Alternative Credit Scoring – Why Is It So Popular?

Priyank Raj from Mumbai was in a fix. He had applied for a loan but his application was rejected as his CIBIL credit score didn’t generate enough data to establish his creditworthiness for the new loan.

Like Priyank, many hopeful loan applicants are facing rejections due to lack of credit history data. And this happens to be a vicious cycle. In the absence of low or no credit score, they cannot get loans, and since they cannot service the loans successfully, they cannot improve their credit scores. What route can they take to overcome the absence of data from credit scoring agencies like CIBIL, CRISIL, ICRA, CARE, ONICRA, SMERA, Brickwork Ratings India Private Limited, Equifax India, Experian India, etc., what is the route they can take in order to overcome this issue?

They can look at alternate credit scoring in order to improve their chances of the successful loan application and subsequent disbursement. Even with low or no credit scores, they can use the alternate credit score to bolster their chances of procuring loans from banks and financial institutions.

What is alternate credit scoring?

Alternate credit scoring helps with a broad-based credit scoring mechanism. It goes beyond the traditional parameters employed by agencies like CIBIL. The biggest beneficiaries of alternate credit scoring are consumers who are new to the credit and financing ecosystem. For such new consumers, there is no sufficient centralized data available. But that doesn’t mean that they cannot avail of credit. New age alternate credit scoring companies use other tangible factors like a digital footprint to determine the credit-worthiness of a new customer.

This provides benefits at both ends. By extending access to credit, customers who are new to the credit and loan system can still avail of loans irrespective of lack of credit scoring data on traditional channels. Lenders too can utilize alternate credit scoring in order to boost their penetration in previously unexplored geographies like semi-urban and rural areas but still keep their risk minimum and check frauds.

At the core of the alternate credit scoring companies’ competencies are three key factors – the ability, intent, and stability of the customer in repayment of the loans advanced on the basis of these innovative scoring systems.

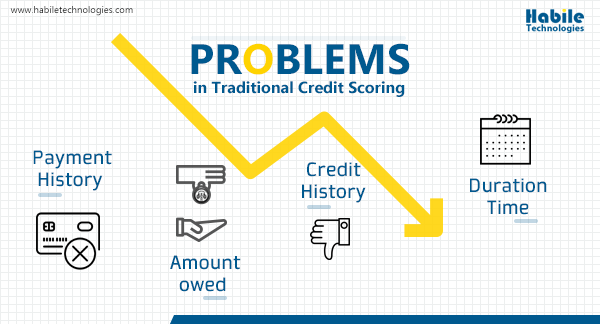

Problems in traditional credit scoring

Traditional credit scoring agencies provided great outcomes for the financial services sector for many years. Some of the underlying factors to help them determine credit scores included the below,

- Payment History – It checks for regular payments on past loans taken. A higher number of problems, delays, or defaults brings down the score.

- Amount owed – Your financial behaviour will dictate your performance on this metric. If you are maxing out your cards regularly and keeping a high outstanding due amount then this will pull down the score.

- Credit history – Applicants with a longer credit history (i.e. they have been taking loans and repaying it back for many years now) have a better score as they provide richer data for assessing creditworthiness.

- Duration of availing new credits – When you take out multiple new credits within a short span of time, your score is decreased as your exposure and risk profile increases.

Each credit checking bureau has its own proprietary algorithm to arrive at a credit score, but these factors are considered crucial for across the board.

It has been seen that, with the evolving domain, the way people view lending, credit, and financing has undergone a sea change over the last five years or so. Be it fintech, payday loans, short-term loans, or cash-checking services, the way consumers access credit in today’s times is far different from what it was almost a decade back. The traditional scoring agencies have not been able to match this radical shift into their way of assessing the creditworthiness of a potential loan applicant. And this is where the problems arose.

It led to a wide demand-supply gap for loan products and its servicing. On one hand, banks, NBFCs, and other financial institutions were not able to advance loans due to lack of visibility on the applicant’s credit score. As a result, the loan approval ratio for these institutions had dipped substantially. On the other hand, many applicants had to face rejections on the application for a loan product as they were new to the credit market and didn’t have a lot of background data to assess their true ability in servicing the loan successfully.

You May Also Like: Why Should You Use A Cloud-Based Loan Management Software?

Features of alternate credit scoring

Alternate credit scoring is a great way to introduce new customers to the credit and financing landscape. The broader inclusion opportunities provided by alternate credit scoring perhaps explains why this is such a hot concept in emerging markets like China and India.

From a supply end too, there has been substantial market penetration by new-age start-ups that are engaged in offering credit scoring to individuals to be used for obtaining credit. At the same time, they provide an avenue for lenders to earn great returns by bringing in more customers to repay their various loan products. Such credit scoring agencies assist individuals and small enterprises to procure different forms of credit like personal loans, working capital loans, and vehicle loans. The huge increase in the number of applications tied up with alternate credit scores shows the immense convenience, speed, and simplicity delivered by such scoring agencies in lessening the demand- supply gap for credit access in India.

This model uses technology to assess various factors like data around the payment history (e.g. utility bill payment), bank balance, ecommerce shopping, travel size, and spending patterns of the loan seeker. It involves the maximum utilisation of technology and digital footprint like social media and mobile and internet usage to determine if the prospective applicant can get the loan or no. Such a broad perspective related to the customer profile significantly enhances the prospects of successful loan disbursements. It also continues protecting the banks, NBFCs, and financial institutions with meaningful data beyond what is provided by the traditional credit scoring agencies.

Advantages of alternate credit scoring data

Alternate credit scoring data has the potential to expand logical and responsible access to loan products for people who do not have adequate background data to strengthen their credit scores. It may happen that a person who hasn’t availed of a loan in the past (and hence having no repayment history) might have been paying off utility bills and

monthly charges promptly. These can provide ample validation to the lenders that the borrower has the intent and the capacity to repay his/ her loan successfully in case of successful loan processing. The lending institutions are able to improve their topline and augment customer accounts in such cases. It can also strengthen their decision making and alleviate the risks associated with people who may have a good traditional credit score but may possess improper payment behaviours for their monthly charges or their utility bills.

Here are some key advantages offered by alternative credit scoring:

1 – Enhanced creditworthiness assessment

Lenders may reject loan applications for people with a poor credit score. With alternate credit scoring, they get a better view of the applicant’s creditworthiness. They can determine which people are less likely to have problems in repayments, by analysing other data like monthly bills payment patterns. This rich suite of information on customer profile comes in handy for making informed decisions. All this, without compromising on their institution’s risk exposure.

2 – Differentiated customer experience

Banks, MFIs, NBFCs, and other lending agencies get the much-needed automation assistance with the supplemental data provided by alternate credit scoring. For example, online bank account information can help speed up and automate manual tasks at the time of loan processing and subsequent approval. What’s more, it can also help the lender to avoid subjective interpretations at the time of application processing. This in turn, helps avoid improper discrimination for credit access.

3 – Customer segment creation

Customer profiles like homeowners, students, retirees and professionals often find it difficult to obtain loans due to issues or gaps in credit scores from traditional agencies. With alternate credit scoring, they can bolster their loan application case. If they have been on top of timely payments of household expenditure, charges, and bills, then there is a high chance that they can secure loans even with a lower credit score.

4 – Credit access made possible for the underbanked

With many people classified as unbanked or underbanked, their credit profile would be unviable for a true creditworthiness assessment. Instead of having almost zero opportunities of securing a loan, they can look forward to alternate credit scoring system to get a fuller picture into the credibility, intent, and capacity of an applicant to service a loan.

5 – Existing borrowers can get a better deal

Borrowers who have already been sanctioned a loan may have been done so at unfavourable interest rates. Because of lack of adequate data on credit history, banks may be charging them higher than normal interest rates to protect the risk they take up by approving such an applicant’s loan. Alternate credit scoring seeks to rectify this problem. It makes maximum use of technology to find out more about the customer’s digital footprint, and past behaviour on ecommerce purchases, banking transactions, and bill payment promptness. It gives an innovative medium to lenders to correctly assess the risk levels in lending and offers the right tool to the analysts and underwriters to help deliver tailored financial products that are a win-win for both – the borrower as well as the lender.

6 – Boost to the underwriting process

The traditional process of underwriting can be enhanced substantially with the use of richer data points or variables that emerge with the help of alternate credit scoring. These may include variables like banking transaction behaviour, credit card repayment and overdue payment, promptness in paying monthly bills like telecom, utility, or cable bills, and employment history. For the underwriting team, they can mitigate credit risk and bring about a much better process of risk modeling and monitoring.

You May Also Like: Loan Origination – A Critical Step in Loan Process

7 – Uses real-time data

In the traditional process of credit scoring, bad history may impact the borrower’s credit standing for as long as 2-3 years after the issue had occurred. It takes a long time for the applicant to overcome the dip in credit score and reach a healthy level again. So even if the person had defaulted just twice 3 years back, he will still be considered a potentially risky profile in current times, even though the applicant’s financial situation may have improved a lot over these last 3 years. With alternate credit scoring system, the data used to make a decision is real-time. It provides a more time-relevant insight and offers a complete assessment carried out to check how creditworthy is an applicant in current times. Since the applicant has to factor in today’s financial scenario when repaying the loan, this type of credit scoring makes much more sense than the traditional credit scoring system.

8 – Eliminates human bias with the help of technology

The rapid inroads made by financial technology or FinTech has made a substantial impact on the level of financial inclusion exercised and deployed by the financial sector in the nation. FinTech uses technology and automated digital tools to prevent biasness in factors like age or demographics from creeping in due to human involvement at the time of decision making. Algorithmic models used in FinTech display the lack of sociological biases associated with human beings. Hence, they do a better job at delivering approval or rejection outcomes which are truly equal for all demographic personas and age groups.

A look at a great use case in alternate credit scoring – Social Loan Quotient

Social Loan Quotient (SLQ) is India’s first credit rating system and is promoted by CASHe – one of India’s leading digital lending agency. SLQ places immense emphasis on the digital footprint of the applicant in order to come up with a credit score.

A major plus point of this SLQ is its ability to factor in the loan requirement of the young urban mass. This demographic profile prefers to obtain small ticket loans that can be paid off in quick time. Traditionally, banks and NBFCs have been averse to service this segment. The lack of credit history too plays a part in making the situation grim. However, with the alternate credit scoring mechanism, this untapped segment can now be opened up to benefit both the applicant and the lender.

SQL ties up diverse and seemingly unrelated data points like social media behaviour, media footprint, bills payment promptness, education, salary drawn, and bank account transactions among a host of other factors to provide a much elaborate picture of how likely the applicant is to default on loan repayments and presents an elevated risk profile to the lender. This way, lenders can make an informed decision about whether to sanction the approval or not.

With SLQ, the focus is on those customer segments that have minor or zero credit history associated with traditional credit lending institutions. The platform is well-suited to a growing class of urban millennials who haven’t transacted with a bank or had a previous loan but are very well connected online, have a good social media presence, and entrusted with monthly household expenditures to be fulfilled. By getting data on their transactional behaviour on these parameters, the concept of financial inclusion can be truly materialized

Our CloudBankin custom rule engine enables the financial institutions can set their own parameters to assess the customer credit score. Their list of structured parameters includes personal information, government ID, geographical location, employment details, financial details, etc., based on which the customers are assessed and rated.

You May Also Like: 12 Factors To Be Considered before Choosing A Loan Management System

Future of credit system – our prediction

In the future, alternate credit scoring system is expected to take off in a big way in developing economies like China and India. It is already a hit model for American citizens looking for short term loan like payday loans. In India, the traction will continue to pick pace as more and more millennials with zero credit history data would need access to credit for specific purposes.

We expect to see this trend strengthen substantially and penetrate deeper into tier 2 and tier 3 cities where the new-age urban youth are struggling to obtain loans in the absence of credit history data from traditional sources like CIBIL. Lending institutions too can get a better way to analyse risk and predict accurately on who is likely to default on a loan EMI repayment, and who is not.

Signing off

To conclude, alternate credit scoring is poised to offer significant traction to the financial services sector of a developing economy like India. It will ensure that many more people can be introduced to the credit ecosystem. For banks, MFIs and NBFCs, it serves as a validation of the customer’s payment behaviour and consistency in periodic repayments.

Related Post

Why Knowing About Them Matters: A Complete Guide to Credit Bureaus In India

Introduction In a world where access to credit can make

Navigating Through The Regulatory Compliances for NBFCs

Overview Regulatory compliance for Non-Banking Financial Companies (NBFCs) has undergone

- Email: [email protected]

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576

Quick Links

Resources

© 2024 LightFi India Private Limited. All rights reserved.

(Formerly known as Habile Technologies)