Unveiling the Top 15 NBFC, Fintechs, and MFI Associations, Networks & Communities in India

(List Updated June 2023)

In the ever-evolving financial landscape of India, Non-Banking Financial Companies (NBFCs), Fintechs, and Microfinance Institutions (MFIs) have emerged as the knights in shining armor, catering to the diverse financial needs of millions. These institutions play a pivotal role in bolstering the economy by providing credit and financial services to the unbanked and underbanked segments of society. As the significance of NBFCs, Fintechs and MFIs grows in India, so does the importance of the associations that represent and support them.

In this article, we take a deep dive into the top NBFC, Fintech and MFI associations & networks that serve as the backbone of India’s inclusive financial ecosystem. Join us as we unveil the giants who not only champion the cause of financial inclusion but also drive innovation, compliance, and sustainable growth in this rapidly expanding sector.

NBFC Associations

1. Finance Industry Development Council (FIDC)

FIDC serves as a Self-Regulatory Organization (SRO) and Representative Body for Non-Banking Finance Companies (NBFCs) in India. Recognized by the Reserve Bank of India (RBI), FIDC is headquartered in Mumbai and has been operating since 2004. It represents NBFCs involved in Assets and Loan financing and actively engages with the RBI and the Government of India in pre-budget and policy-related meetings. Numerous NBFCs, both large and small, are members of this association. FIDC conducts its meetings on a rotational basis in major cities like Delhi, Mumbai, and Chennai, and also has affiliated associations throughout India to address local issues within the NBFC sector. On December 2021, Kamlesh Gandhi, Chairman & MD of Mas Financial Services, was appointed as the Co-Chairman of the association.

FIDC’s influence extends beyond its core activities, as it manages various committees at prestigious organizations such as ASSOCHAM, FICCI, CII, PHDCCI, and ICM Chamber of Commerce and Industry within the Banking, Financial Services, and Insurance (BFSI) sectors.

Follow Them On – LinkedIn, Facebook, and Twitter

FIDC Membership (2023-24):

a) Fee Structure

- Admission Fee (one-time; for new members only) = Rs. 5,000/- plus 18% GST=: Rs.

5,900/- - Annual Subscription Fees for Financial Year 2023-24:

payable based on your Net Owned Fund (including 18% GST) – Click here to know more about it.

Download the membership application form here to become a member of the association

2. Digital Lending Associations of India (DLAI)

![]()

DLAI, an association catering to NBFCs, stands as a dynamic force within India’s digital credit industry. With 90+ members boasting annual disbursements of $5-6 billion, DLAI represents approximately 85% of the industry’s transaction volume. Jatinder Handoo and Priyashmita Guha were appointed recently as the CEO and the COO respectively on April 2023.

Formed in 2016 by 9 prominent players, including Capital Float(Now Axio), NeoGrowth, Zest Money, LendingKart, KredX, Indifi, IndiaLends, MoneyView, and UPF Limited, DLAI aims to create a collaborative platform for digital lenders, MSMEs, consumers, marketplace platforms, and industry members. Its objectives encompass sharing best practices, conducting research on innovative business models, and collaborating with regulators, industry experts, and government bodies to shape favorable policy frameworks for the entire digital credit ecosystem.

DLAI has played a pivotal role in representing, advising, and unifying digital lending players during interactions with regulatory bodies. Notably, during the onset of the COVID-19 lockdown, when several major financial institutions hesitated to extend moratorium benefits to digital lenders, DLAI proactively formulated and advocated for the interests of digital lending firms to regulators and government bodies.

The association has recently announced that it will hold its 2023 conclave conference, “The DLAI Unconclave 2023”

Follow Them On – LinkedIn, Facebook, and Twitter

DLAI Membership:

a) Fee Structure

| Membership Type | Price (per 12 months) | Eligibility | Benefits |

| General | ₹75,000 | Companies directly in the digital lending space | Voting rights, participation in sub-committees, free/discounted passes to events |

| Industry | ₹100,000 | Affiliate industries (consulting firms, law firms, media firms, analytics firms, regulators, etc.) | Access to the member database, free/discounted passes to events |

| Associate | ₹300,000 | Industry members | Promotion as an associate in the respective vertical, promotion of company on DLAI website |

| Partner | ₹600,000 | Industry members | Exclusive slot per vertical, no competitors in the same category, co-authoring white papers/thought leadership |

| International | USD 5000 | Digital lending or associated firms located outside India | Access to the member database, free/discounted passes to events, access to DLAI research reports |

| Subscription | ₹6000 | Year’s subscription, 6 months subscription, 3 months subscription | Based on the chosen subscription duration |

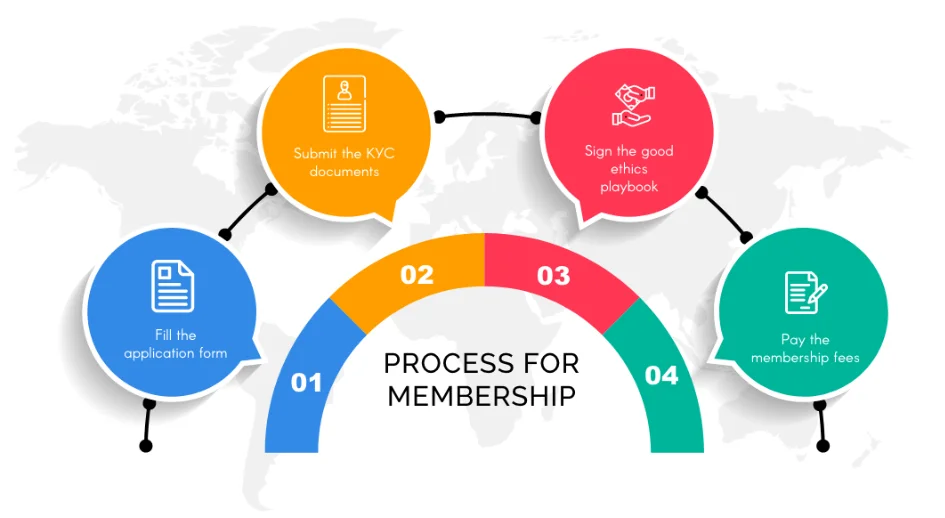

b) Process for Membership

(Image Credit: DLAI)

c) Membership Enrollment

- Select the type of membership you want to subscribe

- Give your account details like Name, Email, Phone Number

- Put it your membership details

- Get a confirmation

Click here to know how to become a member of DLAI.

3. Association of Gold Loan Companies (India)

The Association of Gold Loan Companies (India) is a non-profit organization dedicated to the welfare and advancement of its member companies. Its membership consists of NBFCs registered with the Reserve Bank of India, engaged in financing against gold jewelry. The association’s registered office is currently in Chennai, with its administrative office located in Kochi. The 7 committee members of the association are from Muthoot Leasing & Finance Ltd., Muthoot Fincorp Ltd., Muthoot Fincorp Ltd., Muthoot Finance Ltd., Manappuram Finance Ltd., Concord Credit Ltd., and Mulamoottil Consumer Credits Ltd. George Alexender Muthoot is the current President of the association.

4. Kerala NBFC Welfare Association (KNBFC)

Embracing the spirit of unity and progress, the Kerala Non-Banking Finance Companies Welfare Association emerges as a beacon of collaboration among Reserve Bank of India-authorized NBFCs with a footprint in Kerala. Its primary objective is to promote discipline among its members by implementing a model code of conduct, advocating for the industry’s views when necessary, and providing a unified platform for the sector in Kerala. Currently, there are 11 members in the association.

You May Also Like: Top 15 NBFCs in India

Fintech Associations & Communities

1. Fintech Association For Consumer Empowerment (FACE)

Recognizing the need to unite the various stakeholders driving the significant growth of the FinTech sector, especially in digital lending, a group of founding members from FinTech companies has established the not-for-profit industry body, Fin-Tech Association for Consumer Empowerment. FACE aims to establish productive dialogue and collaborations with industry policy stakeholders such as the Reserve Bank of India, the Ministry of Finance, Niti Aayog, and other government authorities. The association endeavors to represent the views and insights of the digital consumer finance industry and actively contribute to the formulation of an effective policy framework that prioritizes higher-quality consumer engagement and empowerment through digital lending.

The Founding Members of FACE are Akshay Mehrotra(CEO of Fibe), Ashish Goyal(Co-Founder of Fibe), Satyam Kumar(CEO of LoanTap), Dhruv Jain(CEO of CASHe), Madhusudan E(CEO of KreditBee), Vivek Veda(CFO of KreditBee), and Ranvir Singh(CEO of Ring). The CEO is Sugandh Saxena.

The current members of FACE have been instrumental in India’s FinTech lending ecosystem for the past 3-4 years, collectively serving over 4.5 million consumers across 19,000 pin codes throughout the country. Their customer base predominantly consists of underserved markets in Tier B and Tier C cities. To further enhance the association’s purpose and objectives, more member companies are being onboarded. FACE follows a robust governance model, guided by an honorary Advisory Council comprising experienced professionals from various industry spheres. Currently, the association has 13 council meetings.

Follow Them On – LinkedIn, Facebook, and Twitter

FACE Membership:

a) Fee Structure

| Lender | Partner | |

| Eligibility | Entities, other than an individual, directly engaged in activities related to digital lending, regulated by the RBI or otherwise, shall be eligible to apply for membership in the Company. | Entities, other than individuals, in-directly engaged or keen to engage with digital lending for technology, research, investment, advisory, advisories, consulting, debt funding among others. |

| Specific Privileges | 1. Access to FACE Governing Body/FACE Members/Working Groups/Know-how/Communication 2. Eligible to contest for the Board seat and voting rights in General Body |

1. Access to FACE Members/WGs/Know-how/Communication 2. Not Eligible to for Board seat and no voting rights in General Body |

| One-time admission fee* |

1. Rs 50 thousand (for those paying the floor amount)

2. Rs 1 Lakh (for those paying above the floor amount) |

|

| Annual membership fee** | An annual subscription will be 0.01% of disbursement value in the previous FY***, subject to the floor (Rs 3 Lakhs) and cap (Rs 10 Lakhs), pro-rated for the period | Rs. 5 Lakhs |

| *Paid once at the time of joining after membership approval | ||

| ** Every year, the FACE Board approves the annual membership fee structure for the financial year, ratified by the AGM. Paid pro-rated in advance for the year at the time of joining and paid annually subsequently for renewal of the membership at the beginning of the financial year | ||

| *** For FY 22-23, the disbursement value in FY 21-22 will be considered. For FY 23-24, the disbursement value for FY 22-23 will be considered to calculate the annual subscription | ||

a) Process

- To initiate the process, complete and submit the Application Form along with the required documents to the FACE Board for review.

- Once the review is complete, the applicant will receive notification regarding their application.

- Upon approval, the member is required to pay the fees according to the fee structure provided below.

- Join FACE today and become a member.

Click here to know more about FACE Membership

2. The Fintech Meetup

It is India’s largest fintech ecosystem, where innovation knows no bounds. With over 1000 visionary founders, 30+ prestigious BSFI institutions, and 50+ dynamic venture capitalists, this ecosystem is a force to be reckoned with. Inaugurated in 2018, the Fintech Meetup was born with a visionary purpose: to ignite the fintech landscape and foster shared value among all stakeholders. This dynamic gathering serves as a hub, bringing together startups, founders, government bodies, strategic investors, and financial institutions, unveiling the transformations that will shape the future of financial services. Abhishant Pant is the Founder of the community.

The Fintech Meetup is a catalyst for startups, offering market validations, invaluable mentorship, and a vast network of connections. Dedicated to driving innovation, the Fintech Meetup invests in early-stage fintech startups through the SEBI-registered CAT-I AIF, the YAN Angel Fund, operated by the Yatra Angel Network. This strategic investment not only fuels the growth of promising startups but also amplifies their impact on the fintech landscape.

Furthermore, the Fintech Meetup acts as a matchmaker, facilitating meaningful partnerships and paving the way for innovation opportunities between financial institutions and relevant startups. This synergy comes to life during the highly anticipated annual signature event, The Fintech Yatra, where groundbreaking collaborations take flight.

After last year’s success, they are back to bring the next Fintech Meetup in Chennai on 22 June 2023 to bring together all the Fintech founders, senior finance professionals, and venture investors to network and connect with peers in the ecosystem.

Follow Them On – LinkedIn, Twitter, and YouTube

3. Tether Community

It is India’s fastest-growing fintech ecosystem, where fintech enthusiasts, experts, and influencers unite. Tether Community, a dynamic fintech community, was conceived by a visionary collective of like-minded individuals from the financial services realm, sharing a profound vision for the future of fintech.

Envisioned and nurtured by the API infrastructure giant, M2P Fintech, Tether embarks on a transformative journey to revolutionize the financial services industry through innovation and cutting-edge approaches.

Tether serves as a captivating nexus, connecting and engaging various fintech actors, and acting as a catalyst for the advancement of the fintech ecosystem. A vibrant melting pot of ideas and opportunities, Tether provides a go-to platform for startups, communities, and individuals to showcase their ingenuity, experiment with state-of-the-art infrastructure, and cultivate the essential networks needed to bring their product vision to life.

Follow Them On – LinkedIn, Facebook, and YouTube

4. FintechNXT

Step into the forefront of financial innovation with FintechNXT, a leading fintech ecosystem with 7000+ members that fosters collaboration and growth among like-minded individuals from banks, fintech, and credit unions.

As a holistic platform, FintechNXT provides a space for open communication and engagement, enabling industry professionals to stay informed about the latest trends and developments in the finance industry. It serves as a hub for knowledge-sharing, where industry experts impart their wisdom and participants have the opportunity to learn and expand their horizons.

In this thriving ecosystem, they believe in the power of collective growth. By connecting with peers and building networks, individuals can forge valuable partnerships and stay ahead in this rapidly evolving industry. Together, the community celebrates the transformative innovations that technology brings to finance, driving us toward a future where “technology in finance is the next big thing.“

Follow Them On – LinkedIn

You May Also Like: 18 Fintechs in Chennai You Should Know About

MFI Networks & Associations

1. Microfinance Institutions Network (MFIN)

MFIN, the Microfinance Institutions Network, was established in 2009 as an industry association for NBFC-MFIs (Non-Banking Financial Companies – Microfinance Institutions). It became India’s first self-regulatory organization (SRO) for NBFC-MFIs recognized by the Reserve Bank of India (RBI) in 2014. Over the years, MFIN has expanded its scope to cover the entire microfinance ecosystem, including universal banks, small finance banks, NBFCs, fintech companies, and more. Dr. Alok Misra is the current CEO & Director of MFIN.

With a focus on financial inclusion, MFIN aims to create a favorable policy and business environment for its members, promoting responsible finance and upholding the highest standards of customer protection and corporate governance. Collaborating closely with microfinance providers, regulators, government bodies, and other stakeholders across 35 states and union territories, spanning 591 districts, MFIN ensures that credit reaches low-income households.

The association recently held CEOs Conclave 2023 – MANTHAN at Hyderabad, where many lenders from Banks, NBFC-MFIs, Small Finance Banks, NBFCs, and Business Correspondents participated in discussions & debates about “Responsible Microfinance for Inclusive growth”

Follow Them On – LinkedIn, Facebook, Twitter, and YouTube

MFIN Membership:

a) Fee Structure

| Application Fee | One-time Application Fee of INR 1,000 |

| Initial Membership Fee | One-time Fee of INR 1,00,000 |

| Annual Subscription Fee | Payable upon approval of Membership, as follows: 1. An amount equivalent to 0.0275% of Total Gross Loan Portfolio (including managed portfolio), after adjusting for loan portfolios that are 180 days overdue on prorated basis. 2. Subject to a cap of INR 65,00,000 and a floor of INR 1,50,000. |

b) Documents Required

-

MFIN’s Application Form, duly filled

-

Audited Financials

-

Memorandum and Articles of Association

-

RBI Registration Certificate

-

Copy of Board resolution for MFIN membership and adoption of Industry Code of Conduct

-

Copy of RBI inspection report, if any

-

Sample Loan Cards

-

Self-certification that the Company is in full compliance with RBI and other regulatory norms and guidelines

Click here for more details on how to become MFIN member.

2. Sa-Dhan (Association of Community Finance Institutions)

![]()

Sa-Dhan, an association of Impact Finance Institutions and an RBI-appointed Self-Regulatory Organization (SRO) for Microfinance Institutions, has been a pioneering force in fostering Inclusive Impact Finance in India for over two decades. With about 220 diverse members operating in 33 states/UTs and over 600 districts, including MFIs, SHG promoting institutions, banks, rating agencies, and capacity-building institutions, Sa-Dhan works towards enhancing the understanding of the microfinance sector among policymakers, funders, banks, governments, researchers, and practitioners. Its members serve approximately 44 million clients with a loan outstanding of over ₹1,27,801 crores. Sa-Dhan is recognized as a National Support Organization (NSO) by the National Rural Livelihood Mission (NRLM). Jiji Mammen is the current Executive Director & CEO of the Sa-Dhan.

Sa-Dhan recently organized a conclave conference on 16 May 2023 at Guwahati where they discussed “Revitalizing Microfinance in North East India to Accelerate Inclusive Development”. And, on 13 July 2023, they are going to organize another conclave at Chandigarh, where they will be discussing “Microfinance Driving Inclusive Growth: Unlocking Unreached Potentials in North India”

Follow Them On – LinkedIn and Facebook

Sa-Dhan Membership:

a) Fee Structure

- Processing Fee (One Time) – Rs. 11,800 (10,000+18% GST)

- Annual Fee Membership Fee: Click here to know more.

Click here to know more about how to become a member of Sa-Dhan and also download the application form.

3. AKMI (Association of Karnataka Microfinance Institutions)

![]()

Established in 2007, AKMi aims to promote transparency, governance, client protection, and ethical practices among MFIs operating in Karnataka. AKMI functions as a self-regulatory authority, enforcing a code of conduct for its member organizations. As of March 31, 2018, AKMI had 28 MFI members, and it is registered under the Society Act of 1960. The association is governed by an 8-member management committee comprising representatives from renowned financial institutions such as Chaitanya India Fin Credit, Fincare Small Finance Bank, Credit Access Grameen, IIFL Samasta Finance, IDF Financial Services, Sanghamitra Rural Financial Services, Ujjivan Financial Services, and others. The current CEO of the association is Venkatraman Hegde.

AKMi Membership:

a) Type of Members:

- Associate Members – Individuals engaged with CDFIs, conducting operations within the state of Karnataka, and meeting the criteria set by the Executive Committee periodically are eligible to be considered for Associate Membership of the Society.

- Honorary Members – The Executive Committee may invite esteemed individuals to be Honorary Members of the Society, based on their potential contributions to Community Development Finance and poverty alleviation programs. Honorary Members are exempt from fees and charges.

b) Fee Structure

The annual fee for ordinary member is Rs. 5,000 and for associate members, the annual fees are Rs.10, 000 and no fees for honorary members. No entry fee. Fee payable only after approval of membership.

Know more about their membership details here.

4. Association of Microfinance Institutions – West Bengal (AMFI-WB)

![]()

AMFI-WB, also known as the Association of Microfinance Institutions – West Bengal, emerged in 2006 as a self-regulatory organization. Its primary goal is to unite Community Microfinance organizations operating in West Bengal. The association’s mission is to establish a robust field of community development finance in the region, enabling its members to effectively serve their target clients, particularly impoverished women in both urban and rural areas, and assist them in achieving sustainable livelihoods.

The association plays a pivotal role in enhancing the capabilities of its members, implementing best practices, and refining policy and operational mechanisms. Currently, AMFI-WB boasts a membership of 49 organizations. After four years of operation, it became essential for AMFI-WB to formalize its activities and operate in a more proactive manner. Consequently, on December 30, 2010, AMFI-WB obtained registration as a public charitable trust.

On January 13, 2023, AMFI-WB successfully organized the 7th Eastern India Microfinance Summit 2023. Key discussions of the summit focused on

- Leveraging digital transformation for inclusive finance.

- Adapting to the evolving landscape through historical insights.

- Microfinance industry trends under a new regulatory framework.

- Overcoming challenges and seizing opportunities in digital transformation for MFIs.

- Navigating the evolving digital landscape with best practices in Indian microfinance.

Follow Them On – LinkedIn

AMFI-WB Membership:

a) Fee Structure –

- Yearly Membership Fees Structure for Founder/Ordinary Trustee Members of AMFI-WB

- Yearly Membership Fees Structure for Co-Opt Trustee/Member of AMFI-WB

Click here to know the fees for the above categories.

Download application form here.

Know more about their membership here.

5. India Collective for Microfinance (ICMF)

ICMF, the national-level network established in 1997, serves as a collaborative platform for governmental and non-governmental entities, banks, donor agencies, and research agencies. Their shared objective is to combat poverty by leveraging microfinance to provide credit access to the underprivileged. ICMF actively addresses obstacles hindering the achievement of these goals.

Comprising 11 dedicated members, ICMF is wholeheartedly dedicated to expanding the reach of microfinance and making it easily accessible to deserving entrepreneurs and small-scale business owners. By pooling and disseminating information and best practices within the regulatory framework, the association strives to enhance microfinance penetration in rural areas across India. This collective effort aims to educate grassroots organizations about the significance of microfinance and ensure comprehensive coverage throughout the nation.

6. Banking With The Poor Network (BWTP)

BWTP, the Banking with the Poor Network, is a remarkable initiative by the Foundation for Development Cooperation (FDC). As Asia’s only regionally focused network of microfinance stakeholders, BWTP undertakes various activities aimed at enhancing the quality and accessibility of microfinance services. Comprising 47 microfinance stakeholder institutions from 11 countries across Asia, the BWTP Network encompasses esteemed organizations such as ASA in Bangladesh, the world’s largest microfinance institution, and the institutions responsible for shaping microfinance policy in the Philippines, including the Central Bank of the Philippines. Other member countries include India, Sri Lanka, Vietnam, Nepal, Indonesia, Pakistan, and Thailand.

As a unique channel, BWTP reaches vast geographies of financially excluded individuals. They have established connections with over 350,000+ Microfinance Agents & Field Officers, serving 1,300,000+ financially excluded/underserved individuals. Additionally, they engage with 1,000,000+ Micro Merchants and collaborate with 17 Asian economies, 12,000+ Cooperatives, and 1,500+ MFIs.

7. South Asia Micro-Entrepreneurs Network (SAMN)

![]()

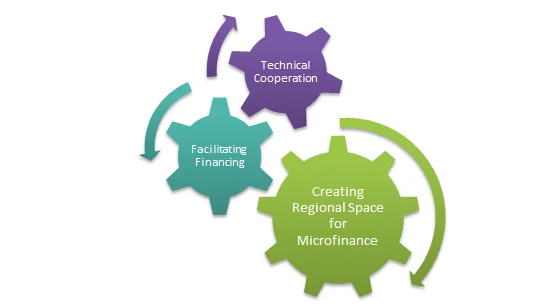

SAMN is a regional network dedicated to enhancing capacity, financing, and regional dialogue within the microfinance sector of South Asia. Governed by prominent Apex Institutions from the region and the Agency for Technical Cooperation and Development (ACTED), SAMN collaborates with MFIs, investors, banks, and other key stakeholders to fulfill its objectives.

Established in 2008, SAMN strives to improve financial inclusion for the low-income population in the region. ACTED, a French INGO, along with ACCESS Development Services and other regional and global microfinance stakeholders, laid the early foundation of SAMN. Today, SAMN membership comprises leading national microfinance apex institutions from six countries, collectively representing the South Asian Micro-Entrepreneur community and serving over 60 million low-income customers in the region. Within India, the present members of SAMN, with a designated seat on the SAMN Board of Directors, consist of the Microfinance Institutions Network (MFIN).

On July 13-14 2023, the association, partnering with the Financial Inclusion Forum (UK), is going to hold a big conference conclave to bring various financial practitioners, regulators, and investors together in London to discussion on “Financial Inclusion in Post-Pandemic Era”

Follow Them On – LinkedIn and Facebook

Get a general overview about the MFI in India here.

SAMN Focus Areas:

(Image Credit: THE SAMN)

You May Also Like: Achieve Your Lending Goals with CloudBankin’s

Conclusion

As the curtain lifts on the stage of India’s economic evolution, the spotlight shines brightly on the top NBFC, Fintech, and MFI associations, networks & communities, illuminating their transformative impact. With visionary leadership, innovative strategies, and a commitment to inclusive growth, they are revolutionizing India’s economy, empowering the marginalized, and paving the way for a prosperous and equitable future. With each step forward, these associations rewrite the script of progress, leaving an indelible mark on the nation’s financial landscape. Together, they are the architects of change, driving a revolution that will shape India’s economic destiny for generations to come.

Related Post

Review of the Best Online Digital Lending Apps and How to Successfully Build One

Do you recall the days when you would have to

How To Identify Fraudulent Digital Lending Apps? Types of Lending Frauds and Their Impact

It’s no doubt that Digital Lending Apps have taken the

Why Should You Use A Cloud-Based Loan Management Software

In today’s competitive market, people are lacking behind in time

- Email: [email protected]

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576

Quick Links

Resources

© 2024 LightFi India Private Limited. All rights reserved.

(Formerly known as Habile Technologies)