Why Should Your Lending Business Get Api-Fied: A Comprehensive Guide To Understanding Lending APIs

47,40,00,00,00,000!

Counting the zeros? Let’s simplify it.

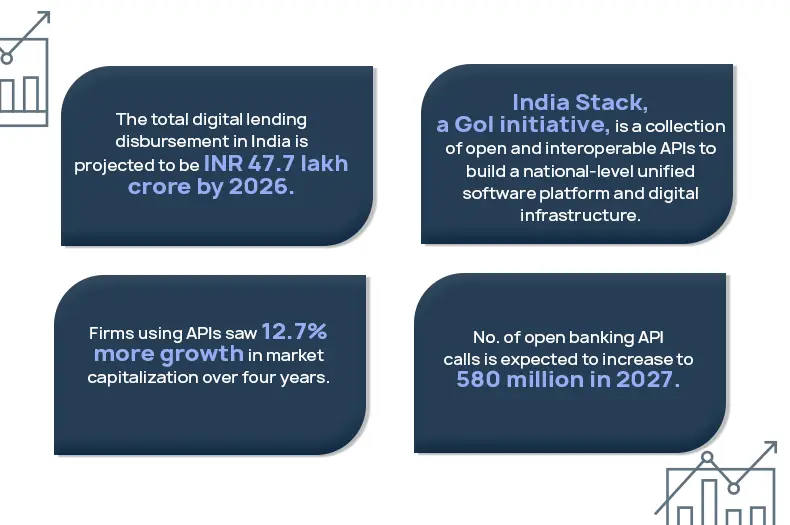

That is the total value of loans in digital lending, estimated to be disbursed by 2026!

A huge amount, right?

As evidenced by this, the digital lending industry in India is on an uptrend and doesn’t seem to be ending soon. Countless financial products and services are popping up daily to facilitate this large quantity of loan disbursements, small or huge, to happen every day. These digital systems should seamlessly disburse loans and ensure there is no room for crimes like data breaches, phishing scams, loan stacking, etc.

So how is this done?

Using the Application Programming Interface (API). This collects customer KYC (Know Your Customer) details, verifies the documents, credit bureau reports, analyzes their bank statements, and sets up e-Nach for automated payments and loan disbursal.

In this blog, we will explore APIs and why it is a good idea to API-fy your lending business.

So, what are APIs?

APIs are a series of protocols that allow a software solution to call on functions from other sources and systems. APIs help lenders acquire critical information for loan origination and management system decisions.

APIs help Financial institutions to streamline digital onboarding processes by automating data collection. It also helps to integrate with external systems such as payment gateways and credit bureaus. This helps in gathering customer details and speeds up the approval process by reducing manual intervention.

API helps to improve operational efficiency by ensuring that customers are onboarded quickly with minimal delays while at the same time maintaining compliance with regulatory standards.

Where do APIs fit in the lending sector?

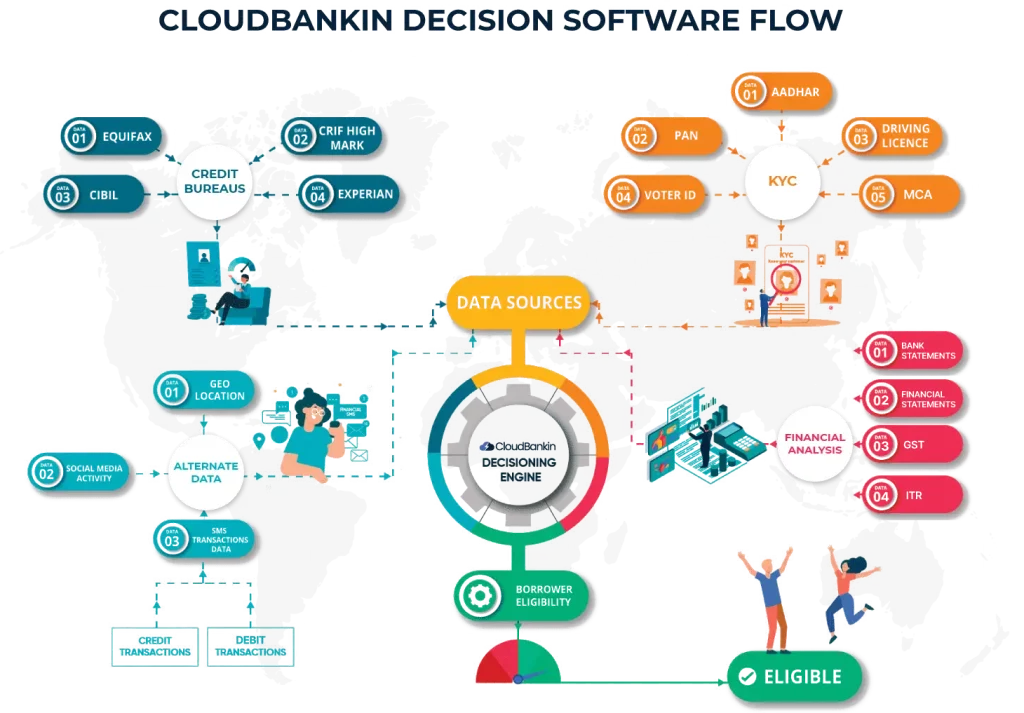

API connects different systems in a lending ecosystem and shares information required for borrowers’ evaluation & loan disbursal.

Imagine this. You are a key decision-maker in a microfinance company that offers loans to small businesses. A grocery store owner who dreams of expanding his business approaches you to avail loan, as this is the best time for them to buy inventory at a discounted rate. They need the loan quickly to utilize the opportunity.

As a lender, you are responsible to:

- Authenticate customer identity by performing KYC

- Check if they have optimal cash flow by analyzing bank statements

- Verify income details and check if they pay taxes regularly

- Perform credit check and assess repayment potential based on past loans if any

The problem? All these should happen blazing fast. If not, the customer is going to find another lender.

Here’s where API can make all the difference

API helps to automate the entire workflow. You can instantly connect to government databases, Income tax portals or credit bureaus and verify what you want.

For example, to check the customer’s PAN validity, simply enter the PAN number and the API fetches you all the information related to the customer’s PAN and income tax details with just a few clicks.

API is that powerful!

API-fication for Lending Businesses – What are the real benefits?

According to API Performance Stats, APIs’ average response time is as low as 339 milliseconds. This allows businesses to analyse, approve, and process loan requests almost instantly.

The following are some of the ways API benefits lending businesses:

- Automates borrower verification and performs data checks in the loan origination system, thus significantly speeding up the loan approval process.

- Improves customer satisfaction by enabling faster credit checks and real-time loan decisions.

- Facilitates easy integration with external systems such as banking platforms or credit bureaus.

- Ensures safe data sharing between platforms and protects critical financial and customer data.

- Lowers operational costs by reducing manual work.

- Allows businesses to manage more loans effortlessly, thus improving the scope for scalability.

Key APIs Used in the Loan Origination Process (LOS)

The range of APIs part of the loan origination system fall under four umbrellas. The categories and their purpose are mentioned below:

- Credit Bureaus – Creditworthiness check

- KYC – Identity verification

- Financial Analysis – Financial health assessment

- Alternate Data – Behavioural insights

The inputs required, the outputs delivered, and the sources used for each of these APIs can be seen below:

Credit Bureaus – Creditworthiness Check

| Component verified | Inputs | Outputs | Sources used | Benefits |

| Equifax | Customer identification (PAN, Aadhaar) | Credit report, repayment behaviour | Equifax credit data | Assess repayment behaviour and creditworthiness and help to take informed lending decisions. |

| CRIF high mark | PAN, Aadhaar, or loan application data | Credit score, outstanding loan information | CRIF High Mark Database | Minimise lending risk by providing accurate credit scores and outstanding loan data. |

| CIBIL | PAN or Aadhaar number, borrower details | CIBIL score, credit history, loan details | Credit Information Bureau (India) Limited | Ensure risk management by providing information on borrower’s credit history and loan details |

| Experian | Borrower identity information | Credit score, financial behavior history | Experian data sources | Helps to determine reliability of the borrower by analysing their financial behaviour. |

KYC – Identity verification

| Component verified | Inputs | Outputs | Sources used | Benefits |

| Aadhar | Aadhaar number | Name, Address, DoB, Gender, and Photograph linked to Aadhaar | Unique Identification Authority of India (UIDAI) | Helps to ensure borrower’s authenticity by conforming their identity. |

| Driving License | Driving license number | Name, DoB, Photo of licensee, Blood group, vehicle categories authorized to drive, Father/ Husband name, License validity, type & Issuing state | National Database for Driving Licenses and Vehicle Registration | Helps to know the vehicle details and acts as an address proof. |

| PAN | PAN number of the customer | Name, Address, and PAN validity | Database from National Securities Depository Limited and the Income Tax Department. | Helps to check if the borrower complies with tax regulations. |

| Voter ID | Voter ID number | Authentication, Name, Gender, Mobile Number, Email ID, DoB, Father/ husband name, Address, Polling booth, Parliamentary constituency | National Portal of India/Electoral Databases. | Helps to prevent identity fraud |

| OCR | Scanned image of any customer ID | Name, Father/ husband’s name, DoB, Face, Card Number | OCR technique | Reduces errors caused by manual inputs. Extracts data quickly and enhances document verification. |

| Passport Check | Passport number which is used to generate the MRZ code | Name, DoB, Age, Address, Passport type, expiration date | Passport Seva Kendra (PSK) Databases | Reliable proof to verify customer’s identity. |

| MCA | Company name or CIN (Corporate Identification Number) | Company details, directors, financial reports | Ministry of Corporate Affairs (MCA) | Verifies business run by borrowers by validating company registration details and financial compliance. |

| Electricity Bill Validation | Consumer ID and Name of the Electricity Service Provider | Address, Bill date, Latest bill amount, Due date, Email ID, Phone number, Payment arrears and Deposits | Regional State Electricity Board or the Authorized Electricity Supply Company of the state | Reliable address proof |

| LPG Connection Verification | LPG Customer ID (obtained from the bill). | Name, Address, Last four digits of registered Phone and Aadhar, Bank details, Bank details, Subsidy status, Number of subsidized refills consumed in the last year, Amount of subsidy availed, Total number of refills, Date since the previously generated bill, Distributor’s Name & Code | Regional State Electricity Board or the Authorized Electricity Supply Company of the state | Check and confirm residential information of the borrower. |

Asset validation

| Component verified | Inputs | Outputs | Sources used | Benefits |

| RC | RC number | RC no., Body type of the vehicle, Chassis number, Fuel type, Registered colour, Gross weight, Name of manufacturer, Number of cylinders, Engine number, Model and make, Registered name of owner, Owner serial number | Vahan portal | Helps to confirm vehicle’s ownership and other details such as vehicle’s make and model. |

Financial Analysis – Financial health assessment

| Component verified | Inputs | Outputs | Sources used | Benefits |

| GST Verification | GST Number | Legal name of the business, Jurisdiction details, Registered name or individual linked to the GST number, Taxpayer type, Business type, Nature of business, Address, Contact info, GST registration date, Cancellation date, Last updated GSTIN, Trade name, Monthly expenses and revenue, Client list, and Tax payable | Central Board of Indirect Taxes and Customs (CBIC) | Helps to check if the borrower’s business operation by paying taxes properly. |

| Bank statements | Uploading Bank Statements (or) Using Net Banking Credentials. | Transaction history, account balance, cash flow patterns | Uses Data Scraping technique. | Helps to analyse financial health of the borrower by analysing cash flow and expenses. |

| Financial statements | Company name, CIN, or financial year details | Profit and loss statement, balance sheet, income statement | Ministry of Corporate Affairs (MCA) company filings | Helps to check credit worthiness of the borrower by analysing financial performance. |

| GST | GSTIN number | Business registration details, tax liability, GST returns | Central Board of Indirect Taxes and Customs (CBIC) | Used to assess business turnover and repayment potential of buyers. |

| ITR | PAN number, ITR form number | Filed income, tax liability, refund status | Income tax portal | Scrutinize tax payments of the borrower. |

Alternate Data – Behavioural insights

| Component verified | Inputs | Outputs | Sources used | Benefits |

| Geo-location | Device location data | Real-time customer location, location history, risk profiling based on location | GPS data, telecom providers | Check the borrower’s physical presence to prevent risks and frauds. |

| Social Media Activity | Social media account details | Social engagement, behavior patterns, interests, network analysis | Social media platforms (Eg: Linkedin, Twitter, Facebook) | Monitor trustworthiness and reputation of the borrower in the social media space. |

| Credit Transactions Data | SMS containing credit-related notifications (e.g., salary credits, incoming transfers) | Total credits, frequency, and source of funds | SMS inbox, banking institutions | Check and analyse borrower’s credit habits and repayment behaviour. |

| Debit Transactions Data | SMS with debit alerts (e.g., purchases, ATM withdrawals, bill payments) | Total debits, spending patterns, categories of expenses | SMS inbox, banking institutions | Analyse borrower’s spending patterns |

Utility API

| Component verified | Inputs | Outputs | Sources used | Benefits |

| IFSC Verification | IFSC Code | Bank name, code, Branch Address (City, District, State), Contact number, RTGS status | Any Indian Bank | Reduce the risk of frauds by confirming bank account details. |

| Face Match API | User Image | A face match score is generated | – | Helps to ensure secure and fraud free onboarding process. |

| Face Extract API | User Image | Cropped face image of the customer | – | Check facial features and confirm identity. |

| Name Match | Name to be checked | Matching score for the given name | Cross-checks with other authorized documents that carry the name of the customer | Reduce the risks of identity frauds by conforming to the borrower’s name. |

| Mobile Number Validation | Mobile number of the customer | Mobile number is determined if valid or invalid | Truecaller | Check if the mobile number provided is valid to ensure seamless communication. |

| Email Validation | Email ID of customer | Email ID is determined if valid or invalid | Public email verification services and SMTP (Simple Mail Transfer Protocol) servers. | Check borrower’s email address to reduce bounce rates. |

| Video KYC |

Scanned copy of the ID, Live video session between customer and lender, and Face comparison with scanned ID in live video session

|

Check and validate ID documents for tampering, and visual authenticity, Check face liveliness, consistency and video activity, and Face comparison result

|

Multiple sources | Enhance onboarding by verifying customer identity in real time. |

Final Word

Alright, we have covered a lot about the different types of APIs in the lending ecosystem.

In a nutshell, lending APIs let you verify customers, analyze their financial profiles and check their creditworthiness almost instantly. This has helped decision making quicker, easier and above all data-driven for several lenders across the globe.

Do you also want to take that leap into API based lending?

You need a reliable tech partner with knowledge of the nuances of lending processes while helping you stay compliant with the regulations.

Our CloudBankin’s adaptable digital lending platform is designed to integrate API into your business seamlessly without affecting your day-to-day operations. With our extensive feature set and robust Loan Origination and Management systems using multiple in-built API protocols, you can get peak efficiency and thrive in digital lending with utmost security and compliance.

Book a demo with us today and discover how CloudBankin’s API-driven solutions can help your lending business’s growth.

So, all set to API-fy?

Related Post

How Branchless Banking is Facilitating Financial Inclusion

One of the biggest boons to mankind in recent years

Top 10 Fintech Companies in India in the Lending Space

Are you getting worried because you have to pay important

What Do Prominent P2P Players Think Of The RBI Regulations?

Following the US and UK models, RBI is all set

- Email: [email protected]

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576

Quick Links

Resources

© 2025 LightFi India Private Limited. All rights reserved.

(Formerly known as Habile Technologies)