Loan Origination System

Expand reach. CloudBankin's Loan Origination System:

Your all-in-one digital lending solution.

What is Loan Origination System (LOS)?

A Loan Origination System (LOS) is a comprehensive digital platform designed to manage the loan origination process, enabling banks and financial institutions to oversee the entire loan application journey, from submission to disbursement. The advanced Loan Origination Software streamlines operations, automates workflows, and enhances both operational accuracy and borrower experience.

Loan Origination Platform, manages all stages of loan processing, including information collection, document verification, credit checks, underwriting, application approval, and fund disbursement. Enjoy improved operational efficiency, increased productivity, and reduced costs with automated workflows and processes. Embrace the future of lending with CloudBankin!

Features & Benefits of our Loan Origination System

1) Low Code Orchestration Platform

Our low-code orchestration platform facilitates complex workflows, supports pluggable API integrations as needed, and offers a dynamic underwriting process, making it easier for the bank’s product team to manage the loan origination process effectively.

2) Workflow

Workflows can be customized in real-time, within seconds, without any coding expertise, allowing for quick adjustments to meet business needs.

3) Multi-Channel Onboarding

Enable onboarding through various channels including,

- Loan officer interfaces

- Self-service portals

- Assisted processes

- Branch visits

- Mobile apps

This ensures a seamless customer experience for both loan officers and borrowers throughout the loan origination process.

4) Coborrower & Guarantor Management

Lenders can customize evaluation criteria for co-borrowers’ incomes, which helps create more personalized credit assessments and improve loan offers. Co-borrowers and guarantors may also go through verification checks, including

- KYC

- Multi-bureau

- Financial statement analysis and

- Alternate data

5) Customer 360 Profiling

Classify clients into the following categories for tailored loan offerings

- High Net-Worth

- Affluent

- Mass Affluent

Further, distinguish between

- New-to-Bank (NTB) customers

- Existing-to-Bank (ETB) customers

Provide customized options for ETB clients based on their repayment history. This approach not only enhances personalization but also helps reduce underwriting costs.

6) Multi-Language Support

Supports multiple languages, making it easier to reach borrowers in various regions and enabling smooth business expansion across geographies.

7) Customer Notification

Integrate CRM for effective lead management, and use pre-defined templates via Email, SMS, and WhatsApp to send customer notifications. Launch occasion-specific campaigns or create personalized campaigns tailored to targeted customers.

8) Pre Approved Offers

Lead bucketing can be done to offer tailored loan products, including pre-approved loans, quick/soft offers, and top-up loan suggestions, based on repayment history over the past few months, and share personalized offers to strengthen customer engagement.

9) Collateral Management

Track assets, collateral, and financial obligations to evaluate the borrower’s financial health and support secure loan approvals. The system can be easily customized to meet specific product requirements for collecting collateral details.

For Gold Loans, in cases involving multiple collaterals, the system allows the closure of the loan for a single collateral, enabling the release of that property. The Loan-to-Value (LTV) ratio is then automatically recalculated for the remaining collaterals.

10) Disbursments & Payouts

Simplify loan disbursements and repayments with our integrated payment gateway. Borrowers can easily register for e-mandates for automated loan repayments. Our system supports tranche-based disbursements and can trigger the Core Banking Solution (CBS) in real-time through API for fund transfers, making the process more efficient.

11) Security Measures

Data Security ensure secure access to customers’ CKYC, CIBIL, and financial statements with their explicit consent. All data is masked and securely stored to protect sensitive information. System Security Comply with ISO/IEC 27001:2022 global standards to manage information security. Safeguard data with encryption both at rest and in transit and maintain VAPT certification from a Cert-in empanelled auditor for added assurance.

12) Fraud Prevention & Detection

Enhance security with robust KYC procedures, including:

- Proof of Identification (POI)

- Proof of Address (POA)

- CKYC and VKYC

- Deduplication checks

- Blacklist screenings

- Mobile authentication

Validate information through government databases, using data triangulation to verify key elements such as:

- Facial recognition

- Name matching

- Location details

- Date of birth

- Bank account information

- Liveness detection

Track successful and failed verification attempts to detect suspicious patterns and proactively block fraudulent activities.

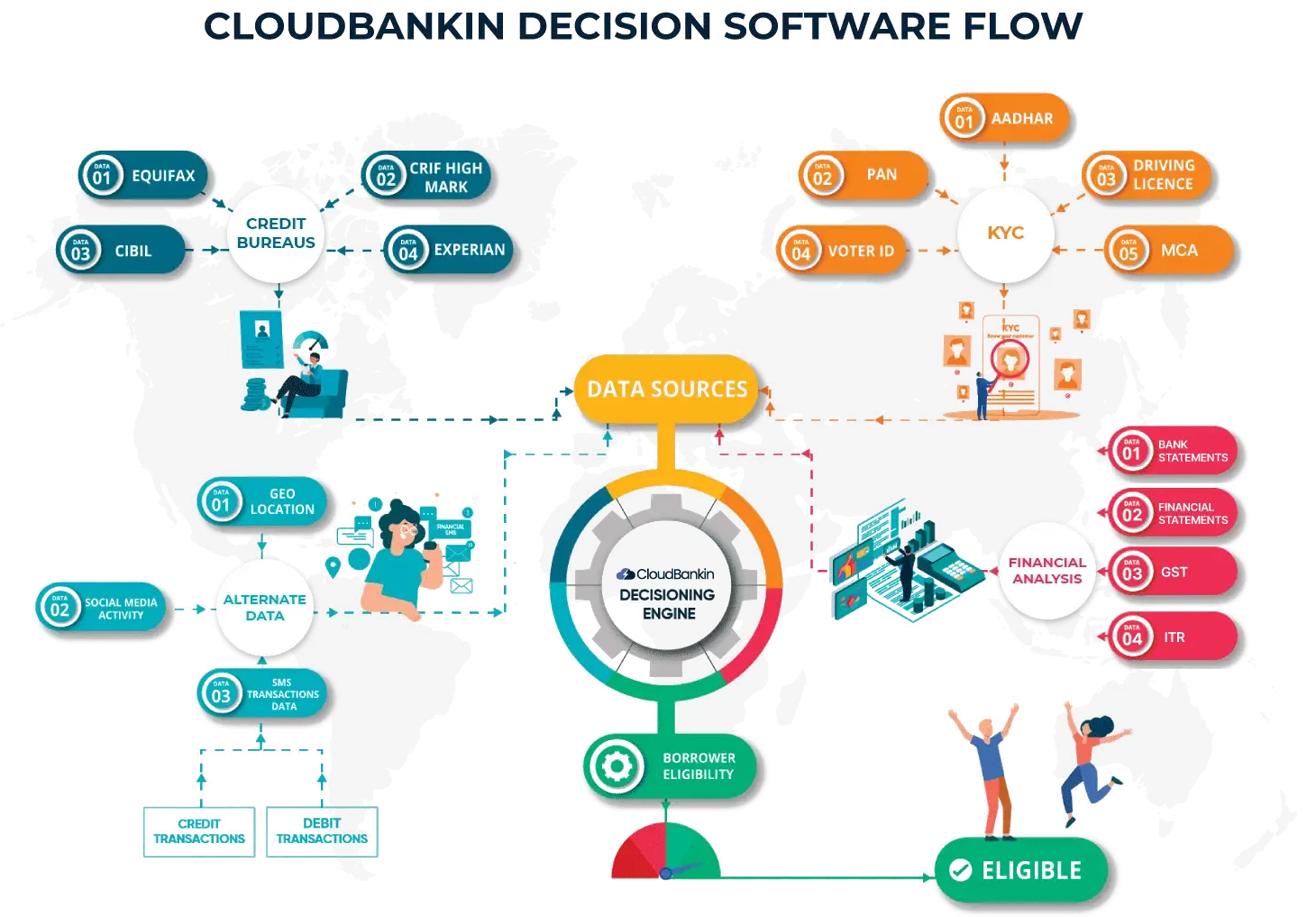

13) Credit Rule Engine

Lenders can customize credit rules by defining their own input variables, web form types, and field details. They can access extensive data points for borrower evaluation, by integrating multiple sources like KYC records, multi-bureau reports, financial statement analysis (e.g., tax filings, balance sheets, Profit & Loss), and alternate data.

Credit decision engine offers automated Straight Through Processing (STP) for instant loan offers, as well as manual review options. With flexible configurations for eligibility criteria, borrower scoring, rule-based validations, and complex calculations, the credit engine streamlines decision-making and adapts to your unique business requirements.

14) Bank Statement Analysis

Bank statements are collected from customers through

- PDF uploads

- Net banking access

- Account Aggregator integration

This helps to evaluate income stability, spending behaviour, and overall financial health. With features like Average Bank Balance and salary transaction analysis, lenders can ensure accurate income verification and make well-informed lending decisions.

Additionally, analyzing bank statements offers real-time insights into an applicant’s loan history, providing accurate financial information even before monthly credit bureau updates are available.

15) API Orchestrator

Integrating with 50+ external services via API Orchestration allows for easy plug-and-play functionality at all stages of the loan origination process, ensuring smooth connectivity with just a few clicks.

Our system is designed to automatically switch to an alternate API in case of a failure. For example, if the Aadhaar API verification does not go through, our platform will seamlessly switch to CKYC verification to maintain uninterrupted customer verification.

16) Document Generation

Easily generate critical loan documents with our pre-defined templates and download them from the document center, including

- Key Fact Statement

- Sanction Letter

- Loan Agreement (with e-signatures and e-stamping)

- GSTIN Certificate

- Welcome Letter

- Repayment Schedule

- Statement of Account

- Interest Certificate

- Foreclosure Letter

- Audit Trail Sheet and

- Payment Receipts.

How Does Loan Origination System works?

Why Choose the CloudBankin Loan Origination Software?

Quick Decisioning

A quick decision-making algorithm works under the hood to generate, customize and export a variety of reports that can help you evaluate customers’ credibility and also potential expansions and new products!

Cost Efficiency

Easily configurable workflows allow you to increase operational efficiency while simultaneously reducing costs, making profitability a part of your business’ DNA! (CloudBankin’s Loan origination system software (LOS) offers automated processes and configurable workflows, increasing operation and cost efficiency).

Product Diversification

A host of features work in tandem towards scaling your business, providing ease of product diversification and also allowing you to expand your geographical presence.

Quick Implementation

It is a low code solution that boasts of a quick implementation time of as low as 24 hours!

Numbers

Loan Book Size

Loan Book Size

Built-in Integrations

Happily Offering Services To 10+ Line Of Businesses

Testimonials

Love from Clients

Gorav Gupta

Director, DigiMoney Finance PvtWe created the 10 mins Lender App to offer customers a seamless experience without document uploads and ensure they check out of the application in the least possible time. By integrating CloudBankin, our digital lending platform became user-friendly, customizable, efficient, and reduced processing time. The turnaround time is also very quick, i.e., less than 10 minutes. CloudBankin's easy-to-use interface, real-time data access, and integration capabilities eliminated manual data entry and saved time & money. Their platform helps modern businesses to stay competitive in today's market.

Awards and Acknowledgements

Cloudbankin is recognised as the High Performer Summer 2024 batch by G2.com for better, faster and excellent service to its clients.

Frequently Asked Questions

What is a Loan Origination System(LOS)?

A loan origination system (LOS) is a platform used by financial institutions to automate and oversee the complete end-to-end loan process from application to loan disbursal or the rejection of the application. It acts as a centralized system where borrowers submit their loan applications, and lenders efficiently process and assess these requests.

How long does it take to disburse a loan using CloudBankin?

CloudBankin’s Loan Origination System (LOS) automates the entire loan process, enabling loans to be disbursed within 10 minutes. Key features include instant KYC verification, real-time credit scoring, bank statement analysis, and a robust credit rule engine for rapid decision-making. Additionally, Enach integration ensures seamless e-mandate processing for direct debit. With these automated tools and third-party integrations, loans are processed, approved, and disbursed quickly, delivering a smooth and efficient experience for both lenders and borrowers.

What are the stages of the loan origination process?

The loan origination process involves several stages: 1) Data Collection - The lender gathers information about the borrower from various sources and focuses on key parameters such as credit history, cash inflow, collateral, and character. 2) Minimum Risk Assessment Criteria - Borrowers are evaluated on factors like age, income, and pincode to minimize the risk of default. 3) Document Collection - The lender requires 2 KYC documents, Proof of Address and Proof of Identity, to be submitted and analyzed. 4) Credit Bureau Check - This step determines the borrower's credit scores based on factors like repayment history, credit utilization, and current loans. 5) Loan Underwriting - The lender assesses the borrower's creditworthiness by considering their credit score, debt-to-income ratio, and collateral value. 6) Video KYC or Field Visit - Borrower identities are verified through a video process with specific conditions such as geotagging, trained loan officers conducting the verification, liveliness checks, and document validation. 7) Loan Negotiation - Final terms of the loan are agreed upon by both parties. 8) E-Mandate - Automatic repayment is set up through a series of steps. 9) Loan Contract - A document that outlines crucial details such as lender and borrower information, specific loan terms, repayment methods and timelines, accepted payment methods, interest rates, etc. 10) Disbursement of Loan - Lenders distribute loans to borrowers upon approval.

Is CloudBankin a loan origination system (LOS)?

Yes, CloudBankin is a comprehensive digital Loan Origination System (LOS). Our platform offers lenders a user-friendly, secure, and scalable solution for digitally onboarding borrowers. With advanced features, CloudBankin streamlines the entire loan application process, ensuring a seamless and efficient user experience from application to disbursement.

Does CloudBankin support online payments?

Yes, CloudBankin enables online payment solutions via integrated payment gateways. This supports both automated loan disbursements and seamless collection of payments through direct debit (E-mandate) from customer accounts, streamlining the process for both disbursements and repayments.

What does origination mean in finance?

In finance, loan origination refers to the entire process through which a borrower applies for a loan and the lender processes the application. The loan origination process involves several steps: It begins with the borrower submitting a loan application. Next, the lender collects and verifies the required documents, followed by underwriting to assess the borrower’s creditworthiness. If approved, the lender presents a loan offer with specific terms. Once the borrower reviews and accepts the offer, they sign the loan agreement, and the lender disburses the loan amount.

What is difference between LOS and LMS?

A Loan Origination System (LOS) is specifically designed to manage the entire loan application process, automating tasks from initial application through to approval and disbursement. It aids lenders in gathering borrower information, assessing creditworthiness, and streamlining documentation to achieve faster approvals. In contrast, a Loan Management System (LMS) takes over once the loan has been disbursed. Its primary focus is on managing the loan throughout its life cycle, which includes tracking payment schedules, handling collections, addressing delinquencies, and facilitating effective communication with borrowers.

Which features in the loan origination software are automated?

CloudBankin automates several key aspects of the loan origination process to boost efficiency and accuracy. These include: 1) Customer Management – Automation facilitates data collection via web portals and APIs, reducing manual entry errors and onboarding delays. 2) Credit Analysis – Automating creditworthiness assessments using KYC, credit bureau reports, bank statements, and alternate data speeds up underwriting. 3) Credit Decisioning – Our rule engine automates verification and decision-making, enabling loan approval in as little as 2 minutes. Automation enhances the process by reducing errors, improving consistency, and speeding up approvals.

Is the LOS configurable to your Organization?

Yes, our LOS is configurable. For instance, 1. We have integrated the credit bureau (Equifax) into our platform, so all you need to fetch your borrowers' credit reports is your licence key. 2. To configure "n" number of parameters in the rule engine, it is easily integrated to add or modify parameters (conditions) that aid in making credit decisions when evaluating your borrowers. 3. Configure product master - simply by adding new parameters in data fields for interest rates, principles, repayments, loan terms, repayment strategies, moratoriums, etc., you can create a new product. The aforementioned examples demonstrate that no human assistance (from developers) is needed for them. To that extent, Cloudbankin is configurable.

Is the LOS Safe and Secure?

Yes, our LOS(Loan origination system) is completely safe and secure. Every data is often stored in a completely encrypted and centralised dedicated tenant-based system with firewall in our cloud-based loan origination system. To guarantee that systems and data are secure at all times, our team combines battle-tested technologies, open-source strategies (like OWASP), strong cloud infrastructure (like AWS), Monitoring System (Prometheus, Graphana), Penetration testing (VAPT), Audit Logs, Application Level User Access Control and risk/security processes & policies. Lenders don’t have to depend on the legacy system’s hardware and the chance of them getting hacked. This makes sharing and updating data with only authorized and trustworthy people within the business a safe and quick manner. Accessing the LOS becomes much easier from any browser, thereby increasing the simplicity and time management efficiency for lenders and their borrowers. This also provides a high level of transparency and access control from any location, device and time.

Is the LOS User-Friendly and Modern?

Yes, CloudBankin’s LOS is designed to be modern and highly user-friendly. It automates quick credit decisions through an advanced rule engine and integrates with APIs such as CKYC, credit bureaus, and bank statement analyzers for seamless data retrieval. Leveraging cutting-edge web technologies like React, Angular, and Capacitor, it enhances the customer experience, reduces acquisition costs, and ensures transparency. Features like personalized SMS/email alerts further improve customer engagement, making the platform both efficient and intuitive for users.

Is the LOS SaaS-Based?

Yes, CloudBankin’s Loan Origination System (LOS) is SaaS-based, offering key advantages: 1. Access the software whenever, wherever you want, using any device. 2. No need for in-house infrastructure, as everything is managed on the cloud. 3. The system integrates seamlessly with various APIs to pull borrower data from multiple sources, ensuring faster time-to-market and efficient loan processing. This cloud-based solution streamlines operations and enhances scalability for lending institutions.

Does the LOS Offer a Point-of-Sale?

Yes, CloudBankin’s Loan Origination System supports point-of-sale (POS) lending, including features for Buy-Now-Pay-Later (BNPL) financing. This allows businesses to offer flexible payment options at the point of sale, helping to enhance customer experience and grow business opportunities. For more details, you can explore our BNPL solutions page.

How do I configure the Loan Origination System (LOS) and Loan Management Systems (LMS) to suit my needs?

CloudBankin’s LOS and LMS are easily configurable through a user-friendly interface. You can customize workflows, set up loan products, and adjust rules for credit decisions, repayment terms, and borrower eligibility. Our support team is available to assist with more complex setups.

What if customer information is not available in the CKYC portal?

If the customer's information is not found in the CKYC portal, you can validate their Aadhaar and PAN details separately. After successful validation, you can manually retrieve and verify the required customer information to proceed with the loan process. This ensures that you can still move forward with customer onboarding even if CKYC data is missing.

How does the system handle loan approval and disbursement? Can it be automated?

Yes, the system automates loan approval using a credit rule engine. Disbursement can either be automatic, triggered through integration with payment gateways, or manual, where an authorized person reviews and disburses the loan. This ensures flexibility in handling approvals and disbursements.

What role does a Loan Origination System (LOS) play in loan lifecycle management?

Loan Origination Systems streamline loan lifecycle management by automating borrower onboarding, document verification, credit checks, and risk analysis. It support multi-channel onboarding, integrate KYC, fraud detection, credit bureau insights, and financial evaluations, ensuring seamless loan processing, regulatory compliance, and improved customer satisfaction.

Related Articles

- Email: [email protected]

- Sales Enquiries: +91 9080996606

- HR Enquiries: +91 9080996576

Quick Links

Resources

© 2025 LightFi India Private Limited. All rights reserved.

(Formerly known as Habile Technologies)

After smartphone penetration, people are not watching their SMS at all. They use SMS only for OTP related transactions. That’s it.

But What can a Lender see in your SMS after you consent to them?

Lender can see income, expenses, and any other Fixed Obligation like (EMIs/Credit Card).

1) Income – Parameters like Average Salary Credited, Stable Monthly inflows like Rent

2) Expenses – Average monthly debit card transactions, UPI Transactions, Monthly ATM Withdrawal Amount etc

3) Fixed Obligations – Loan payments have been made for the past few months, Credit card transactions.

It also tells the Lender the adverse incidents like

1) Missed Loan payments

2) Cheque bounces

3) Missed Bill Payments like EB, LPG gas bills.

4) POS transaction declines due to insufficient funds.

A massive chunk of data is available in our SMS (more than 700 data points), which helps Lender to make a credit decision.

#lendtech #fintech #manispeaksmoney