Loan Origination System

- CloudBankin Loan Origination System is a secure, scalable cloud-based lending platform.

- It streamlines digital customer onboarding for your business, automates loan processing, and eases client evaluation with smart algorithms and third-party integration.

- Seamlessly integrate existing systems, enhance efficiency, productivity, and cost-effectiveness.

- Embrace the future of lending with CloudBankin for a simplified, secure, and efficient lending experience.

Benefits

- Low-code Platform

- Automated Workflows

- Increase your operational efficiency by 75%

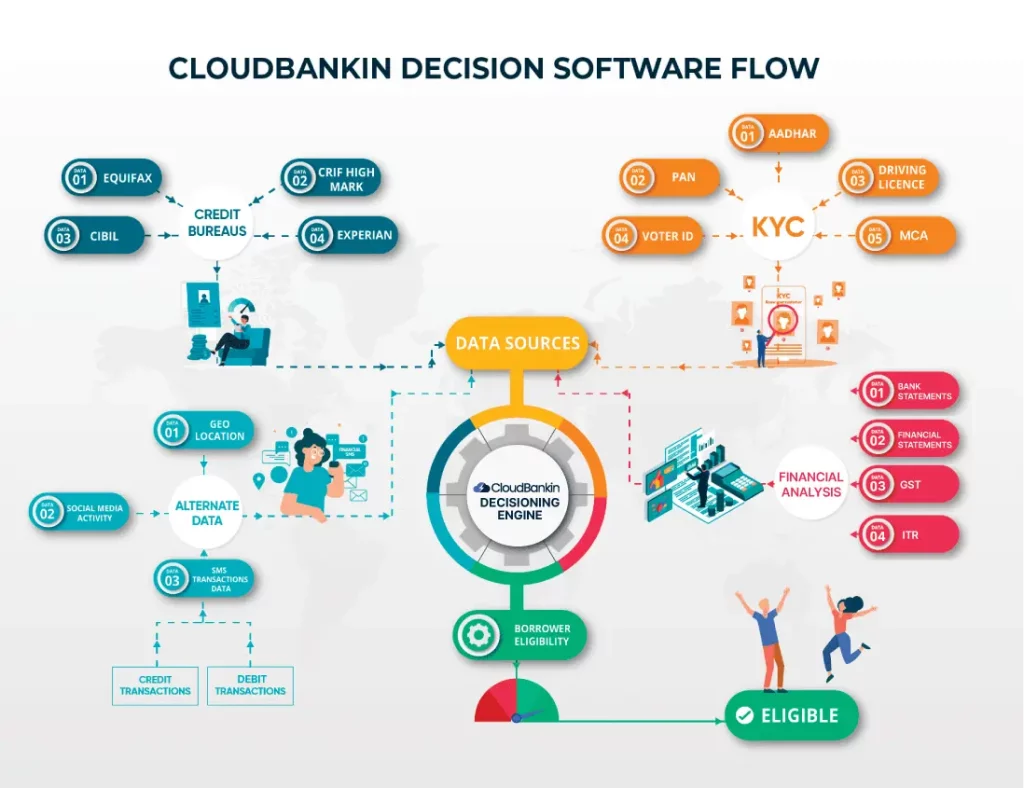

- Comprehensive credit profiling using alternate data sources

- Rapid authentication through SMS Analysis

- Deep financial understanding through Bank statements

- Elevate and optimize your existing system

- Timely seasonal launches

- Introduce new products seamlessly

- Disburse the loan in 10 minutes

- Pre-built API integrations

Features

Client Onboarding

Simplifying the addition of new clients through automated onboarding processes.

e-KYC Process

Gathering necessary documentation to meet regulatory standards is effortless with a comprehensive e-KYC system.

Credit Bureau Integrations

CloudBankin makes credit score assessments seamless and hassle-free, leading to faster decision-making.

SMS Analysis

Analyze client messages to comprehend their spending habits and financial patterns, gaining valuable insights into their lifestyle.

Quick Decisioning Engine

Built-in credit rule engine with adjustable parameters aligned to your lending institution's credit policies and regulations.

Mobile Application

CloudBankin ensures cross-device compatibility, offering uninterrupted access to essential systems and data via a secure, integrated platform.

Why Choose CloudBankin Loan Origination System?

Quick Decisioning

An agile decision algorithm generates customizable reports that aid in evaluating customer credibility and identifying growth opportunities and new product possibilities.

Cost efficiency

CloudBankin’s Loan Origination System (LOS) features customizable workflows for cost-efficiency, improving operational effectiveness and profit margins.

Product Diversification

An array of features collaboratively drive business growth, simplifying product diversification and facilitating geographic expansion.

Quick Implementation

This low-code solution offers swift implementation, with as little as 24 hours for setup.

Self-Assisted Journey For Your Borrowers

Empower borrowers with our branchless, paperless, contactless, agentless loan origination, allowing access to loans from anywhere, at any time, on any device.

Testimonials

Love from Clients

Gorav Gupta

Co-Founder of DigiMoney Finance"We created the Ten Minute Lender App to offer customers a seamless experience without document uploads and ensure they check out of the application in the least possible time. By integrating CloudBankin, our digital lending platform became user-friendly, customizable, efficient, and reduced processing time. The turnaround time is also very quick, i.e., less than 10 minutes. CloudBankin's easy-to-use interface, real-time data access, and integration capabilities eliminated manual data entry and saved time & money. Their platform helps modern businesses to stay competitive in today's market."

Awards and Acknowledgements

CloudBankin is acknowledged as a top-performing batch by G2.com for its superior service in Fall 2023, Winter 2023, Spring 2023, and Summer 2023.

Building excellence with digital lending solution

Are you taking the first step towards revamping the digital infrastructure of your financial institution? Then, do it the Habile-way!

After smartphone penetration, people are not watching their SMS at all. They use SMS only for OTP related transactions. That’s it.

But What can a Lender see in your SMS after you consent to them?

Lender can see income, expenses, and any other Fixed Obligation like (EMIs/Credit Card).

1) Income – Parameters like Average Salary Credited, Stable Monthly inflows like Rent

2) Expenses – Average monthly debit card transactions, UPI Transactions, Monthly ATM Withdrawal Amount etc

3) Fixed Obligations – Loan payments have been made for the past few months, Credit card transactions.

It also tells the Lender the adverse incidents like

1) Missed Loan payments

2) Cheque bounces

3) Missed Bill Payments like EB, LPG gas bills.

4) POS transaction declines due to insufficient funds.

A massive chunk of data is available in our SMS (more than 700 data points), which helps Lender to make a credit decision.

#lendtech #fintech #manispeaksmoney