Decoding the Key Parameters in Indian Credit Bureau Reports

Introduction

In today’s fast-paced financial world, credit plays a vital role in determining an individual’s ability to access various financial products and services. Whether it’s securing a loan for a dream home, obtaining a credit card, or even applying for a small personal loan, lenders in India rely on credit information to assess an individual’s creditworthiness and make informed lending decisions.

At the heart of this credit evaluation process lies the credit bureau report, which provides a comprehensive snapshot of an individual’s credit history and financial behaviour. A lender pulls credit reports of their borrowers to determine whether they have the “intent” to pay loans or not. On the other hand, to determine the “ability” to pay, lenders pull documents like bank statements. In India, credit bureaus such as Credit Information Bureau (India) Limited (CIBIL), Equifax, Experian, and CRIF High Mark collect, analyze, and maintain credit information of individuals from various financial institutions and lenders across the country.

Additionally, credit bureau reports are integral parts of the loan origination system process. They are generally used in one of the 10 loan origination stages, aka Credit Bureau Check.

This blog highlights important parameters in an Indian credit bureau report, vital for individuals seeking credit and maintaining a healthy credit profile. Understanding these parameters reveals what lenders assess for creditworthiness and how individuals can improve their credit standing.

Join us to explore key parameters shaping credit bureau reports in India and their impact on financial opportunities and decisions.

Credit Bureau Overview

When it comes to evaluating creditworthiness, credit bureaus play a crucial role in the financial landscape of India. Let’s delve into the key aspects of credit bureaus in India.

- The credit bureaus act as repositories of credit data.

- They gather information from Banks, Urban Co-Operative Banks (UCBs) Non-Banking Financial Companies (NBFCs), credit card issuers, and other lending entities.

- The credit data encompasses details about credit accounts, repayment history, credit limits, outstanding balances, and more.

- Credit bureaus compile comprehensive credit information into credit reports (aka credit bureau reports), providing lenders with insights into an individual’s creditworthiness and helping them assess the risks of extending credit.

- Understanding the essential sections of credit bureau reports—credit scores, credit history, credit accounts, enquiries, and public records—is crucial for individuals to gauge their creditworthiness and make informed financial decisions.

It’s important to note that credit bureaus in India operate independently and employ different algorithms and methodologies to calculate credit scores. Thus, it is common for individuals to have credit scores that may vary slightly across different credit bureaus. However, the underlying parameters considered in credit reports remain fairly consistent across these institutions.

Now that we have a basic understanding of credit bureaus and their role in India’s financial ecosystem let’s delve deeper into the top parameters used in a credit bureau report.

You may also like: The Most Popular Credit Rating Agencies in India

Key Parameters in a Credit Bureau Report

1. Individual Information

What is it?

The Personal Information section contains details pertaining to the individual’s identity. This parameter aims to provide a comprehensive overview of the individual’s personal details as reported by lenders and Financial Institutions (FIs). Credit reporting is done for both borrower and co-borrower of a loan.

Why is it important?

It is primarily used for identification purposes and to triangulate data from all sources. It helps establish the individual’s unique identity and verify their personal details. Lenders and financial institutions rely on this information to match the borrower’s identity with their credit history and track any potential discrepancies. The accuracy of personal information is vital for conducting reliable credit assessments and preventing identity theft or fraud.

What does it include?

Full Name, Address, Date of Birth, Gender, Contact Details, PAN Card Details, Other Identifying Proof – Aadhaar Card number, Passport number, Voter ID, Driving License, Ration Card, or other official identification documents.

Note: If addresses and phone numbers keep changing frequently, it raises red flags about the borrower.

2. Credit Score

What is it?

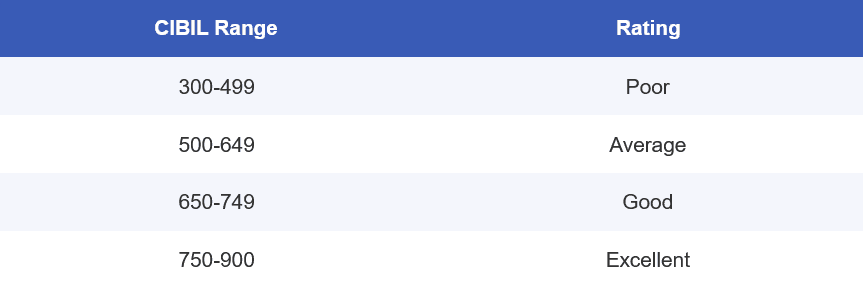

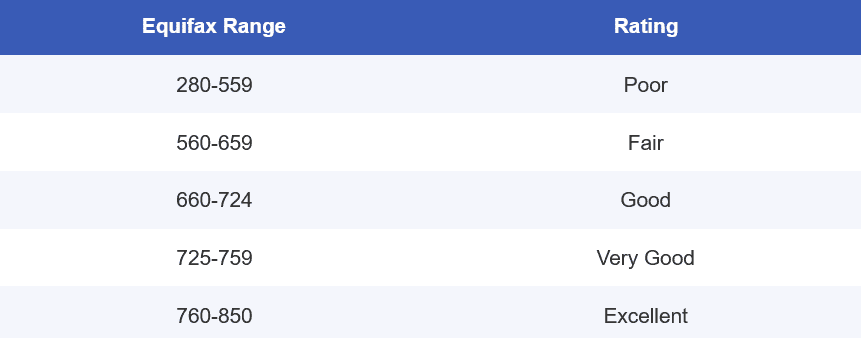

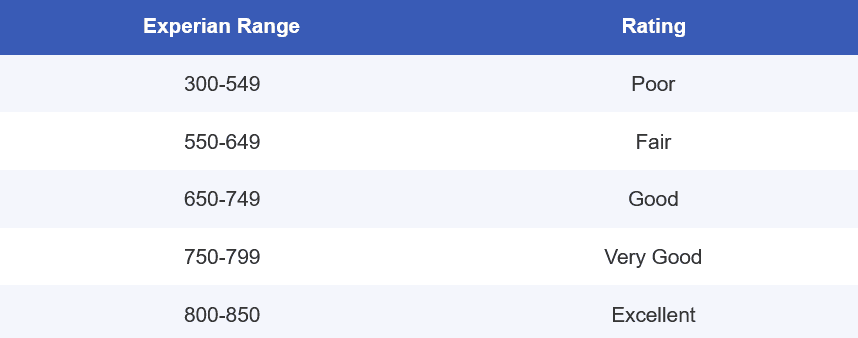

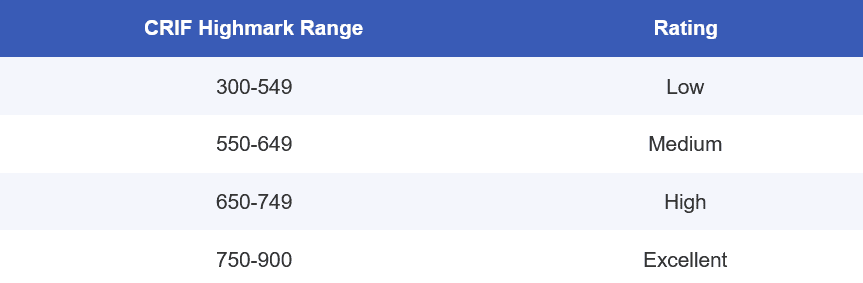

A credit score is a three-digit number that falls within a range of 300 to 900. It is provided by credit bureaus. The score is based on an individual’s credit history, payment behaviour, credit utilization, and other factors. It serves as an indicator of how likely a person is to repay their debts on time.

Why is it important?

Lenders rely on credit scores to evaluate the creditworthiness of applicants. A higher credit score increases the chances of loan approval, while a lower score may lead to difficulties in obtaining credit or result in higher interest rates. Each credit bureau has its own set of criteria & algorithms to determine credit scores. Thus, different credit bureau reflects different score on a credit report. Maintaining a good credit score is essential for accessing favourable terms and financial opportunities.

What is a good credit score?

While credit score ranges may vary across different credit bureaus. A credit score which is 650 & above is typically considered as good. However, each lender may have its own criteria for assessing creditworthiness. It’s important to monitor your credit score regularly and strive for a higher score, as it improves your chances of loan approval and favourable interest rates.

(Image Credit: Forbes)

(Image Credit: Forbes)

(Image Credit: Forbes)

(Image Credit: Forbes)

Based on what factors credit scores are evaluated?

- Payment History: It includes all your past and present payments to lenders, reflecting your reliability as a borrower. Unpaid bills can negatively impact your payment history and overall score.

- Credit Utilization Ratio (CUR): The percentage of available credit being used, usually on a credit card. For example, a credit card has ₹ 1,00,000 amount as the limit, out of which ₹ 10,000 is used already. Hence, CUR is 10,000/1,00,000, which is 10%. High CUR above 30% = bad credit management, indicating financial indiscipline & potential loan default. Keep CUR below 30% for healthy management of credit.

- Credit History Age: The duration for which you have been utilizing credit is what defines the age of your credit history. Lengthier credit history has a positive impact on your credit score.

- Credit Mix: Borrowers may possess different types of credit accounts, including education loans, mortgages, credit cards, and vehicle loans. This assortment of credit accounts is known as the credit mix. This determines how well a borrower is able to manage all kinds of credit.

- Credit Enquiries: Credit Enquiries are typically necessary when an individual seeks a loan or applies for a credit card. A lender does an enquiry to access a credit report for the borrower.

Factor | Impact |

Payment History | High |

Credit Utilization | High |

Credit Age | Medium |

Total Credit Accounts | Low |

Credit Enquiries | Low |

3. Account Information

What is it?

Account Information in the credit bureau report provides crucial details about your credit accounts, including loans and credit cards. It encompasses information about account types, payment history, account status, ownership, and more.

Why is it important?

- Credit History and Credibility: Account Information helps establish your credit history and credibility. Having multiple accounts, especially older ones, positively influences your credit score, demonstrating your experience in managing credit responsibly.

- Credit Mix and Score Impact: Account Information reveals the composition of your loan portfolio, including the mix of secured and unsecured loans. Maintaining a healthy mix can contribute to a higher credit score, indicating your ability to handle different types of credit.

- Lender’s Decision and Loan Eligibility: The information on your current loan balances and outstanding amounts directly affects a lender’s decision to grant you additional credit. High outstanding balances or long-term loans may lower your credit score and impact your loan eligibility.

- Payment History and Delays: Account Information provides insights into your payment patterns and any delays or defaults. Longer periods of delinquency can result in a lower credit score.

What information does it include?

- Account Identification: Account numbers, loan types, ownership details (individual or joint), and opening/closing dates.

- Account Status: Active or closed account status indicating your current credit relationships and credit history with specific lenders.

- Credit Limits and Usage: Credit limits assigned to each account, and your credit utilization ratio reflecting the amount of credit used compared to the total available.

- Payment History: Details on payment frequency, amounts due, actual payments made, and any payment delays.

- Secured and Unsecured Loans: Differentiating between loans with collateral (secured) and those without (unsecured), such as auto loans, home loans, and credit cards.

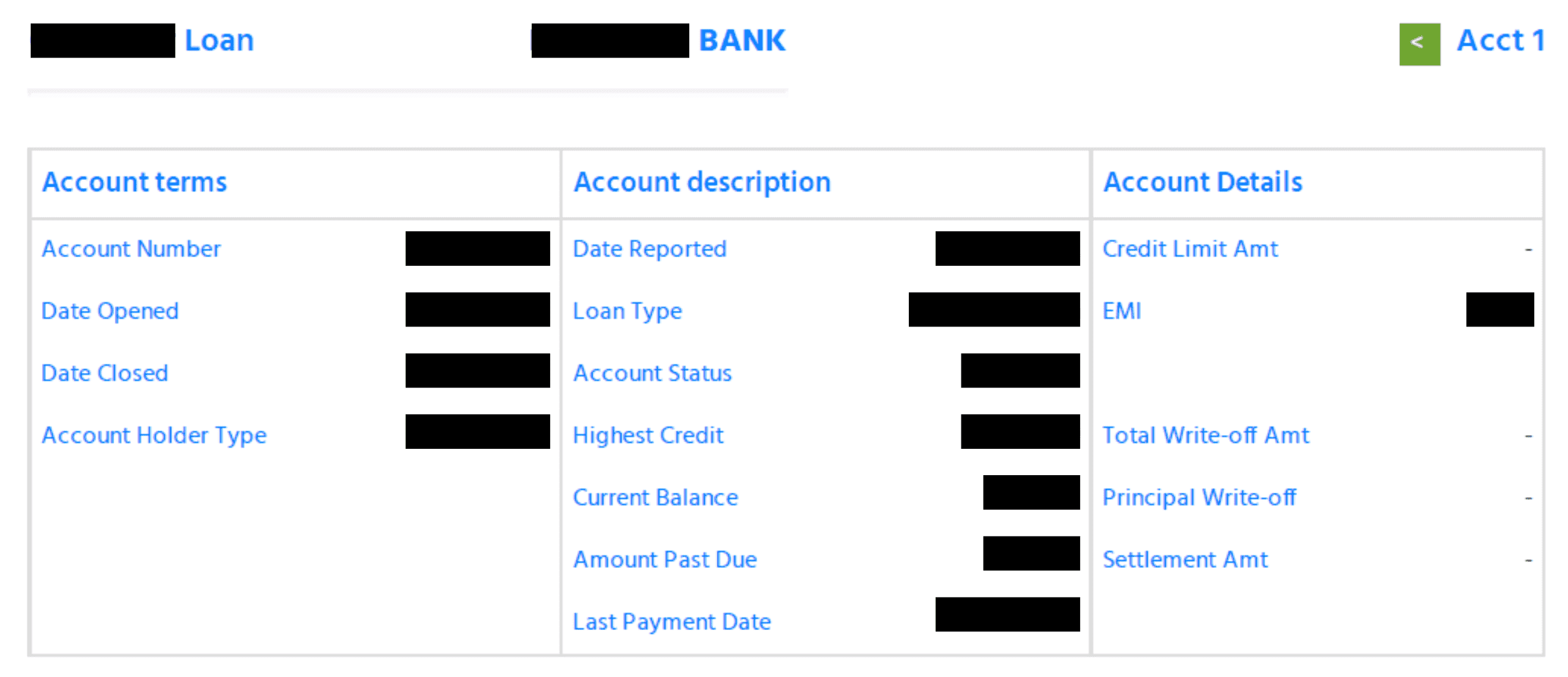

An Example of Account Information – CIBIL Report

Name | Description |

Account Terms | |

Account Number | Account number of the financial institution you have taken the loan from (in this case, a bank). |

Date Opened | When the loan account is opened. |

Date Closed | When the loan account is closed. |

Account Holder Type | What type of account it is, whether an individual, joint, etc. |

Account Description | |

Date Reported | Date on which data is submitted by that bank. |

Loan Type | The type of loan taken. |

Account Status | Account status is either active or closed. |

Highest Credit | The highest amount of payment owed by you to the bank. |

Current Balance | The amount left to be repaid when the report was generated. |

Account Past Due | The amount that’s not been paid on time, basically an overdue amount. |

Last Payment Date | Date on which the last payment was made when the report was generated. |

Account Details | |

Credit Limit Amt | Valid only for credit cards – the amount limit allowed to be withdrawn. |

EMI | The amount you are required to pay each month. |

Total Write-off Amt | The total loan amount defaulted. |

Principal Write-off | The total loan amount subtracting the interest amount. |

Settlement Amt | Both bank and you agree to settle the loan on a certain amount. |

4. Enquiries Information

What is it?

Credit enquiries refer to instances when your lender requests access to your credit report for a hard pull from a credit bureau. It is typically necessary when you ask for a loan or a credit card. These enquiries provide valuable information about your credit history and play a crucial role in determining your credit prospects.

Why is it important?

Enquiries are essential because they reflect your credit-seeking behaviour and provide insights into your creditworthiness. Lenders and financial institutions consider your credit enquiries when evaluating your loan or credit card applications.

How is it done?

- Soft Pull: Soft inquiries are created when you or financial institutions look into loan options. They usually happen when you ask for your credit report or when a creditor pre-screens you for loan eligibility.

- Hard Pull: When you apply for credit, lenders must check your credit report to see before extending you the credit or giving you a loan. These checks are called hard inquiries. It is important to note that hard enquiries are visible to lenders and can affect their decision to approve or reject your loan or credit card application.

How Do Enquiries Impact Credit Scores?

- Soft Enquiries: No direct impact on your credit score.

- Hard Enquiries: Each hard enquiry may lower your score by a few points (typically 5-10 points) temporarily, typically lasting a few months to a year. Hard inquiries are removed from your credit reports after a period of two years.

- Multiple Hard Enquiries: Having multiple hard enquiries within a short period shows your desperation, raises concerns and negatively affects your credit score for a longer duration.

5. Payment History

What is it?

Payment History in a credit bureau report reflects a borrower’s past payment behaviour on credit accounts, including timely payments, missed payments, defaults, and Days Past Due (DPD) information indicating payment delays.

Why is it important?

Payment History is one of the most significant factors considered by lenders when assessing your creditworthiness. It demonstrates your ability to manage credit responsibly and fulfil your financial commitments. A positive payment history, with a track record of timely payments and minimal DPD, can greatly enhance your credit score and increase your chances of obtaining future credit at favourable terms.

What information does it include?

- Timely Payments: Details of payments made on time, indicating responsible credit management and reliability.

- Missed Payments: Information on any instances where you failed to make payments by their due dates.

- Late Payments: Records of payments that were made after the due dates but within a specified grace period. It may also include information on the number of days by which the payments were delayed (DPD).

- Defaults: Instances where you have failed to make payments for an extended period, leading to default on credit obligations.

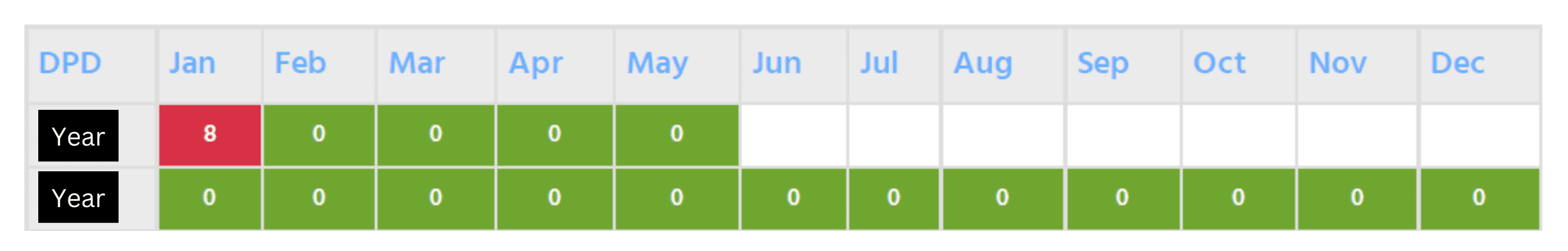

6. DPD Information

Days Past Due (DPD) in Payment History indicates payment delays by specifying the number of days payments were overdue. Lower DPD reflects a strong payment track record, while higher DPD may indicate financial instability or difficulty in managing credit obligations.

Credit bureaus provide information on different levels of payment delay, indicated by terms like 01+DPD, 30+DPD, 60+DPD, 90+DPD, and so on, up to 720+DPD.

An Example of the Payment History of CIBIL Report

DPD ‘0’ : The numerical ‘0’ within the circle signifies that the payment has been made in accordance with the agreement, and the credit account is current.

DPD >0 : The numerical value within the circle indicates the “Days Past Due” reported by the lender, reflecting any delay in payment.

7. Public Records

What is it?

Public records refer to the section in the credit bureau report that contains records of any publically available information related to your financial history. It includes information sourced from official public records, such as bankruptcies filed, tax filed or collection accounts.

Why is it important?

it offers valuable insights into your financial behaviour and any notable legal or financial events that might influence your creditworthiness. Lenders and financial institutions carefully consider this information when assessing your credit applications, as it helps them gauge your financial responsibility and potential risk. Additionally, this report allows creditors to ascertain an individual’s total current fixed obligations.

What does it include?

- Bankruptcy filings: Details of any bankruptcy proceedings initiated by you or against you.

- Tax filed: Information on income tax filings, liabilities, and compliance.

- Collection accounts: Records of debts sent to third-party collectors due to non-payment, indicating past delinquency or default.

8. Any Guarantor Detail

What is it?

Guarantor Details refer to the section in a credit report that highlights individuals who have provided a guarantee for someone else’s loan or credit. As a guarantor, they are responsible for repaying the debt if the borrower fails to do so.

Why is it important?

Knowing the Guarantor Details is important as it indicates the level of financial obligation and responsibility undertaken by the guarantor. Lenders consider the presence of a guarantor when evaluating the creditworthiness of a borrower. Guarantor Details can impact the overall assessment of credit applications and determine the risk associated with the borrower.

What does it include?

- Guarantor name

- Guarantor type

- PAN

- Address

- Phone Number

- Other relevant (in case the guarantor is an entity) like CIN, TIN, business category, business type, incorporation date, registration number, etc.

9. Entity Details (In case of Borrower as an Entity)

What is it?

Entity Details refer to the section in a credit report that outlines the information related to a borrower when they are an entity. It includes details about the entity’s legal structure, registration information, and other relevant information.

Why is it important?

Knowing the Entity Details is important as it helps lenders assess the creditworthiness and credibility of the entity. Lenders evaluate the financial stability and legal standing of the entity before extending credit facilities. Entity Details provide valuable insights into the entity’s background and financial history.

What does it include?

- entity’s legal name,

- address,

- phone number,

- PAN,

- registration number, date, city

- date of incorporation,

- business structure (e.g., private limited, partnership, sole proprietorship), and

- other relevant identification details like business category, industry type, corporate identification number, taxpayer identification number, etc.

- It may also include information about the entity’s directors or key stakeholders.

10. Other Parameters & Terms

- Settled Accounts: Partial payment made on a loan or credit card. Negative impact on credit score. A full closure is required to remove the remark.

- Written Off of Loans: Unpaid loan or credit card amount for over 180 days. Detrimental status for future credit applications.

- Post Credit Write-off Settled: Settlement after credit write-off. Seriously damages credit health and hinders future loan or credit card approvals.

- Wilful Default: Intentional non-payment of a loan or misuse of funds. Negative remark with legal implications. The RBI has a whole checklist to identify wilful defaulters.

- Closed: Loan fully paid off and reported as closed. Obtain a No Dues Certificate (NDC) for closure confirmation.

- Standard: Overdue < 90 days.

- Special Mention: Accounts that are specially monitored closely by a lending organisation for some discrepencies like delays or irregulatories in payments.

- Sub Standard: Overdue > 90 days for less than or equal to 12 months.

- Doubtful: Overdue > 90 days for more than 12 months.

- Loss: Has been identified as loss & amount not written off.

Bottom Line

Understanding key parameters in Indian credit bureau reports is crucial for managing creditworthiness. Decode these parameters to maintain a positive credit profile, make timely payments, and achieve financial goals. Regular monitoring and necessary actions are key for a strong financial foundation.

A digital lending software such as CloudBankin leverages credit bureau reports to:

- Obtain credit information instantly through API integration.

- Access reports within the software system itself.

- Share these credit parameters with our credit rule engine system.

- Make instant decisions based on the provided information.

So, upgrade your lending system and let it easily & seamlessly handle credit evaluation for your borrowers.

Frequently Asked Questions

What is a credit bureau report?

Credit bureaus collect a wide range of credit-related information from different lenders and financial institutions. This includes data on an individual's credit accounts, such as loans and credit cards, their repayment history, credit limits, outstanding balances, and any defaults or late payments. The credit data is collated and organized into credit reports, also known as credit bureau reports, which present a detailed snapshot of an individual's credit history and financial behaviour.

Why is a credit report important for individuals & businesses?

For Individuals: a) A positive credit report reflects responsible financial behaviour, timely repayments, and a good credit history, making it more likely for individuals to qualify for various financial products and services. b) With a favourable credit report, individuals can access loans, credit cards, mortgages, and other credit facilities at competitive interest rates and favourable terms. c) On the other hand, a negative credit report, indicating missed payments or defaults, may lead to loan denials, higher interest rates, or limited borrowing options. For Businesses: a) Credit reports help businesses establish their creditworthiness and credibility in the financial market. b) A positive credit report can enhance a company's chances of securing business loans, lines of credit, and trade credit from suppliers. c) With a strong credit report, businesses can negotiate better terms with vendors and suppliers, improving cash flow management. d) Conversely, a poor credit report may deter potential investors or partners and limit access to essential financial resources.

What kind of information do credit bureaus collect and compile into credit reports?

Credit bureaus collect a wide range of credit-related information from different lenders and financial institutions. This includes data on an individual's credit accounts, such as loans and credit cards, their repayment history, credit limits, outstanding balances, and any defaults or late payments. The credit data is collated and organized into credit reports, also known as credit bureau reports, which present a detailed snapshot of an individual's credit history and financial behaviour.

What are the potential risks to the frequent addresses changes and phone numbers changes in a credit report?

Frequent changes in addresses and phone numbers may raise red flags about the borrower's stability or reliability. Lenders may view such changes as potential risks, as they could indicate instability or a higher likelihood of default.

How is a credit score calculated?

It is calculated based on an individual's credit history, payment behaviour, credit utilization, and other factors. The credit score serves as an indicator of how likely a person is to repay their debts on time.

What factors are evaluated to determine credit scores?

Credit scores are evaluated based on several factors, including payment history, credit utilization ratio (CUR), credit history age, credit mix, and credit inquiries. Payment history and credit utilization ratio (CUR) have the highest impact on credit scores because they reflect an individual's payment behaviour and credit management. On the other hand, the age of credit history, credit mix, and credit inquiries have lower impact levels on credit scores.

What is Credit Utilization Ratio (CUR), and its significance?

Credit utilization ratio (CUR) is the percentage of available credit being used, typically on a credit card. A high CUR above 30% is considered bad credit management, indicating financial indiscipline and potential loan default. Keeping the CUR below 30% is advisable for healthy credit management.

How are credit enquiries made?

a) Soft Pull: Soft inquiries occur when you or financial institutions look into loan options. They usually happen when you request your credit report or when a creditor pre-screens you for loan eligibility. No direct impact on credit score. b) Hard Pull: Hard inquiries occur when you apply for credit, and lenders must check your credit report before extending credit or granting a loan. Hard inquiries are visible to lenders and can affect their decision to approve or reject your loan or credit card application. Each hard enquiry may temporarily lower the credit score by a few points (typically 5-10 points) for a period lasting a few months to a year.

Can multiple credit enquiries impact credit score?

Having multiple hard enquiries within a short period can raise concerns about desperation and negatively affect credit scores for a longer duration.

How long do credit enquiries stay on a credit report?

Hard inquiries remain on a credit report for a period of two years before they are removed.

How are the payment delays in DPD represented in a credit report?

For Days Past Due (DPD), credit bureaus use terms like "01+DPD," "30+DPD," "60+DPD," "90+DPD," and so on, up to "720+DPD" to represent different levels of payment delay. Each term indicates the number of days the payment was overdue beyond its due date.

What do the terms Standard, Sub Standard, Doubtful, and Loss signify in a credit report?

a) Standard: Accounts that are overdue for less than 90 days. b) Sub Standard: Accounts that are overdue for more than 90 days but less than or equal to 12 months. c) Doubtful: Accounts that are overdue for more than 90 days and have been overdue for more than 12 months. d) Loss: Accounts that have been identified as a loss, and the amount has not been written off.

Related Post

A Complete Guide to Regulatory Compliances of NBFCs

In India's financial landscape, Non-Banking Financial Companies (NBFCs) hold a

10 Powerful Tools To Help Automate Your Lending Process

In a fast-paced, competitive world of the lending industry, financial

- Email: [email protected]

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576

Quick Links

Resources

© 2025 LightFi India Private Limited. All rights reserved.

(Formerly known as Habile Technologies)