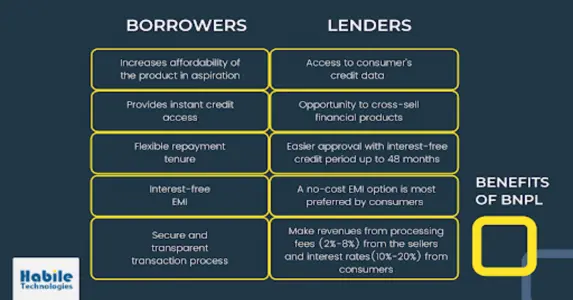

Due to the fact that there are thousands of transactions taking place between lenders and borrowers every day, this data provides the foundation blocks towards building a sustainable integration of BNPL modules into lenders’ Loan Management Systems. The financial institution or lender gets access to the borrowers’ credit information which can be utilized for cross-selling other financial products.

Using the data available and analyzing the customer pattern, the bank or NBFC will be able to supply the right product at the right time and earn ROI of approximately 2.5% to 8% (Subvention Rate & Processing fees) or more than 15% returns depending on the volume of their businesses.

As a lender, what are the different ways BNPL can be applied to your consumers? Let’s walk through the nuances of BNPL with the help of some common use cases.

Raj wants to purchase an iPhone worth 65,000 INR which has been on his wishlist for quite some time. He explores different credit options available for his product within his line of credit.

Let’s assume Amazon is the seller here offering BNPL service for the product he wishes to purchase.

Here are a few ways for a Lender to offer a BNPL service to Raj.

Use Case 1

In the first scenario, Raj checks for his credit limit based on which he will be eligible for the BNPL service. Based on his financial data, the lender will set a credit limit. He then purchases 65,000 INR by paying a processing fee.

The lender sets the due date for repayment of Raj’s credit via BNPL and makes the payment on or before the due date.

In a nutshell, the Lenders can earn 2% processing fees on each transaction and scale their profitability. Even 1000 transactions in a day, similar to Rs. 65,000 each can fetch them an ROI of 25% considering a 30-day repayment period.

Use Case 2

In this scenario, Raj’s credit limit is set, and he purchases the product by paying a processing fee. When he’s unable to make the payment on or before the due date, he requests the lender for an EMI option.

The lender converts the repayment option as an EMI, which must be paid within a stipulated period. The EMI levied on this Credit method could be interest-free, or have a small interest rate, according to the lender’s business policy.

The profit margin may look a bit squeezed in this case, but it prevents the customer from defaulting and brings down the recovery cost for the lender.

In this use case, as mentioned above, the lender will earn interest or if the lender defaults, then finance charges are applied on the outstanding amount, which adds to the charm of BNPL. In the case of zero-interest EMI schemes, usually, the margins are built into the cost of the product itself; for example, if the iPhone costs INR 65,000 if you pay 100% up-front, it may cost you INR 66,000 if you pay with an EMI scheme.

Use Case 3

In the third scenario, Raj’s line of credit is analyzed, and he makes a purchase by paying a processing fee. A due date will be set before which he should ideally make the payment. If he fails to pay on time or has surpassed the due date, the customer default occurs. The default fee could further be charged post which the payment method will be converted as an interest-free EMI. Let us look at this use case:

- Raj purchases an iPhone worth Rs. 65,000

- Add a processing fee of 2% of the above amount, i.e., Rs. 1300

- Based on the installment option plan chosen by Raj, i.e., 6 months, 12 months, 18 months, etc., we can arrive at the EMI amounts.

For example, 6 months EMI for 65,000 will be Rs. 10,617

- Raj defaults after how many installments (5?)

- Apply default fee 29.99% – Rs. 3185, Total amount pending is 13,802

- Arrange Total Final Litigation Balance of Rs. 13,802 by Raj’s choice of EMI conversion tenure.

This scenario is important to be addressed because the customer defaulting on the payment will cause unexpected loss to the Lender’s revenue. The customer’s creditworthiness is to be vetted thoroughly to avoid these kinds of scenarios.

Usually the 5 C’s of credit underwriting (Capacity, Capital, Collateral, Character, and Conditions) are golden eggs to determine the creditworthiness of a customer, however, these days alternate data has come into the fore to aid further checks. Metrics like purchasing behavior, social media searches, online subscriptions, and more have taken credit decisions by storm and provided lenders with more useful information to cut their losses and maximize profits. A robust Fintech Integration will give enough data access to assess customers creditworthiness to ensure better credit underwriting to minimize such losses.

Use Case 4

The fourth scenario highlights the situation where Raj pays the Minimum Amount Due (down payment) and converts the remaining amount into EMI

- Raj purchases an iPhone worth Rs. 65,000

- Add a processing fee of 2% of the above amount, i.e., Rs. 1300

- Raj purchases another iPhone worth Rs. 65,000

- Add a processing fee of 2% of the above amount i.e., Rs. 1300

- The total amount due is Rs. 1,32,600.

- Raj will pay the Minimum Amount Due (MAD) as agreed mutually with the lender. For example, here, MAD may be Rs. 20,000, which Raj pays.

- Based on the installment option plan chosen by Raj, i.e., 6 months, 12 months, 18 months, etc., we can arrive at the EMI amounts for the outstanding amount of Rs. 1,12,600 into 1 year BNPL EMIs i.e. Rs. 9384.

It is a textbook scenario where one can avail BNPL EMI for the Total Number of Purchases made.

Use Case 5

The fifth scenario shows utilizing the available Line of Credit (LOC) to pay off the debts and opt for a BNPL EMI plan to clear his outstanding amount. Through this method, the customer can redeem his credit limit and reduce his overall cost by a fair margin, thereby avoiding bad debts.

- Raj purchases an iPhone worth Rs. 65,000

- Customer chooses BNPL EMI (zero interest), if available, or credit card EMI (charges approx. 3.5% per month) (Based on loan amount)

- Based on the installment option plan chosen by Raj, i.e., 6 months, 12 months, 18 months, etc. we can arrive at the EMI amounts.

For example, 6 months, 0% EMI for 65,000 will be Rs. 10,834.

- Line of Credit is an up-and-coming credit instrument that lenders – both banks and NBFCs are offering to expand their product lines. In a LOC, customers can draw funds from a preset credit limit for personal or business purposes. Funds can be withdrawn any number of times, and interest is levied only on the amount drawn, and not on the overall credit limit. The interest rates on LOC are lower than those of credit cards, making them a more viable option for big-ticket purchases.

In this scenario, Raj starts with using his line of credit worth INR 15,000 to partially pay for the iPhone and fund the balance using an EMI option. Accordingly, his LOC is debited, reducing the limit to zero, and reducing the outstanding amount for the phone to INR 50,000. He gets an interest rate of say, 2% on the LOC that he has to repay in the agreed terms with the lender. For the balance iPhone amount of INR 50,000, he chooses 6-month EMIs. This process makes it easy for Raj’s repayment as his INR 15,000 gets a lower interest rate, and the INR 50,000 gets a 3.5% interest rate.

- Now assume Raj was the owner of an MSME (Medium, Small, and Micro Enterprise) and he wanted to get 5 iPhones to all his top employees. Interest subvention is a scheme that RBI brought with the advent of COVID-19 to provide an interest relief of 2% per annum to the MSME, should they require it.

In the above scenarios, the lender takes a cut of interest (Subvention) ~< 1.5% per month (Rs. 975 per month (1.5% of Rs. 65,000 plus the Rs. 1,300 Processing fees)). The customer, in turn, has to pay only Rs. 1,300 compared to the hefty interest rates that he pays to Credit Cards. This is probably one of the principal reasons why BNPL is gaining popularity in an economically upgrading country like India.

Further, the process mitigates the risk of loss if the customer defaults to nil. The Lender is highly benefited with the scope of repeat business which promises a minimum ROI of 1.5%, as mentioned above.

Final Thoughts

The above-explained scenarios strongly recommend lenders to have a digitalized Loan Origination System (LOS) like CloudBankin to analyze the creditworthiness of the borrowers and prevent losses due to customer default. Further LOS implementation also provides infinite access to customers’ financial data which opens opportunities for a lot of data-driven financial products.

If you are a Lender who wants to drive the ROI and scale your business through BNPL, then get in touch with us today for a digital transformation. Let’s do it the CloudBankin-way!