How Much Do You Know About The Evolution Of Lending?

Lending is a term which arose in ancient days. We all have heard or spoken about this word in our day-to-day life. Until the world exists, the term lending will evolve with humans. Firstly, let me put a question before you.

What is lending?

Every individual has a different form of an answer but ends up with a common statement, i.e. “getting the money for interest”. A Lender gives a loan to a person to repay with a certain amount of pre-defined interest.

Let’s have a look at the lending system journey throughout the ages!

The Lending System Before Technology

It’s the year 1754 BCE in Mesopotamia. The Sumerian worship places started serving as banks for the population. This is where the very first system of credit and loans began on a large scale. The code ofHammurabi was introduced, which defined the price of silver and how to regulate interest rates on silver loans.

Then came the ancient times of Greece and Rome in 400 BCE, where pawnbrokers used to lend money with items to be kept as collateral or security, thus reducing their risk. This is where secured lending originated.

The first ever loans in India are mentioned to be dated back to 200 BC during the time of the Mauryan Empire. But, charging higher interest rates to lend was considered a sin. But, this changed when something called “adesha” was introduced in the 2nd century. It was a kind of promissory note to lend between people.

The middle ages, roughly around 1400 AD, brought the largest form of authority from religion. Be it the Christians in Europe or the Muslims in the Middle East, both outlawed lending practices. Only Jews at that time could lend money to people with or without interest.

International trade was booming in the 18th century. And the banking system had to have much-needed control over it. So, Mayer Amschel Rothschild cleverly set up five banks by placing his sons in Europe’s major cities (France, Frankfurt, London, Naples and Vienna). He created a network of transferring money, thus responsible for pioneering the concept of international finance by establishing a centralised banking system.

There was a Zamindar system introduced in India in 1793. The population relied on getting loan amounts from zamindars and then repaying the debts by working for the zamindars. This practice was abolished in 1951.

The early 1800s saw a new era of lending when the Philadelphia Savings Fund Society opened its doors to provide loans to the average population and also a means of savings. In fact, it became the very first savings bank in the US.

Throughout the middle ages to the 1800s, the rich used to lend money to the poor without interest, and in turn, borrowers had to pay off the debt by means of working on the rich lenders’ estates.

A new era of mortgage lending was ushered in 1932 when the Federal Home Loan Bank Act was established to support mortgage finance by local financial institutions.

The Lending System With The Start Of Technology

The 1950s-70s saw another lending revolution. Frank McNamara was the first to pay a restaurant bill using a card (now called Diner’s Club Card). In 1958, Bank of America introduced BankAmericard (now known as Visa). In 1959, FICO scores were popularly used by lenders to make savvy credit decisions in mortgage lending. Dee Hock, the CEO of Visa, computerised the credit card system in 1973, cutting down transaction times to just one minute.

Before computerisation, transactions and payments were very slow and manual, with phone calls. But, post-computerization saw a reduction in transactions and payments time from days to minutes.

The Lending System When Online Lending Was Born

Computers came into play just in time as a result of the hundreds of hours of paperwork involved in handling and filing loans, as well as the growing population and demand for loans. The development of computers and electronic data also influenced the evolution of lending practices.

Quicken Loans in Detroit significantly sped up the mortgage lending system by making the majority of their loan origination stages (application and review processes) online in 1985. In 1999, online banking became commonplace, and borrowers were no longer required to leave their homes or engage in social interactions to submit a loan application.

The Lending System With The Era Of FinTech Lending

A completely new online lending era has begun due to this enormous technological leap, which has eliminated the massive amount of paperwork and hassle associated with traditional loans. This is the era of FinTech Lending.

What is it, actually? This means financial institutions integrate technology, machine learning, data analytics, and digital marketing into finance to serve their borrowers better.

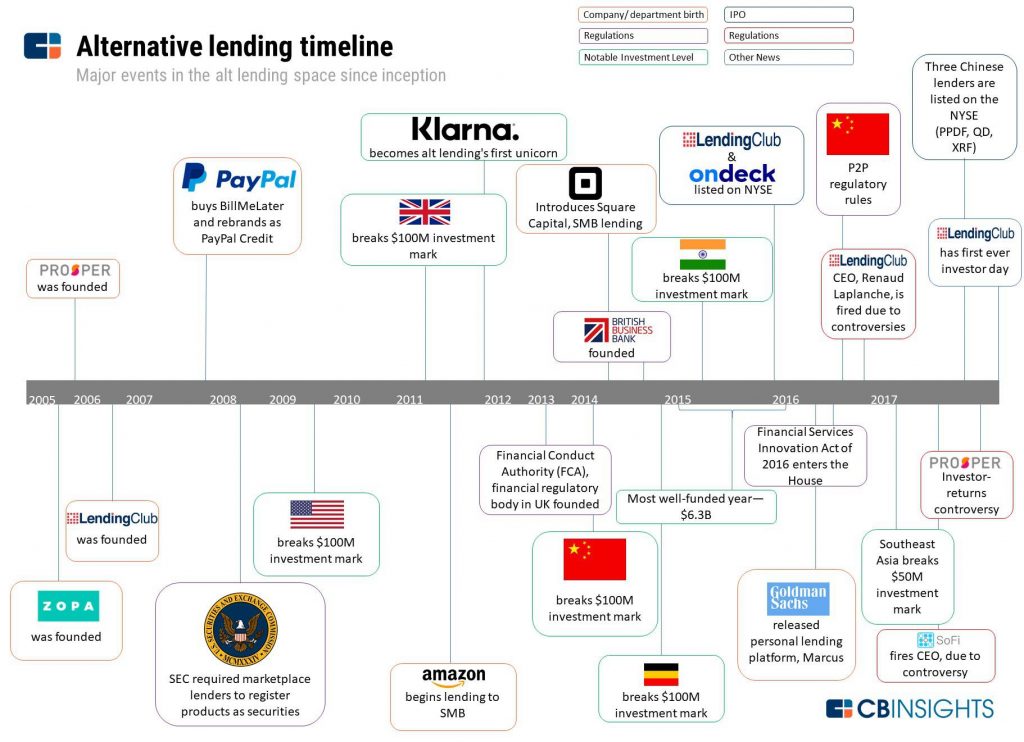

The First generation of FinTech Lending came into being in 2005. The first group of digital lenders emphasized offering better risk modellings with standard loan products that banks provided. This group consisted of LendingClub, Prosper, PayPal and Zopa. Later Amazon and Square also joined. The products they provided were credit cards, personal loans and lines of credit (LOC).

Image Credit – CBInsights

This industry expanded in the 2010s. There was a 40% increase in FinTech Lending from 2013 to 2018. The reason for this was

- The massive inflow of data (such as KYC, credit bureau, bank statement analyser, biometrics, etc.) to improve lending modules.

- Integration of modern technology (ML, data science, etc.) to improve underwriting by pulling in alternate data. Cloud service is being used to process data for faster credit decisions.

- Technology as an infrastructure paved the way for streamlining lending platforms and optimizing operational cost and time. Loan Origination System and Loan Management System were not needed to build from scratch. The financial institutions outsourced vendors like CloudBankin to provide those services.

- Leveraging marketing through online channels (website, social media, emails, etc.) became the norm to acquire borrowers easily.

This resulted in lowering operational costs and risk for lenders.

The second generation of Fintech Lending started in the late 2010s (2019 to present). These new lenders focus more on personalising credit products with less cost and are able to provide less risk for borrowers. New credit products and concepts are being leveraged, such as co-lending, BNPL, embedded finance, mobile financing, etc. The growth in this sector factors to borrowers demanding more innovations in loan products and ways to build credit while lowering debt risk.

FinTech Lending is gradually swallowing the traditional lending model while providing a quicker, user-friendly, modern and seamless lending process and emphasizing solely on borrowers. These transformations and transparency in the process are going to be more in the upcoming years as we are now giving importance to uniting all the different parts of the lending process, starting from loan origination and loan management till closure, on a single platform. We are on the path to building a smoother, quicker process with very few bottlenecks is the end result.

Concluding Words

Paul Thomas, former MD of Provenir, states that the fundamental idea behind lending and the extension of credit hasn’t changed throughout history, but how lending actually occurs has. Due to the advancement of technology and the requirement for innovation to satisfy changing customer expectations, this change will only continue. Customers demand quick responses and smooth transactions. Institutions can only stand out to gain by embracing the opportunities presented by the internet, cloud computing, predictive analytics, and other such innovations to grow in the future.

What’s to expect from the future? Well, digital lending is going to be the norm in the upcoming years. It will upgrade and flourish as there will be more financial inclusion to grow and strengthen the economy of the world. New products and services like BNPL, TNPL, embedded finance, co-lending, etc., will continue to drive greater digital lending penetration among the population. We will also see digital lending software as a one-stop solution for all lending processes. And it is definitely an exciting future in lending we all look forward to!

Frequently Asked Questions

What software do most banks use?

The most common tools used by banks to quickly onboard borrowers are cloud-based loan origination software and loan management software. Technology has completely changed the lending market to the point where lenders can now access their lending platform anywhere, anytime. The fact that cloud-based software is platform independent (using only a web browser), enhances user experience, is much smoother to update and upgrade, and generally maintains data integrity are just a few of the many advantages it offers. As a result, the lending process is more cost-effective, quick, efficient with regard to data management, and secure.

Related Post

Is P2P Lending Really A Threat To Non-Banking Financial Companies (NBFCs)?

P2P lending is a relatively new kid on the block

From Visionaries to Leaders: Meet the 19 Influential Women of Fintech Lending India

(List Updated March 2023) The winds of change have swept

Safeguarding Your Money: How Do Financial Institutions Detect & Prevent Frauds?

Introduction During the years 2021-22, Indian banks were confronted with

- Email: [email protected]

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576

Quick Links

Resources

© 2024 LightFi India Private Limited. All rights reserved.

(Formerly known as Habile Technologies)