the loan to the business or suggests some tailored services. Whether it’s a loan to expand your business or a financial plan crafted to fit your needs, the financial data helps process your request with precision!

Step 6: Repeat as Needed!

Anytime you need to share your data again, just give your AA a heads-up. They’re always ready to teleport your data securely, anytime, anywhere.

For example, Ram wants to open a small cafe in his neighborhood and serve up the best coffee in the town. But the process of getting a business loan is so daunting! He needs to gather financial statements from his bank, collect investment records, and track down his insurance documents. The more he digs, the more he realizes that his financial data is scattered across various institutions and forms.

If he decides to approach private lenders, there will be high interest rates and demanding terms. But with GSTN on Account Aggregators, this is no more of a hassle. This tool creates a seamless bridge that makes it easier for businesses to borrow money, invest, or get advice. Ram just needs to give his consent and then poof! All his financial data will be securely fetched, consolidated, and sent straight to the lender. The “consent management layer” lets him control who gets to see his financial data, and decide on which data goes where and when. Its robust system ensures that his data is invisible to everyone except the lender he wants to work with.

What kind of data will be shared in AA?

Here’s a quick rundown of the essentials that will be shared in the account aggregator network.

Business Details | Information about business registration, ownership, and other relevant legal details. |

GST Invoices | These include GSTR-1, GSTR-3B, and other relevant returns that showcase the business’s sales, purchases, tax liabilities, and input tax credits. |

Tax Returns | Information from GST returns provides a snapshot of the business’s financial health and tax compliance |

Bank Statements | Transaction history and balances offer a comprehensive view of cash flow and financial stability. |

Financial Statements | Balance sheets, profit & loss statements, and other key financial documents. |

Credit Information | Data about existing loans, repayment history, and creditworthiness. |

There are 19 categories of information that fall under ‘financial information’, besides various other categories relating to banking and investments. To share such information, the FIU is required to initiate a request for consent by way of any platform/app run by the account aggregator. Such a request is received by the individual customer through the aggregator, and then this information is further shared by the aggregator after consent is obtained.

What impact will the GST inclusion in the Account Aggregator Network Will Have?

The AA framework helps collate and consolidate all the scattered financial data, simplifying the road to credit access for individuals and organizations.

Benefits for Lenders

Better credit assessment

GSTN includes profile details like the legal name of the business, trade name under GST, business address, information around taxes already paid and payable, the input tax credit availed, delayed tax filing, and any late fees or interest can be accessed which can be fetched through AA. Thus, GSTN integration can provide the most accurate image of the borrower for the lenders. It’s like having an all-access backstage pass, letting lenders see the entire performance, not just the highlights! Lenders can determine the creditworthiness of MSMEs using verifiable and reliable information. This will help in assisting in making better decisions about the credit in the process.

Data access period and frequency

GSTN allows Account Aggregators to access up to 18 months of data. This extended data history enables lenders to analyze patterns, assess creditworthiness more accurately, understand seasonal trends, and make well-informed lending decisions. This depth of information reduces risk and allows for more tailored digital lending solutions, ensuring both lenders and borrowers benefit from a clear and accurate financial picture.

Risk assessment through a wide range of predictors

Using verified GSTN data can reduce fraudulent loan applications providing greater security for lenders. With AAs, lenders have an X-ray vision! They can analyze cash flow patterns, and make informed decisions regarding creditworthiness, risk assessment, and loan structuring. It also allows insight into the total penalty paid, counts of late returns filed, days delayed, interest paid, EMI affordability, and preferred NACH dates. This real-time visibility helps them to identify signs of distress or financial instability proactively. This reduces the risk of digital lending and ensures better loan performance.

Reduced operational costs

Automating data collection and verification reduces the need for manual paperwork and processes. This efficiency lowers operational costs and allows lenders to offer more. It’s a win-win that saves time and money!

Benefits for Businesses

Frictionless loan disbursement

Usually, businesses have to physically submit their financial documents for loan approval. The integration of GSTN in the AA framework, it’s like fast-tracking through airport security with a VIP Pass! It has eliminated the need for excessive documentation, making it easier for businesses to access credit. Businesses can simply consent to share their financial data directly from GST records. This quickens the verification process and results in faster frictionless loan approvals.

Access to competitive loan offers

Combining GST records with banking information allows lenders to access a company’s tax records and other financial information via a single platform. This results in higher transparency allowing the lender to assess an entity’s profitability and repayment capabilities. When blended with Credit Bureau reports, it provides a data-backed picture of the business. With this transparency you can compare rates and choose the best deal, saving money and securing better terms.

Inclusive financial system

It is a blessing for MSMEs because it allows loans based on cash flow and they no longer need to rely on private money loan providers for their cash flow needs! AAs, simplify loan approvals and minimize friction in credit disbursement based on their verified financial data. Not only MSMEs but also small businesses listed as partnerships, private limited companies, and LLPs can now apply for business loans, and their financials are assessed through GST data. Lenders can create innovative credit products that address the specific challenges faced by different segments and offer sophisticated credit solutions tailored to the unique needs of each business.

List of Account Aggregators in India

Under the Sahamati Scheme of the Government of India, RBI has given license to the following NBFCs to act as account aggregators in India.

- Agya Technologies Private Limited (Product titled Setu AA)

- CAMSFinServ

- Cookiejar Technologies Private Limited (Product titled Finvu)

- CRIF Connect Private Limited

- Cygnet Account Aggregation Private Limited

- Dashboard Account Aggregation Services Private Limited

- Digio Internet Private Limited

- FinSec AA Solutions Private Limited (Product titled OneMoney)

- NESL Asset Data Limited (NADL)

- Protean (formerly NSDL E-Governance Account Aggregator Limited)

- Perfios Account Aggregation Services Pvt Ltd (Product titled Anumati)

- PhonePe Technology Services Private Limited

- Tally Account Aggregator Services Private Limited (Product titled TallyEdge)

- Unacores AA Solutions Private Limited (Product titled INK)

- Yodlee Finsoft Private Limited

Future Outlook

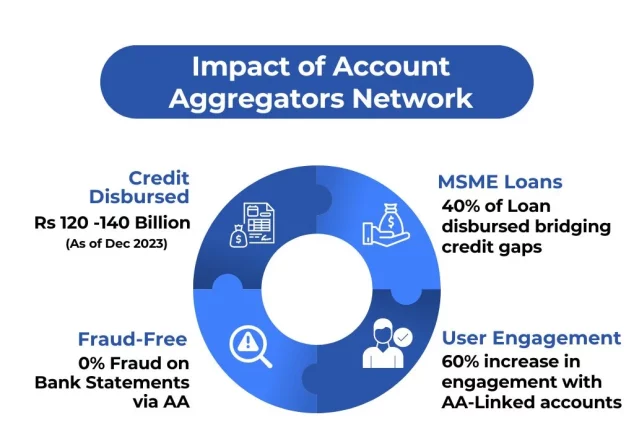

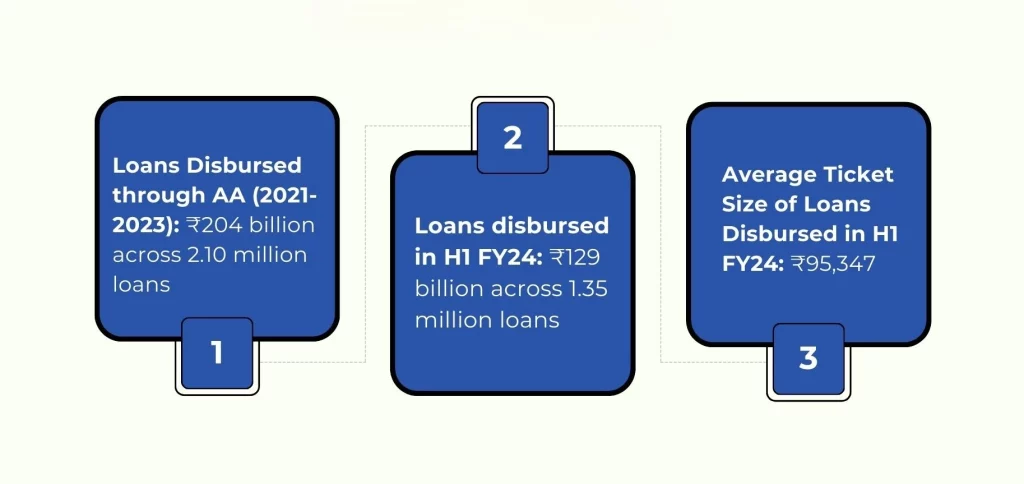

A recent ET report mentions that currently, around 70 million individuals have consented to share their data, with about 10 million new consents generated monthly. With a staggering 20,000 crores in loans disbursed between 2021 and 2023, and around 38 to 40% of these loans benefiting small businesses, it’s clear that the ecosystem is making a significant impact.

The AA framework has already made its mark by reducing the fraud rates to zero and slashing the loan processing times to just 30 minutes. MSMEs that have struggled with credit access are now finding a lending surge because of the streamlined process.

Looking ahead, the future for Account Aggregators (AAs) is brimming with promise and potential. The ecosystem is poised for significant growth with an anticipated 10,000 financial institutions and four billion financial accounts over the next five years. In the coming years, the focus will likely shift towards enhancing user experience, reducing turnaround times even more, and continuing to drive financial inclusion, particularly for MSMEs. The AA system promises to be the backbone of a more connected and efficient financial ecosystem, transforming how we access and manage our financial data.

Related Post

Gold Loans – the Whats, Hows and Whys

Shiny, pure and incredibly valuable, gold is the metal that’s

Credit Reporting Format For Financial Institutions By The RBI

Credit Reporting Format For Financial Institutions By The RBI Let's

Micro Credit – Empowerment and Challenges – A Srilankan Perspective

Rajeshware Srinivasan’s dialogue with Ms. Renuka Rathnahewage, Founding Director and

- Email: [email protected]

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576

Quick Links

Resources

© 2025 LightFi India Private Limited. All rights reserved.

(Formerly known as Habile Technologies)