Working capital loans

These are small-sized, short-term loans that will cover your day-to-day expenses and current obligations such as purchasing inventory, payroll, GST payments, etc.

Buy Now, Pay Later (BNPL)

While shopping on eCommerce platforms, you may have come across the BNPL facility. When you’re about to purchase a product and can’t make an upfront payment, it will allow you to still complete the purchase on credit. Interestingly, this payment mode is widely used by customers, bringing the total revenue of the global BNPL market to $19 billion as of 2024.

Merchant Cash Advance

Under this type of financing, you receive a lump sum of cash upfront in exchange for a portion of your future sales. When your sales take a hit, MCAs will help you make ends meet temporarily. And for this, your ability to repay depends on your sales history.

Overdrafts

Did you know that you could make withdrawals from your bank account even with a negative balance? Thanks to overdrafts, it is entirely possible. Banks usually allow this to help customers address temporary cash shortfalls. But don’t get too attracted to it! It’s still a loan you need to pay off eventually.

Invoice Financing

Invoice financing is a credit facility that allows you to borrow money using high-value unpaid invoices as collateral. It requires no physical assets and no personal guarantees. Instead of waiting weeks or even months for your clients to pay their invoices, you can turn those unpaid bills into instant cash. This is an ideal funding solution if you’re looking to boost your firm’s cash flow and meet short-term expenses.

Supply Chain Financing

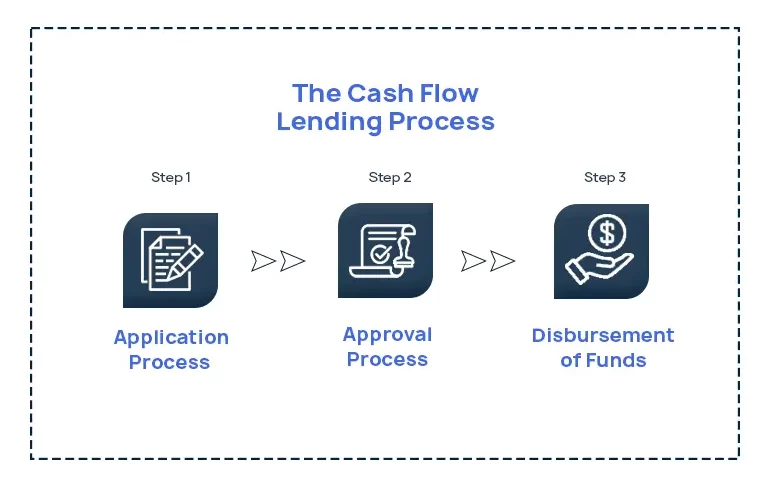

Also known as Supplier Finance, this form of lending helps both buyers and suppliers optimize their working capital by speeding up cash flow. Curious to know how it works? Here’s a quick rundown:

- The supplier delivers the goods to the buyer and submits an invoice.

- Instead of waiting for the buyer’s payment, the supplier receives an early payment from a bank or any other financial institution, often at lower interest rates taking the buyer’s creditworthiness into account.

- Finally, the buyer pays the amount to the financial institution on the agreed-upon date.

Revenue-based Financing

This form of financing is where businesses receive capital from investors in exchange for a percentage of their future revenue. Think of it as a win-win partnership! The investor bets on your business’ growth and you receive funds without the pressure of repayment schedules. Instead, they are flexible and are tied to your company’s performance. Payments increase when sales are high and they are smaller when sales are low. Revenue-based financing is popular with startups and subscription-based businesses looking to scale up without accumulating massive debts.

Line of Credit

Line of credit allows you to borrow money up to a set limit and repay it over time. It’s a highly flexible loan and the best part? You only pay interest on the amount you actually use. It’s a cycle where you can borrow, repay, and borrow again as needed. Looking to seize that new business opportunity? Or you simply might need to cover some unexpected expenses. Either way, line of credit will ensure your finances are controlled and that you have funds right when you need them.