Credit Reporting Format For Financial Institutions By The RBI

Credit Reporting Format For Financial Institutions By The RBI

Let’s decode the RBI’s credit reporting format for financial institutions. It acts as a beacon for financial entities, ensuring data integrity and streamlined operations.

Access the complete documentation from here.

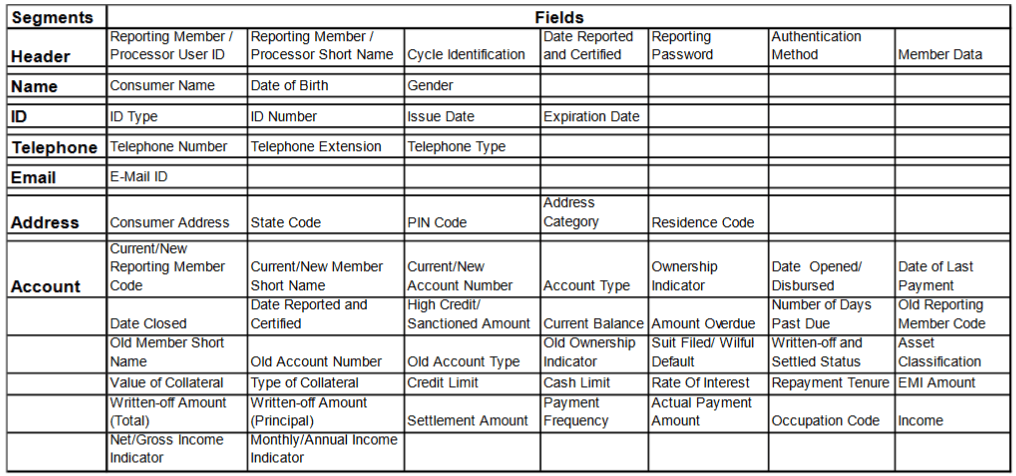

Credit Reporting Format For Consumer Borrowers

(Image Credit: Equifax)

What’s Segments Are Included?

1. Header

- Reporting Member / Processor User ID: This field likely identifies the unique ID of the reporting member or the processor user. It ensures that the data is traceable back to the source.

- Reporting Member / Processor Short Name: A concise name or abbreviation for the reporting member or processor. This provides a quick reference to the entity submitting the data.

- Cycle Identification: This might refer to the specific reporting cycle or period, helping in organizing and categorizing the data.

- Date Reported and Certified: The date when the data was reported and verified. This ensures the timeliness and authenticity of the information.

- Reporting Password: A security measure to ensure that only authorized entities can submit data.

- Authentication Method: The method used to verify the identity of the reporting entity, ensuring data integrity and security.

- Member Data: General data or metadata about the reporting member.

2. Name

- Consumer Name: The full name of the consumer whose credit information is being reported.

- Date of Birth: The birthdate of the consumer, which can be crucial for identity verification.

- Gender: The gender of the consumer.

3. ID

- ID Type: The type of identification document (e.g., PAN, Aadhar, Passport, Driver’s License).

- ID Number: The unique number associated with the identification document.

- Issue Date: The date when the ID was issued.

- Expiration Date: The date when the ID will expire.

4. Telephone

- Telephone Number: The primary contact number of the consumer.

- Telephone Extension: Any extension number associated, typically used for landlines within large organizations.

- Telephone Type: The kind of telephone (e.g., Mobile, Landline).

5. Email

- E-Mail ID: The email address of the consumer.

6. Address

- Consumer Address: The full residential address of the consumer.

- State Code: The code representing the state of residence.

- PIN Code: The postal code of the consumer’s address.

- Address Category: The type or category of the address (e.g., Permanent, Temporary).

- Residence Code: A code indicating the type of residence (e.g., Owned, Rented).

7. Account

- Current/New: Indicates if the account is a newly opened one or an existing one.

- Reporting Member Code: Unique code identifying the financial institution reporting the account details.

- Current/New Member Short Name: Abbreviated name of the current or new reporting member.

- Current/New Account Number: Unique number identifying the current or new account.

- Account Type: Specifies the kind of account (e.g., Savings, Loan).

- Ownership Indicator: Shows the ownership type of the account (e.g., Individual, Joint).

- Date Opened/Disbursed: The date when the account was opened or loan was disbursed.

- Date of Last Payment: The date of the most recent payment made on the account.

- Date Closed: The date when the account was closed or settled.

- Date Reported and Certified: The date the account details were reported and verified.

- High Credit/Sanctioned Amount: The maximum credit limit or loan amount sanctioned.

- Current Balance Amount: The outstanding balance in the account as of the report date.

- Overdue Number of Days Past Due: Number of days the payment is overdue.

- Old Reporting Member Code: Code of the previous financial institution that reported the account.

- Old Member Short Name: Abbreviated name of the previous reporting member.

- Old Account Number: Unique number identifying the old account.

- Old Account Type: Specifies the kind of the old account.

- Old Ownership Indicator: Shows the ownership type of the old account.

- Suit Filed/Wilful Default: Indicates if any legal action has been taken or if there’s a deliberate default.

- Written-off and Settled Status: Status indicating if the account has been written off or settled.

- Asset Classification: Categorization of the account based on its risk (e.g., Standard, Substandard).

- Value of Collateral: The monetary value of any collateral held against the account.

- Type of Collateral: The kind of collateral (e.g., Property, Gold).

- Credit Limit: The maximum amount that can be borrowed or spent on the account.

- Cash Limit: The maximum cash amount that can be withdrawn or borrowed.

- Rate Of Interest: The interest rate applicable to the account.

- Repayment Tenure: The duration over which the borrowed amount is to be repaid.

- EMI Amount: The monthly instalment amount to be paid.

- Written-off Amount (Total): Total amount that has been written off as uncollectible.

- Written-off Amount (Principal): Principal amount that has been written off.

- Settlement Amount: Amount agreed upon for settlement of the account.

- Payment Frequency: How often payments are made (e.g., Monthly, Quarterly).

- Actual Payment Amount: The actual amount paid in the most recent transaction.

- Occupation Code: Code indicating the consumer’s occupation type.

- Income Net/Gross Income Indicator: Specifies if the reported income is net or gross.

- Monthly/Annual Income Indicator: Indicates the frequency of the reported income.

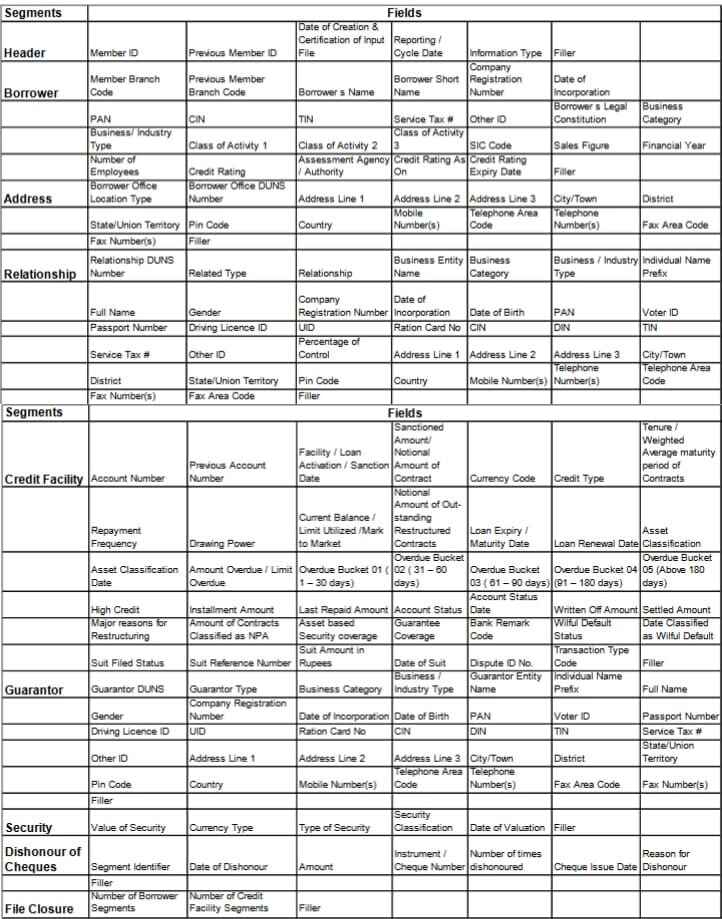

Credit Reporting Format For Commercial Borrowers

(Image Credit: Equifax)

What’s Segments Are Included?

1. Header

- Member ID: A unique identifier for the financial institution reporting the data.

- Previous Member ID: The identifier for the institution that previously reported the data, if applicable.

- Date of Creation & Certification of Input File: The date when the report was created and subsequently certified for accuracy.

- Reporting / Cycle Date: The specific date or period the report pertains to.

- Information Type: Specifies the nature of the information being reported (e.g., new account, overdue payment).

2. Borrower

- Member Branch Code: A unique code identifying the specific branch of the reporting financial institution.

- Previous Member Branch Code: The code for the branch that previously reported the data, if any.

- Borrower’s Name: The full legal name of the commercial borrower.

- Borrower Short Name: A concise or abbreviated name for the borrower, often used for quick reference.

- Company Registration Number: The official registration number of the borrower if it’s a company, indicating its legal recognition.

- Date of Incorporation: The date when the company (borrower) was officially incorporated or established.

- PAN: Permanent Account Number, a unique tax code for entities in India.

- CIN: Corporate Identification Number, specific identifier for companies.

- TIN: Taxpayer Identification Number, specific identifier for taxpayers.

- Service Tax #: The unique number associated with the borrower’s service tax registration.

- Other ID: Any other identification number or code associated with the borrower.

- Borrower’s Legal Constitution: The legal structure of the borrower (e.g., Private Limited, Partnership).

- Business Category: The broad category of the borrower’s business (e.g., Manufacturing, Services).

- Business / Industry Type: A more specific classification of the borrower’s industry or sector.

- Class of Activity 1, 2, 3: Specific activities or operations the borrower is involved in.

- SIC Code: Standard Industrial Classification code, used for categorizing industries.

- Sales Figure: The reported sales or revenue figure for the borrower.

- Financial Year: The fiscal year associated with the reported sales figure.

- Number of Employees: The total workforce count of the borrower.

- Credit Rating: The creditworthiness rating assigned to the borrower.

- Assessment Agency / Authority: The agency or body that provided the credit rating.

- Credit Rating As On: The date when the credit rating was assigned.

- Credit Rating Expiry Date: The date when the credit rating will be up for review or renewal.

3. Address

- Borrower Office Location Type: Specifies the nature of the office location (e.g., Headquarters, Branch Office).

- Borrower Office DUNS Number: A unique identifier, typically used for businesses, provided by Dun & Bradstreet.

- Address Lines 1, 2, 3: Detailed address lines capturing the exact location of the borrower’s office.

- City/Town: The city or town where the borrower’s office is located.

- District: The specific district of the office location.

- State/Union Territory: The state or union territory in which the office is situated.

- Pin Code: The postal code associated with the office address.

- Country: The country where the borrower’s office is located.

- Mobile Number(s): Contact mobile number(s) associated with the borrower or the office.

- Telephone Area Code: The area code for landline numbers.

- Telephone Number(s): Landline contact number(s) for the borrower’s office.

- Fax Area Code: The area code for fax communications.

- Fax Number(s): Fax number(s) associated with the borrower’s office.

4. Relationship

- Relationship DUNS Number: A unique identifier, typically for businesses, indicating a relationship with another entity, provided by Dun & Bradstreet.

- Related Type: Specifies the nature of the relationship (e.g., Parent Company, Subsidiary).

- Relationship: Describes the specific relationship between the borrower and the related entity (e.g., Owner, Partner).

- Business Entity Name: The name of the related business entity.

- Business Category: The broad category of the related business (e.g., Manufacturing, Services).

- Business / Industry Type: A more specific classification of the related business’s industry or sector.

- Individual Name Prefix: Prefix for the individual’s name (e.g., Mr., Mrs.).

- Full Name: The complete name of the related individual.

- Gender: Gender of the related individual.

- Company Registration Number: The official registration number if the related entity is a company.

- Date of Incorporation: The date when the related company or business entity was legally established.

- Date of Birth: Birthdate of the related individual.

- PAN: Permanent Account Number, a unique tax code for entities in India.

- Voter ID: Identification number from the voter registration of the related individual.

- Passport Number: Passport number of the related individual.

- Driving Licence ID: Driving license number of the related individual.

- UID: Unique Identification number, often referring to the Aadhaar number in India.

- Ration Card No: Ration card number, a form of identification in India.

- CIN: Corporate Identification Number for companies.

- DIN: Director Identification Number, specific to individuals who are directors of companies.

- TIN: Taxpayer Identification Number.

- Service Tax #: The unique number associated with the related entity’s service tax registration.

- Other ID: Any other identification number or code associated with the related entity.

- Percentage of Control: Indicates the extent of control or stake the borrower has in the related entity.

- Address Lines 1, 2, 3: Detailed address lines capturing the exact location of the related entity.

- City/Town: The city or town where the related entity is located.

- District: The specific district of the related entity’s location.

- State/Union Territory: The state or union territory in which the related entity is situated.

- Pin Code: The postal code associated with the related entity’s address.

- Country: The country where the related entity is located.

- Mobile Number(s): Contact mobile number(s) associated with the related entity.

- Telephone Number(s): Landline contact number(s) for the related entity.

- Telephone Area Code: The area code for landline numbers of the related entity.

- Fax Number(s): Fax number(s) associated with the related entity.

- Fax Area Code: The area code for fax communications of the related entity.

5. Credit Facility

- Account Number: Unique identifier for the borrower’s credit account.

- Previous Account Number: Identifier for the borrower’s prior credit account, if applicable.

- Facility/Loan Activation/Sanction Date: The date when the credit facility or loan was officially approved and activated.

- Sanctioned Amount/Notional Amount of Contract: The total amount approved for the credit facility or the notional value of a financial contract.

- Currency Code: The currency in which the credit facility is denominated.

- Credit Type: Specifies the kind of credit (e.g., Term Loan, Overdraft).

- Tenure/Weighted Average maturity period of Contracts: Duration of the loan or the average maturity period of financial contracts.

- Repayment Frequency: How often the borrower is expected to make repayments.

- Drawing Power: The maximum amount the borrower can draw from the credit facility.

- Current Balance/Limit Utilized/Mark to Market: The outstanding balance or the amount utilized from the credit limit, or the current market valuation.

- Notional Amount of Outstanding Restructured Contracts: The hypothetical or notional value of contracts that have been restructured.

- Loan Expiry/Maturity Date: The date when the loan will come to its end or mature.

- Loan Renewal Date: The date when the loan can be renewed or rolled over.

- Asset Classification: Categorization based on risk (e.g., Standard, Substandard).

- Asset Classification Date: The date when the asset was categorized based on its risk.

- Amount Overdue/Limit Overdue: The total amount or limit that hasn’t been paid or settled by the due date.

- Overdue Buckets 01 to 05: Specific categorizations based on the number of days the payment is overdue, starting from day 1 to above 180 days.

- High Credit: The highest amount ever owed on the account.

- Installment Amount: The amount to be paid in each instalment.

- Last Repaid Amount: The amount paid in the most recent transaction.

- Account Status: Current status of the account (e.g., Active, Closed).

- Account Status Date: The date when the account status was last updated.

- Written Off Amount: Amount that has been deemed uncollectible and written off.

- Settled Amount: Amount agreed upon for settlement of the account.

- Major reasons for Restructuring: Primary reasons why the credit facility or contract was restructured.

- Amount of Contracts Classified as NPA: Value of contracts that have been classified as Non-Performing Assets.

- Asset-based Security coverage: The coverage or value of assets held as security against the loan.

- Guarantee Coverage: The extent to which the loan is covered by guarantees.

- Bank Remark Code: A code indicating specific remarks or notes from the bank regarding the account.

- Wilful Default Status: Indicates if the borrower has been classified as a wilful defaulter.

- Date Classified as Wilful Default: The date when the borrower was labelled as a wilful defaulter.

- Suit Filed Status: Indicates if any legal action has been initiated against the borrower.

- Suit Reference Number: A unique number associated with the legal action.

- Suit Amount in Rupees: The amount involved in the legal action.

- Date of Suit: The date when the legal action was initiated.

- Dispute ID No.: If there’s any dispute related to the account, this number identifies it.

- Transaction Type Code: The code indicating the nature of the recent transaction on the account.

6. Guarantor

- Guarantor DUNS: A unique identifier for the guarantor, typically used for businesses, provided by Dun & Bradstreet.

- Guarantor Type: Specifies the type of guarantor (e.g., Individual, Corporate).

- Business Category: The broad category of the guarantor’s business (e.g., Manufacturing, Services).

- Business / Industry Type: A more specific classification of the guarantor’s industry or sector.

- Guarantor Entity Name: The name of the business entity acting as a guarantor.

- Individual Name Prefix: Prefix for the individual’s name (e.g., Mr., Mrs.).

- Full Name: The complete name of the guarantor if it’s an individual.

- Gender: Gender of the guarantor if it’s an individual.

- Company Registration Number: The official registration number if the guarantor is a company.

- Date of Incorporation: The date when the guarantor company or business entity was legally established.

- Date of Birth: Birthdate of the guarantor if it’s an individual.

- PAN: Permanent Account Number, a unique tax code for entities in India.

- Voter ID: Identification number from the voter registration of the guarantor.

- Passport Number: Passport number of the guarantor.

- Driving Licence ID: Driving license number of the guarantor.

- UID: Unique Identification number, often referring to the Aadhaar number in India.

- Ration Card No: Ration card number, a form of identification in India.

- CIN: Corporate Identification Number for companies.

- DIN: Director Identification Number, specific to individuals who are directors of companies.

- TIN: Taxpayer Identification Number.

- Service Tax #: The unique number associated with the guarantor’s service tax registration.

- Other ID: Any other identification number or code associated with the guarantor.

- Address Lines 1, 2, 3: Detailed address lines capturing the exact location of the guarantor.

- City/Town: The city or town where the guarantor is located.

- District: The specific district of the guarantor’s location.

- State/Union Territory: The state or union territory in which the guarantor is situated.

- Pin Code: The postal code associated with the guarantor’s address.

- Country: The country where the guarantor is located.

- Mobile Number(s): Contact mobile number(s) associated with the guarantor.

- Telephone Area Code: The area code for landline numbers of the guarantor.

- Telephone Number(s): Landline contact number(s) for the guarantor.

- Fax Area Code: The area code for fax communications of the guarantor.

- Fax Number(s): Fax number(s) associated with the guarantor.

7. Security

- Value of Security: The monetary value of the collateral or asset held as security against the loan.

- Currency Type: The currency in which the valuation of the security is done.

- Type of Security: Specifies the kind of collateral provided against the loan (e.g., Property, Gold, Shares).

- Security Classification: Categorization of the security based on its nature or quality (e.g., Prime, Subprime).

- Date of Valuation: The date when the collateral or security was last assessed or valued.

8. Dishonour of Cheques

- Segment Identifier: A unique code or identifier for this specific segment within the report.

- Date of Dishonour: The date when the cheque was not honoured by the bank.

- Amount: The monetary value of the dishonoured cheque.

- Instrument/Cheque Number: The unique number associated with the dishonoured cheque.

- Number of times dishonoured: Indicates how many times this particular cheque has been dishonoured.

- Cheque Issue Date: The date when the cheque was originally issued by the borrower.

- Reason for Dishonour: The specific reason provided by the bank for not honouring the cheque (e.g., Insufficient Funds, Account Closed).

9. File Closure

- Number of Borrower Segments: Indicates the total count of borrower segments associated with the report or file.

- Number of Credit Facility Segments: Specifies the total count of credit facility segments related to the report or file.

Credit Reporting Format For Micro-Finance Institutions

You can find the credit reporting format for the MFIN Segment here.

Take a look at why uniform credit reporting is significant and how it benefits financial institutions in the next chapter.

Related Post

Conclusion: Significance of Uniform Credit Reporting For Financial Institutions

Significance of Each Segment in the Uniform Credit Reporting Format

Gold Loans – the Whats, Hows and Whys

Shiny, pure and incredibly valuable, gold is the metal that’s

How To Identify Fraudulent Digital Lending Apps? Types of Lending Frauds and Their Impact

It’s no doubt that Digital Lending Apps have taken the

- Email: [email protected]

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576

Quick Links

Resources

© 2025 LightFi India Private Limited. All rights reserved.

(Formerly known as Habile Technologies)