Top Digital Lending Trends To Watch Out For In 2024

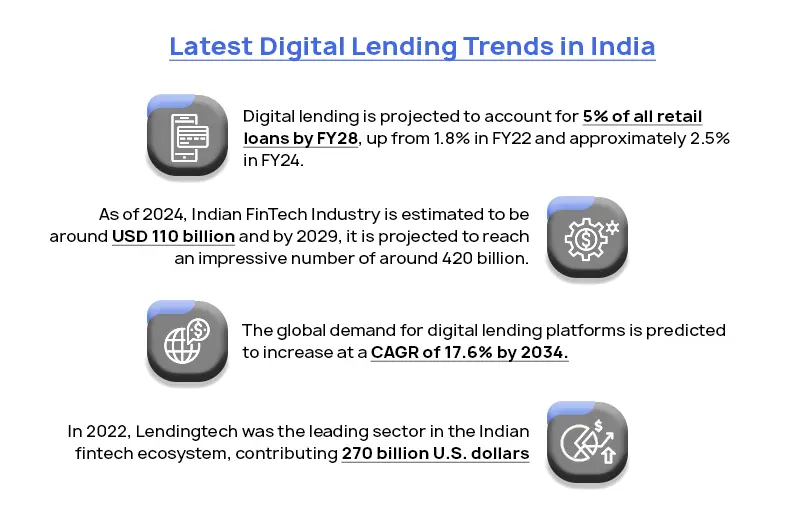

As a digital lender, you may be interested to know that the global demand for digital lending platforms is predicted to increase at a CAGR of 17.6% by 2034. But it’s more than just lending platforms as now, the demands and preferences of customers are evolving. Thus, scaling up your services by implementing new technologies can help you gain a competitive advantage and satisfy your customers.

Due to changing market conditions, you may ponder the question on how you can achieve all that. Look no further as this blog will cover some of the latest digital lending trends of 2024 you can look out for and implement in your lending services.

Latest Advancements in Digital Lending 2024

Here are some of the latest digital lending advancements to look out for in 2024:

Personalization at Scale

Borrowers today have unique needs and preferences, which is why digital lenders leverage advanced technologies to help fulfill their expectations. For example, lenders can use customer data and behavioral insights to provide tailored services such as customization of loan terms, interest rates, and repayment schedules. With more flexibility and personalized services, customers can be more satisfied, improving loyalty and overall lending landscape on a broader perspective.

Embedded Finance – Integration of lending services into non-financial platforms

Due to rising demand for personal and convenient banking services without customers having to be redirected to third-party financial institutions, Embedded finance rises as one of the top fintech trends of 2024. It refers to the integration of financial services into non-financial platforms, enabling customers to access financial products without leaving their preferred platforms. For example, a retail platform could integrate lending services into their shopping app, allowing customers to apply for loans directly through the app.

The global embedded finance market is expected to grow annually by a whopping 35.5% between 2023 and 2028 and as it continues to evolve, it could reshape the lending landscape by enhancing overall customer loyalty and opening up new monetization opportunities for businesses.

Open Banking and API Integration

Open Banking refers to a system where financial service providers can securely access financial data of customers from other banks or financial institutions through the use of APIs (Application Programming Interfaces). API Integration, on the other hand, integrates various software applications to ensure they work well together. Through open banking, digital lenders have the opportunity to offer personalized and data-driven services which can lead to quicker credit assessments, improved risk management, and open up more tailored loan offers.

API Integration allows lenders to offer embedded finance solutions that can be integrated with a wide range of services, such as e-commerce and real estate. Together, open banking and API Integration provide customers with varied options to manage their money and more control over their financial data with enhanced security and data privacy.

Expansion of ESG Lending

Environmental, Social, and Governance (ESG) factors are becoming increasingly important in lending due to the growing concerns over environmental and ethical issues within financial institutions. According to the World Economic Forum, most customers, especially Gen Zers, show more preference to purchase from organizations that stand up for environmental and social issues.

In the lending landscape, investing in ESG-friendly technology, offering sustainability-linked loans, and being more transparent about environmental and social efforts can help lenders gain a competitive advantage in the market. With more businesses developing strong ESG practices, this is expected to be a trend for years to come.

Technological Advancements in Digital Lending 2024

As technology continues to evolve, the scope for innovation has risen in the banking sector where lenders and other financial institutions leverage various technologies to streamline loan application processes and satisfy their customers. Here are some of the latest technological trends in digital lending that can be seen in 2024:

Automation & No-Code Configuration

Thanks to automation and no-code configuration, developing custom lending solutions has become easier as lenders can adapt to changing markets, launch new lending products, and optimize lending workflows without extensive IT support. Lending professionals now have the opportunity to offer tailored services to customers and speed up application assessment and underwriting processes with minimal downtime. For example, automation and no-code can help banks create and run dashboards that are highly functional, visually appealing, and personalized for every user, maximizing customer satisfaction and loyalty.

Together, automation and no-code configuration have the power to drive innovation, reduce costs, and create more flexible lending solutions that will help boost customer satisfaction and retention.

AI-powered Lending Platforms

Artificial intelligence is making waves in the digital lending market and its integration into lending platforms has been able to streamline almost every aspect of the lending process, from customer acquisition, to credit scoring, risk assessment, and fraud detection. The global market size for AI-powered lending platforms in 2024 is estimated at $107.68 billion, which is expected to cross $1.64 trillion by the end of 2036, indicating the rapid adoption of AI-powered lending platforms.

Through these AI-driven platforms, lenders can target the right customers and enhance their experiences by providing holistic lending decisions swiftly. Additionally, AI can also help detect and prevent frauds in the loan origination process, protecting the lender from potential losses.

Evolving eKYC Processes

Most customers do not wish to wait in long queues for loan applications. Which is why eKYC processes eliminate the need for filling lengthy forms and submitting various copies of physical documents to the bank. A recent statistic has shown that the global eKYC market is expected to reach a valuation of $2445.65 million by 2030, making it a game-changer in the digital lending landscape.

Below are some of the eKYC trends that are expected to revolutionize digital lending processes that can enhance customer onboarding experiences:

- AI and Automation: AI and automation are expected to remove all obstacles associated with manual KYC processes, speeding up and simplifying verification processes such as data extraction, risk assessment, and document verification.

- OTP-based verification: OTP verifications are considered to be a more secure and trusted method that protects customers from data breaches and ensures verification is done online instantly. eKYC authentication is done to ensure customer verification meets industry standards.

- Real-time eKYC verification and monitoring: Manual KYC processes can be time-consuming and frustrating when done one-by-one in a physical location. Modern eKYC providers offer an API solution that allows lenders to conduct real-time verification with an OTP. This method reduces the chances of frauds.

Digital Document Management

Digital document management refers to a software solution that can collect, store, and manage digital documents and images. These documents typically comprise digital assets and images of paper-based materials. In the realm of digital lending, even loan applications have evolved into paperless processes and lenders are adopting advanced digital document management systems to handle key activities such as loan applications, document verifications, agreements, and compliance.

Under digital document management, e-signatures for approvals and AI for automation of document classification are some of the key technologies under this system. Its integration with other lending systems facilitate quick decision-making and real-time access to documents, which are crucial in an era where speed and accuracy is critical.

A few examples of digital document management trends in 2024 include eco-conscious document management that focuses on reducing paper consumption and switching to cloud-based solutions to maintain a lower energy footprint. Another trend includes the “Paperlite” approach that utilizes the strengths of both physical and digital formats to optimize document management. This trend is for documents that may need to be physically stored for legal and compliance purposes.

Leveraging Alternative Credit Data

Alternative credit data is also a significant and rising lending trend that allows lenders to assess the creditworthiness of an individual through alternate data sources such as SMS transactions, social media activity, bank statements, financial statements, GST, ITR, etc. These data sources are leveraged for customers with limited credit histories. By analyzing these details, lenders can create a comprehensive credit profile of the customer, reducing default risks and promoting greater financial inclusion.

A credit decision software, also known as a credit decision engine, makes this process easier as it leverages machine learning and advanced data analytics to evaluate a potential borrower’s credit worthiness through analysis of their credit history and other factors

Seamless Omnichannel Experiences

Omnichannel banking primarily focuses on bringing customers together from different channels so they can interact amongst themselves and financial service providers to navigate their banking needs with maximum efficiency and confidence. In 2024, the digital lending landscape is also aiming to connect borrowers and lenders across multiple platforms such as mobile apps, chatbots, and websites to enhance communication and support during loan application processes. For instance, customers can initiate transactions on their mobile devices without a loan officer, freeing up their time to perform other tasks.

Following the omnichannel banking approach in digital lending can enhance customer satisfaction and loyalty by allowing them to seamlessly transition between devices or channels to meet their needs and preferences. This way, lending services are more personalized.

Big Data for Better Insights

When we look at some of the latest trends in the financial sector, Big Data is one that cannot be ignored. The overall global data generation is projected to surge from around 120 Zettabyte in 2023 to 147 Zettabyte in 2024, indicating a massive influx of data that is transforming India’s fintech landscape as well. In digital lending, big data represents a massive repository of information that keeps expanding. The integration of all these data points allow lenders to evaluate the creditworthiness of a potential borrower, reducing risks.

Beyond credit assessments, the use of big data also encompasses fraud detection, predictive analysis, customized lending, etc. Financial institutions leverage big data to anticipate periods of cash surplus or shortfalls for their clients and proactively offer solutions such as flexible repayment schedules that can help them manage their cash flows.

Adoption of Cloud-based Solutions

The banking industry is witnessing rapid transition into cloud-based services to reduce IT costs and enhance scalability of their services. By migrating to the cloud, digital lenders can easily adapt to changing market conditions and leverage advanced analytics, artificial intelligence, and machine learning tools to improve decision-making and offer more personalized lending experiences for customers.

Digital lenders can leverage the integration capabilities of cloud-platforms with third-party services for enhanced collaboration and cloud-based lending can also improve data security, disaster recovery, and compliance management. And for automating the loan origination process, safely managing documents, and preventing risks such as theft or frauds, cloud-based lending solutions can be extremely beneficial.

Enhance Your Digital Lending Capabilities with CloudBankin’s Loan Origination System

Here are some of the latest digital lending advancements to look out for in 2024: Digital lending trends are not restricted to only the ones that have been mentioned above as more technological advancements are on the way to help streamline the loan application process and ensure safe and secure banking experiences for customers. If you’re looking to lead the race in efficient lending, look no further as CloudBankin’s Loan Origination System and Loan Management System can be integrated with your platform to manage the loan application, approval, and disbursement processes.

If you’d like to know more about the capabilities of our Loan origination and management systems, contact us today!

Related Post

Innovation at its Best: Shaping the Customer Experience in Urban Co-operative Banks

Overview In today’s world, as we navigate through the digital

Are 2022 Regulations on Digital Lending a Boon or a Bane?

Overview There has been exponential growth in the digital lending

- Email: [email protected]

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576

Quick Links

Resources

© 2025 LightFi India Private Limited. All rights reserved.

(Formerly known as Habile Technologies)