Turning Treasures into Funds: A Guide to Gold Loan Processes and Benefits

A family in need of an emergency fund to cover their medical expenses, a farmer requiring capital to purchase seeds for the season, a student hoping to pay for their education abroad, or an entrepreneur who thinks to expand his small business. What do they do to get that emergency fund? What do they all have in common? – Gold!

For decades and centuries, in India gold has been more than just a symbol of status, it has also been a lifeline! According to a 2023 survey by the World Gold Council, Indian households have accumulated up to 25,000 tonnes of gold, thereby retaining the tag of the world’s largest holders of the metal. Indians typically have a strong emotional attachment to gold and often accumulate significant quantities that can serve as a reliable financial resource during emergencies. In fact, during the COVID-19 pandemic, as many as 80% of customers, have taken multiple loans against their household gold, said executives of gold loan NBFCs in an ET report.

Historical Gold Rate Trend in India

Since 2001, the metal has grown at a rate of about 15% per year and is currently sold at ₹7,025 per gram.

| Year | Price (24 karat per 10 grams) |

| 1965 | ₹63.25 |

| 1975 | ₹540.00 |

| 1985 | ₹2,130.00 |

| 1995 | ₹4,680.00 |

| 2005 | ₹7,000.00 |

| 2015 | ₹26,343.50 |

| 2024 | ₹74,490.00 |

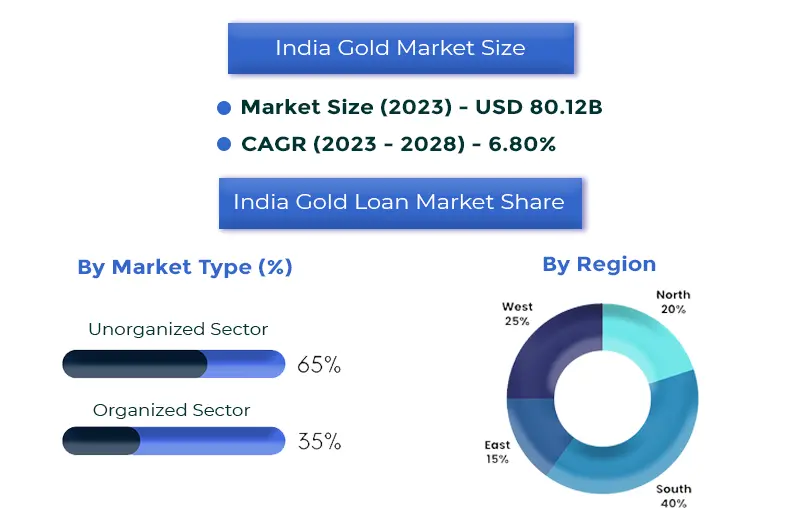

India’s Expanding Gold Loan Market

Organized Gold Loans are usually offered by banks, both in the public and private sectors as well as cooperatives, non-banking financial companies [NBFCs], and Nidhi companies. There also exists an unorganised gold loan market, comprising pawnbrokers and money lenders. The unorganized sector holds a 65% share, while organized players, including banks and NBFCs, represent the remaining 35% share.

In India alone, the overall gold loan market is ~INR 18LCr, with an organized market size that reached USD 80.12 billion in 2023 and is expected to grow at a CAGR of 6.80% from 2023 to 2028. As the demand for gold loans surges, so does the need for lenders to understand the intricacies of this unique financial product. From the emotional attachment to the meticulous process of assessing the value, the world of gold loans is rich and intricate.

Why do borrowers prefer the Gold Loans over Personal Loans?

#1 Low Rate of Interest

The rate of interest against gold loans is historically lower starting from 7.35% than most unsecured loans like personal loans start from upwards of 10%. Interest rates on gold loans in India typically range from

- 7.35% to 18% per annum for public-sector banks

- Up to 26% per annum for private-sector lenders

Banks generally charge lower interest rates compared to NBFCs for gold loans some lenders also slap a 1-3% loan processing fee. The gold loan rate of interest varies with each lender and is typically based on the gold weight, loan amount, loan tenure, and the borrower’s credit history.

#2 Minimal Documentation

Since the gold itself stands as collateral, lenders don’t require extensive credit checks or proof of income. The documentation required is minimal, limited to basic identification and address proof.

Eligibility Criteria To Secure A Gold Loan

Gold Loan eligibility criteria determine whether the borrower can secure a loan against his/her gold loan assets. Fulfilling the eligibility criteria and having all the required documents will streamline the loan application process and enhance the chances of securing the loan.

| Eligibility Criteria | Requirement |

| Age | 18 to 75 years |

| Nationality | Indian Resident |

| Gold Purity | 18 – 24 carat |

| Occupation | Self–employed individuals, business owners, homemakers, senior citizens, and salaried individuals are all eligible for a Gold Loan. |

Documents required for Gold Loan

Any individual between the age of 18-75 having the following documents can avail of a Gold Loan. Here’s a list of what you will need:

| 1 | Proof of Identity | Aadhar Card, PAN Card, Passport, Voter ID, Driving License |

| 2 | Current Address Proof | Aadhar Card, Passport, Voter ID, Utility Bills, Ration Card, Driving License |

| 3 | Photographs | Recent passport-size photographs of the applicant |

| 4 | Gold Details | Invoice or receipt of the pledged gold item (if available) |

| 5 | Bank Details | Bank account details for loan disbursal and repayment |

| 6 | For Agriculture loans | Proof of land holding in case of an Agriculture Loan of more than Rs 1 lakh |

#3 Maximum Loan Amount

Gold loans offer a high loan-to-value (LTV) ratio, which means the borrower can get a substantial loan amount based on its current market value. LTV or the Loan to Value ratio is the ratio of the loan amount sanctioned for the value of gold deposited by the borrower as collateral. A higher LTV ratio would result in a higher interest rate, indicating a riskier investment for lenders.

LTV = Taking the loan amount / the market value of the borrower’s collateral

RBI Guidelines on Gold LTV Ratio:

Maximum Limit

Presently, the maximum gold loan-to-value ratio (LTV) set by RBI is 75% of the gold’s market value. Borrowers can get a loan amount equivalent to 75% of their pledged gold’s worth. RBI sets a maximum LTV to prevent excessive lending which could lead to higher default risks.

Temporary Increase

During the COVID pandemic, the RBI temporarily increased the LTV to 90% to help individuals facing financial difficulties. However, this relaxation in LTV was available only till March 31, 2021.

#4 Flexible Repayment Options

Gold loans offer flexible repayment options for the borrowers, that let them repay the amount without affecting their finances.

- Bullet Repayment: Borrowers repay the entire principal and the interest amount is paid at the end of the loan tenure.

- Instalment Repayment: Loans can also be repaid in EMIs, where both principal and interest are paid off gradually over the loan term.

- Overdraft Facility: Some lenders provide an overdraft facility where borrowers can withdraw funds as needed up to a specified limit, paying interest only on the amount utilized.

- Part-Payment: Borrowers may make partial payments towards the loan, reducing the principal amount and thereby the interest burden.

#5 Quick Processing

Gold loans are one of the quick and easy loans to process. The loans are approved within a few hours of application and the loan amount is disbursed quickly.

In general, a gold loan can be approved in 90 to 120 minutes, depending on the customer’s ability to submit the necessary KYC documentation and bank rules.

#6 Tax Benefits of Gold Loans

Gold loans offer various tax benefits making them an attractive option for borrowers.

- Home Improvement: Under Section 80C of the Income Tax Act, 1961, Borrowers can opt for gold loans to meet the cost of home improvement expenses that are eligible for tax deduction. Tax benefits amounting to Rs 1.5 lakh can be availed and the deduction is applied to the principal payment.

- Purchasing/ Construction of Residential Property: Under Section 24 of the Income Tax Act, gold loan borrowers can claim a tax deduction of up to Rs2 lakh in a tear if the loan amount is used for the purchase or construction of residential property.

- Business Expenses: Taking a gold loan to meet expenses related to the business also has tax benefits. The loan amount can be deductible as a business expense under the Income Tax Act, effectively bringing down overall tax liabilities.

- Other Assets: If the borrower uses the gold loan for the purchase of assets like stocks, equities, bonds, or any other assets than property, they can claim the interest paid towards the gold loan as a cost of acquisition, which reduces the taxable capital gains and cut downs the tax liability.

What happens If The Borrowers Cannot Repay the Loan?

Typically lenders give numerous reminders via calls, messages, and emails to repay the loan along with some extra time after the due date. However, if the borrowers consistently default on payments then these actions might follow

The lender charges a penal interest

The lender will charge an additional interest rate over the applicable interest rate for the months on which the payments have not been made. This penal interest is usually charged at the rate of 1% to 7%p.a., and it varies from lender to lender.

The lender can auction the gold

Gold is pledged as collateral against the loan, and hence failure to repay will give the right to auction the gold by the lenders. The gold will be considered a non-performing asset and sold off at a fair price to recover or offset the losses incurred from the loan. If the sale happens more than the to-be-paid amount, the remaining amount will be returned to the borrower.

The lender might take legal action

If the amount received through the gold auction is insufficient to close the loan, the lender can also take legal action against the borrower. The legal actions may vary depending on the jurisdiction and the loan agreement terms.

Negatively Impacts the CIBIL™ Scores

Defaulting on gold loan payments can negatively impact the borrower’s credit score, which makes it difficult for them to avail loans in the future.

Jumping Interest Rate

When the borrowers delay their EMI payment in the month it’s due, they can be charged an extra rate on interest on the overdue payment. This is called the Jumping interest rate and it can go above the base interest rate. For example, A borrower takes a loan for ₹10,000 on 1st August and his next repayment date is 1st September with a 1% interest. In case the borrower doesn’t pay, the interest for the following month will jump to 2%. After the borrower starts paying the amount properly, the interest rate will be taken back to 1%.

What are the Challenges faced by the Lenders in the Gold Loan Processing?

Despite the promising market, lenders face several challenges when it comes to gold loans:

Dependency on Assessor

Lenders usually rely on gold assessors to test the purity and the value of the collateral gold. When the assessors are unavailable, then dependency causes delays in loan processing. They assess the gold manually which is prone to human errors and inaccuracies. This affects the lenders and borrowers, due to inconsistencies, and increased processing times.

Documentation and Compliance

RBI has stringent norms and gold loan applications that are non-compliant lead to delays or rejections. However, with the traditional paperwork process, lenders face complexity in adhering to regulatory requirements.

Operational Efficiency

Traditional loan processing methods result in operational inefficiencies with up to 25% higher operational costs compared to automated systems. Loan applications are delayed due to manual errors in the verification and validation process. Inefficiencies can lead to longer loan processing times, increased overheads, and reduced customer satisfaction.

Handling Multiple Jewels

Borrowers often pledge multiple pieces of jewelry for loans. Each and every jewel pledged by the borrowers needs to undergo individual appraisal and documentation. This adds even more complexity to the appraisal process it requires meticulous record-keeping to ensure each item is correctly valued and tracked.

Locker Issues

Safeguarding all the pledged gold is no easy task. Lenders require secure lockers to store the gold. This involves the cost of the security, insurance, and maintenance of the gold items. Issues with locker availability, security, or management can jeopardize safety. Also, packing, unpacking, and returning the jewels to the borrowers upon repayment requires careful management to avoid loss, damage, or mix-ups. This process is labor-intensive and necessitates robust protocols.

Increasing Competition

India’s gold loan market is witnessing neck-to-neck competition as new entrants flood causing lenders to offer lower interest rates and better terms for borrowers. The rise of NBFCs and online gold loan platforms has intensified the competition. Now, lenders are trying to leverage technology for an improved customer experience and gain an edge in this market.

Unorganized Gold Loan Market

For decades, gold loans have been availed by people from all sections of society from the unorganized market through pawn brokers and lenders. These lenders, having local market knowledge, provide quick funds with almost no documentation and exorbitant interest rates. Although it is completely unregulated and involves many risks, it holds 65% of the gold loan market.

| Sector | Bank | NBFCs | MoneyLenders/ Pawn Brokers |

| LTV | Upto 75% | Upto 75% | Upto 80% |

| Interest Rate | 8 – 26% pa | 9.5 to 28% pa | 15 -50% pa |

| Disbursal | Up to Rs 20000: Cash >20000: Account Transfer | Must have an Account in the Same Bank, Where Money Will Also be Disbursed | Cash |

| Regulatory Body | RBI | RBI | Unregulated |

| Disbursal time | 2 days – 4 weeks | 1 day to 3 weeks | Same day or with in a few hours |

The shift from unorganized sources of finance to organized lenders for gold loans is gaining momentum. Increased awareness about the risks associated with informal borrowing has driven more people to seek reliable, regulated options. Organized lenders are capitalizing on this trend by integrating advanced lending software to streamline their processes. Borrowers benefit from improved efficiency, enhanced security, and greater transparency, making organized lenders a more attractive choice for gold loans.

How Digital Lending Software Transforms Gold Loan Management?

Digital lending platforms are the operational engine for seamless business flow in the gold loan management industry. Used for loan maintenance, gold loan renewals, multi-valuation, rebate calculations, margin calls, maturity date reminders, and more, gold loan software provides a clean-cut, no-frills, and efficient solution to gold loan lenders Digital lending software reduces manual intervention through automated processes and streamlines the workflow.

- Digital KYC: Quick and accurate verification of customer identities through digital KYC processes.

- Automated Valuation: Use of advanced algorithms to assess the purity and value of the gold.

- Instant Approval: Speeding up the approval process through automated decision-making.

- 24/7 Access: Customers can apply for loans and check their status anytime, anywhere.

- Data Analytics: Leveraging data to make informed decisions and identify trends.

Door-step Onboarding

Now loans against gold can be availed right from the borrower’s home through door-step onboarding. It’s all completely automated and digitized: a customer service rep visits the borrower’s house with a tablet (which has weighing equipment attached) on a pre-fixed date and time.

- Carries out digital checks of required documents,

- Verifies and vets their gold assets

- Input all these details into the gold loan origination software built-in into the device

- Generates the loan documentation

- Gets automated approval through the software

- Immediately disburses the loan to the borrower’s account.

The gold is kept in a tamper-proof packet that is marked with a unique customer ID and is stored in a vault room at the lender’s premises. A vault number is allocated against the customer’s loan ID for easy tracking. During this entire process, the customer representative’s location is monitored. Some lenders also offer insurance coverage against gold loans, although the coverage amount is limited based on the lender’s discretion.

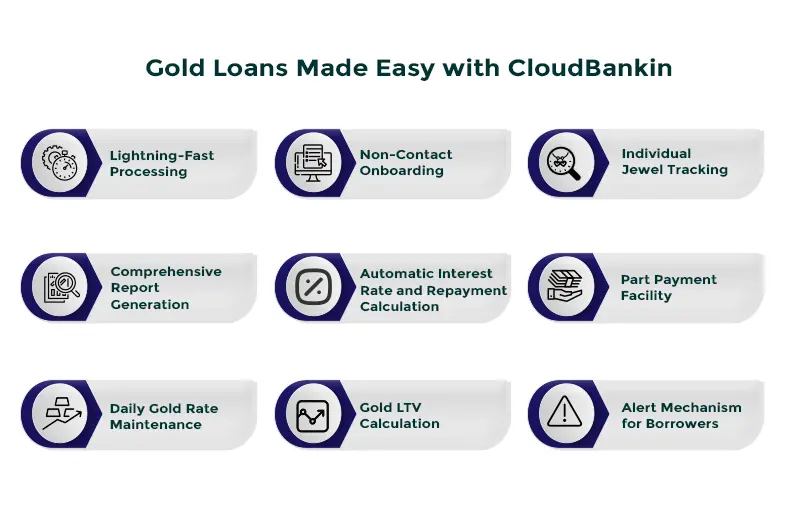

How does Cloudbankin make the Gold Loan Process Simpler and Faster?

CloudBankin’s scalable loan origination system and loan management system handle the entire lifecycle of a gold loan, from loan origination to closure.

- Lightning-Fast Processing: CloudBankin ensures that gold loan applications are processed and disbursed with unmatched speed. This reduces turnaround time, enabling faster decision-making and loan processing.

- Non-Contact Onboarding: Utilize CloudBankin’s CKYC feature to onboard customers without physical contact, ensuring compliance with statutory requirements

- Individual Jewel Tracking: Lenders can track each piece of jewelry including weight, purity, and valuation pledged by borrowers. Each item is recorded separately under the borrower’s name, ensuring accurate and detailed record-keeping.

- Fully Customizable: Customize workflows, repayment options, and interest rates to meet the changing demands of the market and ensure smooth operations.

- Automates Calculation: Automatically calculates gold loan interest rates and repayment options available from lenders. Captures and sends out reminders for penalties on overdue loans, in addition to interest recalculation.

- Part Payment: Borrowers can reclaim specific jewelry items through part payments which provides flexibility to the customers.

- Comprehensive Report Generation: Lenders can generate detailed reports on the gold loans and share them with the borrowers effectively.

- Daily Gold Rate Maintenance: The software automatically updates and maintains the daily gold rates, ensuring that valuations and loan calculations are always based on the most current market prices.

Ready to simplify and accelerate your gold loan processes? Experience the power of CloudBankin and unlock peak efficiency in your lending operations. Book a Demo today and see how CloudBankin can revolutionize your gold loan services!

What does LTV stands for?

LTV stands for Loan to Value ratio. It is a financial metric that compares the loan amount a borrower is seeking to the market value of the asset being used as collateral. The LTV ratio helps lenders assess the risk of a loan. A higher LTV indicates a higher loan amount relative to the value of the asset, which can result in higher interest rates due to increased risk. LTV = (Loan Amount / Market Value of Collateral)

Related Post

How Management Information Systems (MIS) Help The NBFC Companies?

NBFC (Non-Banking Financial Companies) are responsible for doing a lot

Review of the Best Online Digital Lending Apps and How to Successfully Build One

Do you recall the days when you would have to

Gold Loans – the Whats, Hows and Whys

Shiny, pure and incredibly valuable, gold is the metal that’s

- Email: [email protected]

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576

Quick Links

Resources

© 2024 LightFi India Private Limited. All rights reserved.

(Formerly known as Habile Technologies)