Review of the Best Online Digital Lending Apps and How to Successfully Build One

Do you recall the days when you would have to submit a loan application and wait for days to get it approved? Sometimes even not having the required documents or knowing the process would have kept you from availing a loan. But now, thanks to digital lending apps, you do not have to face that anymore. You can apply for loans digitally and financial institutions can reach a wide customer base by offering services transcending traditional banking.

As of 2022, the total digital loan disbursement in India was valued at INR 21.6 lakh crore and is expected to reach a whopping INR 47.4 lakh crore by 2026, representing a CAGR of 22%. This shows that digital lending is at its ever-growing phase and is making its mark in the Indian economy. As the industry continues to evolve, so do the demands and expectations of lenders and borrowers, which makes digital lending platforms a necessity and not a trend.

Reviewing The Best Digital Lending Apps in 2024

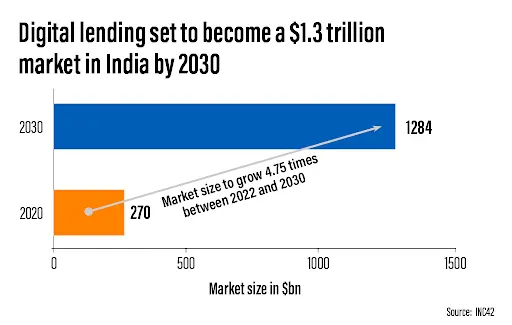

As customers are transitioning rapidly into the digital age, the use of smartphones has increased significantly. This has resulted in a 40-60% jump in the purchase of digital loans. The digital lending market is set to become a $1.3 trillion industry by 2030, and what could contribute to that is the overwhelming number of personal loan apps currently in the market and the number of users actively taking loans.

The target audience for instant personal loan apps is primarily individuals or borrowers and the features offered should cater to their needs. However, even the best rated apps in the current market will always have a scope for improvement.

Hence, we will break down some of the key features every personal loan app should have, common positives that customers enjoy, and the negative aspects that need to be fixed or avoided when developing the app. Common customer reviews and suggestions observed from the Google Play Store are highlighted below for various lending apps: popular and not so popular.

Category 1: User Experiences (UX)

A large number of reviewers have positively reviewed the user interfaces of every loan app.

Positives

- Some of the most popular digital lending apps have a multitude of positive feedback complimenting the user interface of these apps and how easy it is to navigate the app.

- Lending apps with as many as a few hundred thousand downloads have users complimenting their easy-to-understand interface and seamless navigation.

Category 2: Security & Transparency

Regarding security measures, even the best digital lending apps have seen mixed reviews in this aspect.

Positives

- Most apps have received praise for their in-built security features such as two-factor authentication and data encryption.

- Though security has been a point of concern even for some of the best personal loan apps with higher ratings and downloads, users have praised their transparency levels, mentioning that they had immediate access to crucial loan information such as interest rates, processing charges, eligibility criteria, etc.

Negatives

- Some have been deemed as fraudulent apps that collect confidential information of borrowers and don’t issue any loans.

- Users have negatively reviewed some apps due to their unclear loan terms and conditions, lack of instructions and tutorials for easy navigation, and even for incorrect information about interest rates and charges.

Category 3: Technical Issues & Customer Support

The performance and customer support reviews of the top personal loan apps leaned more towards the negative side.

Positives

- Some customers reported the apps had a proactive and friendly customer service team.

Negatives

- Frequent technical issues such as the app crashing, blank screens while submitting loan applications, and login issues have been reported by borrowers.

- They have also complained about longer loading times while navigating the app.

- Borrowers reported horrible customer support where they did not give prompt responses and follow-up systems were not in place for addressing grievances.

Category 4: Loan Application and Foreclosure

Digital lending apps have received mixed reviews regarding the loan application, disbursement, and foreclosure processes.

Loan Application

Negatives

- Customers have faced several technical glitches and longer loading times while submitting applications and in some cases, even after filling the form, the application doesn’t go through successfully.

- Frustrated borrowers gave negative reviews stating longer wait times for application processing and loan approvals.

- A few customers also expressed their grievances with document uploads, which sometimes never went through due to technical glitches.

- Lengthy KYC processes in several apps have also been reported.

Loan Disbursement

Positives

- Several customers complimented the loan disbursement process, stating that lenders process their applications quickly and disburse the loans within a short time span.

Negatives

- Users have negatively reviewed the disbursement, reporting delays by weeks and even months to receive their loan.

Foreclosure and Loan Management

Negatives

- Loan foreclosure reviews have been limited although some users have faced foreclosure issues from the lenders’ side.

- Sudden changes in interest rates and repayment periods without the customer’s knowledge are also common complaints.

- One of them includes the predatory practice of increasing the final loan amounts. For example, a borrower had taken a loan of Rs. 36,000 but was wrongly credited Rs. 42,000. On repayment of Rs. 42,000, the final loan amount suddenly increased to Rs. 46,000, which is nothing but an unnecessary expense the customer had to bear and a malpractice on the lender’s side.

- Despite completing the loan foreclosure process, customers have stated that in some cases, the foreclosure status read incomplete, which has impacted the credit scores of users even after the timely repayment of the loans.

- Many users have also reported unprofessional behavior from lenders or recovery agents and have even been subject to threats against borrowers and their families in case of delayed payments.

Category 5: Interest Rates and Charges

Most apps have been negatively reviewed for charging high interest rates and processing fees, which has caused difficulties for some borrowers to settle their debts on time.

Features and Suggestions Made By Customers

Customers who’ve reviewed the top personal loan apps have also given a few recommendations to improve the apps, some of which include:

- Frequent bug fixes and consistent updates to prevent server issues and app crashes.

- More flexibility in repayment tenures and more credit limit options in case of good credit scores.

- Prepaid credit limit mechanism, a feature similar to prepaid credit cards can be beneficial for users with poor credit scores.

- Pre-EMI payment facility for reducing repayment burdens.

Criteria for Evaluating the Digital Lending Applications and Recommendations for New Developers

Individuals or developers looking to go into the digital lending space need to understand the elements that make a successful lending app. The following criteria can be used as a benchmark for lending platforms to improve their services. Lending app developers can also look into the criteria and recommendations for building a good personal loan app that will stand out among the competition and provide the best of its services to borrowers.

1) User Experience & Interface

Whether it’s a personal loan app or any other app for that matter, a simple and intuitive user interface can enhance user experiences and attract new customers, or in this case, borrowers.

Developer Recommendations

- The app should have a simple and intuitive interface that is visually appealing and easy to use.

- Additionally, it should have faster loading times and minimal bugs to ensure maximum performance, especially when prospective borrowers are attempting to complete the loan application process.

2) Loan Application & Approval Process

Sometimes, despite completing the loan application process, there may be delays in receiving approvals. Borrowers need to understand the intricacies involved in the application process and the time taken to get them approved. Normally after completing a loan application process, the app analyzes the credit scores of the applicants and after an underwriting procedure, the loan may be approved or denied.

In case of non-approval or non-receipt of information, borrowers can follow an escalation matrix, contacting customer support and compliance heads and addressing their grievances. To prevent such concerns, application tracking facility should be implemented in digital lending apps so borrowers will be able to monitor its status at all times and make decisions accordingly in case of any issues.

For seamless application and disbursal of loans, customers can check if Loan Origination Systems have been implemented into the apps. They are built to automate and support the entire loan lifecycle, from application submission and approval to disbursement, complying with regulatory and internal requirements at the same time.

Developer recommendations

- Several digital lending apps do not provide customers the option to foreclose their loans within the same platform. This is a primary feature that should be implemented.

- When building a personal loan app, higher transparency should be maintained where customers have access to clear instructions and guidelines from the application process till foreclosure.

- The app should also give them a comprehensive understanding of the eligibility criteria, the features they can leverage, regulatory information, interest rates, and processing fees payable.

- Additionally, the implementation of a Loan Origination System (LOS) is also advisable since it makes borrowing easier for loan seekers and helps lenders control the risk of payment defaults.

- The LOS market, which was valued at $100 billion in 2023 is expected to reach a staggering $177.1 billion by the end of 2030, indicating the rapid growth and implementation of this system into digital lending platforms.

3) Compliance with Digital Lending Guidelines

Besides offering the best loan services, app developers are also responsible to ensure that personal loan apps are compliant with digital lending guidelines. The guidelines are applicable to digital loans offered through any platform provided by banks and non-banking financial institutions. For starters, the RBI drafted a new framework that ensures borrowers have prior information about the potential lenders so they can make informed decisions.

Developer Recommendations

- App developers must ensure full transparency in terms of interest rates, fees, loan terms, and repayment schedules.

- They should obtain explicit consent from borrowers for data collection and processing, which is crucial under data protection laws.

- They should also ensure maximum compliance with consumer protection laws, data privacy regulations like the GDPR or CCPA and all regulations governing digital lending.

- Additionally, app developers must comply with Google Play Store’s policies to ensure smooth launch of their APK.

4) Customer Support & Service

An app with a proactive and dedicated customer support team who’ll be available 24/7 to take care of customer needs is crucial. Digital lending apps can crash often due to bugs or server issues and these issues can only be resolved by a highly responsive technical support that consistently monitors the app and performs bug fixes.

Developer Recommendations

- The platform should house a sound technical team that can instantly resolve performance issues.

- Additionally, multiple support channels like chat, email, and phone should be open for customers to seamlessly communicate with the support team.

5) Security & Privacy Measures

Safety and security in instant personal loan apps are crucial to protect the personal data of borrowers and prevent them from being scammed.

Currently, in the digital lending market, fraudulent applications that phish for personal documents or private user information are on a rapid rise and customers need to watch out for such apps. Prospective borrowers should look into all the security features provided by the app, such as advanced data encryption, multi-factor authentication, data minimization, etc.

According to a report by the Fintech Association for Consumer Empowerment (FACE), it was revealed that one-third of high-confidence customers in India had limited knowledge of their digital loans and had no idea on how to differentiate between illegal loan apps. This is also one of the banking industry’s pressing issues and customers need to verify the apps thoroughly and analyze their authenticity before installing them.

Developer Recommendations

- Digital app developers can implement several security measures such as the ones mentioned above along with a few more measures such as incidence response, where the app will instantly notify users and authorities in case of a data breach.

- Regular security audits should be conducted and biometric authentication should also be included as an extra layer of security.

6) Features and Functionality

Quick personal loan apps offer a plethora of varying features, ranging from loan services to security features and much more.

Developer Recommendations

- For digital lending app developers, a highly recommended feature would be to include a Loan Management System (LMS) to streamline loan servicing, support, reporting, and monitoring for customers.

- Other features such as pre-EMI payment facility, integration with bank accounts, and prepaid credit limit mechanism can also be added.

7) User Reviews & Feedback

Finally, user reviews and customer feedback are also critical towards choosing the best apps for instant personal loan. Going through the platform’s official website, testimonials, app store reviews, and verified review sites will give a comprehensive understanding of the app’s features, customer support, authenticity, etc.

Developer Recommendations

App developers can also review customer feedback of multiple apps to gain a comprehensive understanding of what to do and not to do when developing the application.

Enhance the Power of Digital Lending Through Loan Origination and Loan Management Systems

As digital technologies continue to grow, the sheer increase in the number of digital lending platforms in the near future should not come as a surprise. Customers are actively looking to get hassle-free loans where the entire loan lifecycle is seamlessly managed, from the point of application to closure of the loan. For that, CloudBankin offers Loan Origination System and Loan Management Systems to streamline the entire process for borrowers and lenders, respectively.

Book a demo today for comprehensive insights into the platform’s capabilities and revolutionize lending for your borrowers

Related Post

How GSTN on Account Aggregators are Making Business Lending Smarter and Faster?

A world where getting a business loan is as easy

Conclusion: Significance of Uniform Credit Reporting For Financial Institutions

Significance of Each Segment in the Uniform Credit Reporting Format

What is Co-Lending and How will NBFCs Benefit From It?

With more than 1.4 billion in India, nearly 63% of

- Email: [email protected]

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576

Quick Links

Resources

© 2024 LightFi India Private Limited. All rights reserved.

(Formerly known as Habile Technologies)