A primary reason is stagnating growth brought about by lack of access to credit in a timely and adequate manner.

This leads to a huge market opportunity to the alternate lenders who wish to serve these customers better. With the help of non-traditional credit profile, they expand the outreach of tailored financial products that reach MSME business owner, right when they need it the most.

With the phenomenal traction they have been receiving, these agile lenders have moved to wider areas such as student loans and real estate loans, and even wedding loans.

How does it work?

As opposed to cumbersome credit profiling, the new age digital lenders are looking at alternative demographic and financial data. This helps them to determine creditworthiness to people who don’t typically use traditional banking avenues routinely.

Such sleek digital lending not only helps in quick disbursement but also offers tailored products like wedding loans – a highlight that is sorely missing in the traditional banks.

You May Also Like: CloudBankin – Saas Banking Engine

How did it start?

Digital lending started off as an alternative to the offline banking experience. Until a decade ago, digital lending was only restricted to automating manual processes. The narrow focus meant that they simply replicated the offline banking experience, which in turn, brought down the level of customer satisfaction.

However, things have changed in the last 7-8 years now, thanks to

1 – Rise of digital payments after demonetization, through channels like UPI and mobile wallets

2 – Better bandwidth and internet penetration

3 – Regulated operations for MSMEs after GST rollout

This is why, in the present times, informal MSME lending is going through an evolutionary disruption.

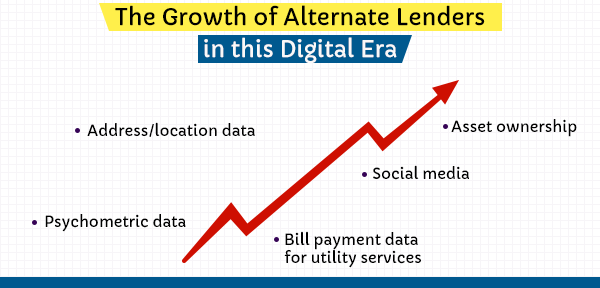

ACD at the heart of Successful Lending Business

Alternative credit decisioning (ACD) combines unconventional channels of consumer information and then decides the creditworthiness of the applicant. Some of the common factors include

1 – Address/location data

2 – Bill payment data for utility services

3 – Social media

4 – Asset ownership

5 – Psychometric data

These are combined with traditional sources like CIBIL scores to help applicants move successfully from banks to alternative lenders.

What next?

The below 3 trends in Fintech innovations are expected to take the digital lending space to a new level:

a. New models of processes and workflows

Since its evolution, this trend has been the primary driver of this sector’s growth. However, with approaching maturity levels, innovators need to re-think the existing digital lending processes.

New age lenders are integrating new data sources and re-imagining the loan origination avenues. They are experimenting a lot with enhancing end-to-end customer experiences with newer processes.

b. Bringing personalization mainstream

Today’s digital customer needs only that information which is relevant to him/ her. This explains the rise of personal financial management tools and software.

Alternate lenders can sense a massive opportunity to provide deeply personalized financial options and then disburse the loans accordingly. With AI and big data, this advantage can be delivered at scale to consumers across the board.

c. Adding a touch of ‘human’ to technology

With the online-offline divide fast disappearing, lenders see an opportunity in enabling better personal advice and support. This goes beyond traditional avenues like phone calls or chats.

Digital products like co-browsing tools and video chat enhance the degree of satisfaction delivered by support executives working for alternate lending institutions.

Types of Alternative Digital Lenders in the Market

There are several types of alternative digital lenders in the market who took over the lending business by storm.

You May Also Like: Alternative Credit Scoring – Why Is It So Popular?

Following is the list of alternative digital lenders:

• P2P Lenders

• Reward-Based Crowdfunding

• B2B Lending

• Equity-Based Crowdfunding

• Community Shares and Microfinance

• Donation-Based Crowdfunding

• Invoice Trading

• Debt-Based Securities

To sum it up

These trends aptly depict the transition from paper-based processes to re-designing the customer experience completely when they seek a loan from an alternate lender. These nimble Fintech disruptors emerge as the choice of alternate lenders in this digital era for a wide population of MSMEs and individuals.